Question

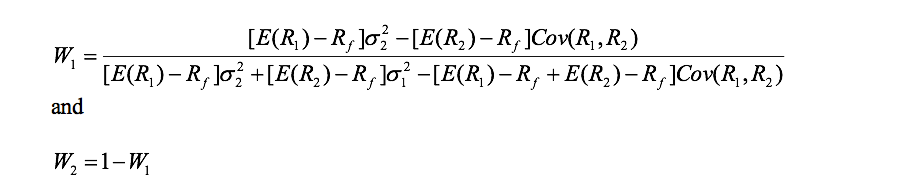

we know, in case of two risky assets, the solution for the weights of the optimal risky portfolio, P can be shown as follows: R

we know, in case of two risky assets, the solution for the weights of the optimal risky portfolio, P can be shown as follows:

Rf = 4.25%

A. what are the weights for Fund A and Fund B if ?

B. What are the expected return and Standard Deviation of the optimal risky portfolio P?

C. What is the Sharpe Ratio (Reward-to-Variability) of the CAL line that joins the risk-free asset and optimal risky asset P?

D. If your risk aversion index A = 4, what is your optimal allocation between risky asset P ( ) and risk-free asset (1- )?

E.. What are expected rate of return and standard deviation of your complete portfolio that is constructed with risky asset P and risk-free asset?

The data is

| State of the Economy | Probability | HPR (Fund A) | HPR (Fund B) |

| Boom | .50 | 7% | 25% |

| Normal growth | .3 | -5% | 10% |

| Recession | .2 | 20% | -25% |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started