Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We have data on business activities of Mist Group as follows: Gross turnover exclusive of VAT: VND20 billion of which, VND8 billion comes from

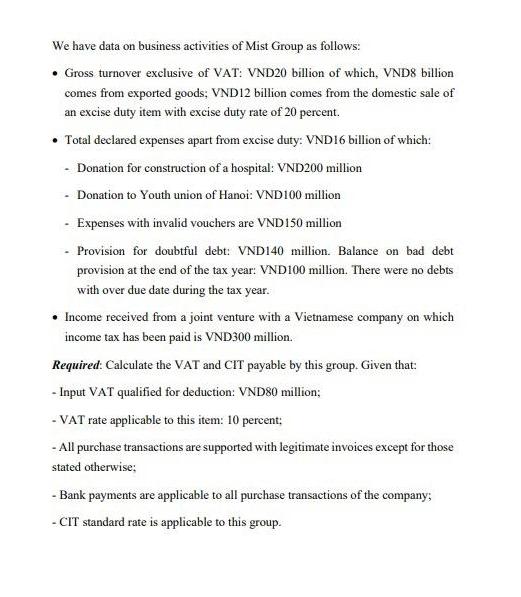

We have data on business activities of Mist Group as follows: Gross turnover exclusive of VAT: VND20 billion of which, VND8 billion comes from exported goods; VND12 billion comes from the domestic sale of an excise duty item with excise duty rate of 20 percent. Total declared expenses apart from excise duty: VND16 billion of which: Donation for construction of a hospital: VND200 million - Donation to Youth union of Hanoi: VND 100 million Expenses with invalid vouchers are VND 150 million Provision for doubtful debt: VND140 million. Balance on bad debt provision at the end of the tax year: VND100 million. There were no debts with over due date during the tax year. Income received from a joint venture with a Vietnamese company on which income tax has been paid is VND300 million. Required: Calculate the VAT and CIT payable by this group. Given that: - Input VAT qualified for deduction: VND80 million; - VAT rate applicable to this item: 10 percent; - All purchase transactions are supported with legitimate invoices except for those stated otherwise; - Bank payments are applicable to all purchase transactions of the company; - CIT standard rate is applicable to this group.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

VAT payable 20000000000 8000000000 01 80000000 2800000000 80000000 2720000000 CIT payable 20000000000 8000000000 12000000000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started