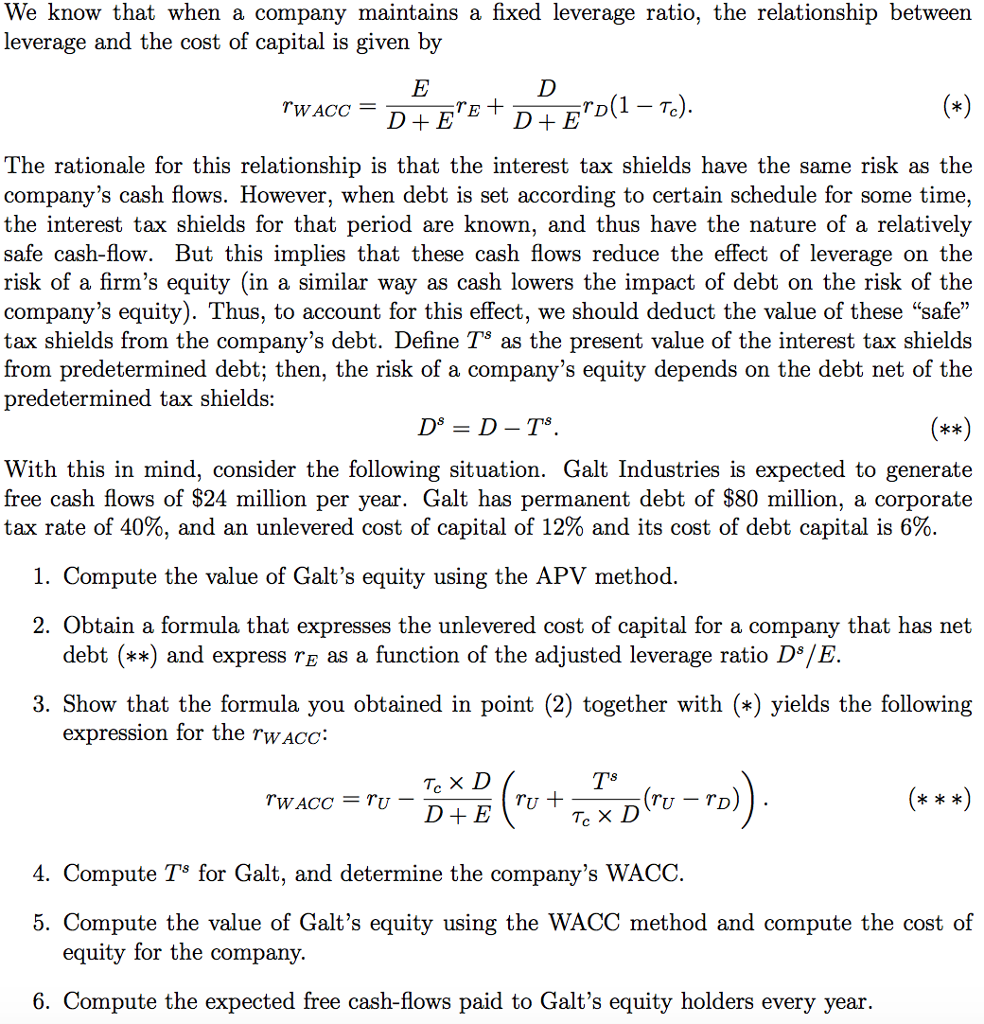

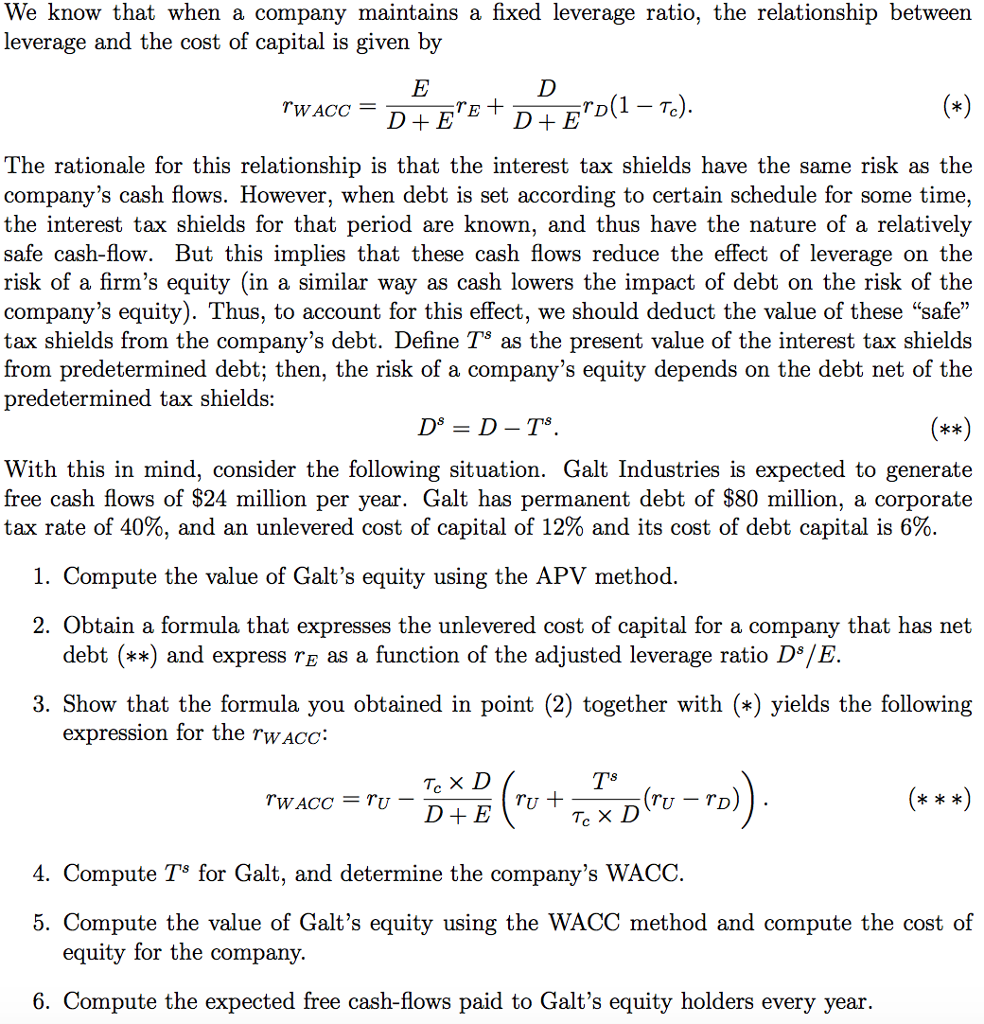

We know that when a company maintains a fixed leverage ratio, the relationship between leverage and the cost of capital is given by r_W ACC = E/D + E r_E + D/D + E r_D (1 - tau_c). The rationale for this relationship is that the interest tax shields have the same risk as the company's cash flows. However, when debt is set according to certain schedule for some time, the interest tax shields for that period are known, and thus have the nature of a relatively safe cash-flow. But this implies that these cash flows reduce the effect of leverage on the risk of a firm's equity (in a similar way as cash lowers the impact of debt on the risk of the company's equity). Thus, to account for this effect, we should deduct the value of these "safe" tax shields from the company's debt. Define T^s as the present value of the interest tax shields from predetermined debt; then, the risk of a company's equity depends on the debt net of the predetermined tax shields: D^s = D - T^s. With this in mind, consider the following situation. Galt Industries is expected to generate free cash flows of $24 million per year. Galt has permanent debt of $80 million, a corporate tax rate of 40%, and an unlevered cost of capital of 12% and its cost of debt capital is 6%. 1. Compute the value of Galt's equity using the APV method. 2. Obtain a formula that expresses the unlevered cost of capital for a company that has net debt (**) and express r_E as a function of the adjusted leverage ratio D^s/E. 3. Show that the formula you obtained in point (2) together with (*) yields the following expression for the r_W ACC: r_W ACC = r_U - tau_c times D/D + E (r_U + T^s/tau_c times D (r_U - r_D)). 4. Compute T^s for Galt, and determine the company's WACC. 5. Compute the value of Galt's equity using the WACC method and compute the cost of equity for the company. 6. Compute the expected free cash-flows paid to Galt's equity holders every year. We know that when a company maintains a fixed leverage ratio, the relationship between leverage and the cost of capital is given by r_W ACC = E/D + E r_E + D/D + E r_D (1 - tau_c). The rationale for this relationship is that the interest tax shields have the same risk as the company's cash flows. However, when debt is set according to certain schedule for some time, the interest tax shields for that period are known, and thus have the nature of a relatively safe cash-flow. But this implies that these cash flows reduce the effect of leverage on the risk of a firm's equity (in a similar way as cash lowers the impact of debt on the risk of the company's equity). Thus, to account for this effect, we should deduct the value of these "safe" tax shields from the company's debt. Define T^s as the present value of the interest tax shields from predetermined debt; then, the risk of a company's equity depends on the debt net of the predetermined tax shields: D^s = D - T^s. With this in mind, consider the following situation. Galt Industries is expected to generate free cash flows of $24 million per year. Galt has permanent debt of $80 million, a corporate tax rate of 40%, and an unlevered cost of capital of 12% and its cost of debt capital is 6%. 1. Compute the value of Galt's equity using the APV method. 2. Obtain a formula that expresses the unlevered cost of capital for a company that has net debt (**) and express r_E as a function of the adjusted leverage ratio D^s/E. 3. Show that the formula you obtained in point (2) together with (*) yields the following expression for the r_W ACC: r_W ACC = r_U - tau_c times D/D + E (r_U + T^s/tau_c times D (r_U - r_D)). 4. Compute T^s for Galt, and determine the company's WACC. 5. Compute the value of Galt's equity using the WACC method and compute the cost of equity for the company. 6. Compute the expected free cash-flows paid to Galt's equity holders every year