Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We observe the following actively-traded bonds (none of them are T-bills) which we consider to be accurately priced: Maturity Yield Market Value 6 months

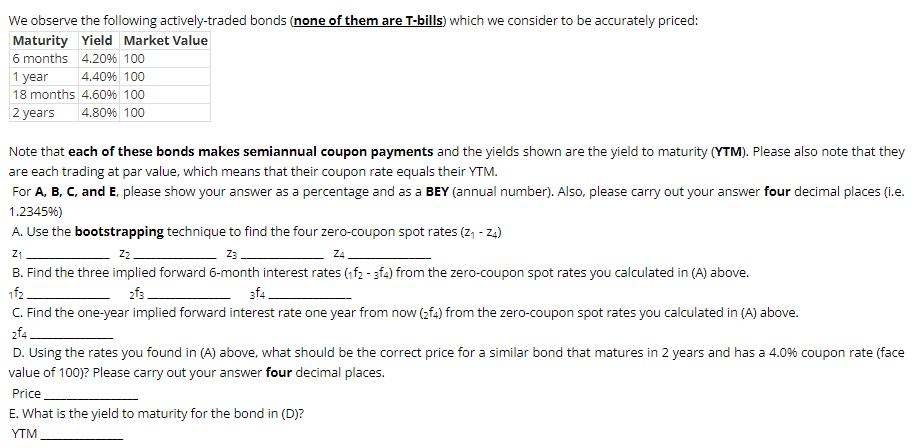

We observe the following actively-traded bonds (none of them are T-bills) which we consider to be accurately priced: Maturity Yield Market Value 6 months 4.20% 100 1 year 4.40% 100 18 months 4.60% 100 2 years 4.80% 100 Note that each of these bonds makes semiannual coupon payments and the yields shown are the yield to maturity (YTM). Please also note that they are each trading at par value, which means that their coupon rate equals their YTM. For A, B, C, and E. please show your answer as a percentage and as a BEY (annual number). Also, please carry out your answer four decimal places (i.e. 1.2345%) A. Use the bootstrapping technique to find the four zero-coupon spot rates (Z - Z4) Z Zz Z3 Z4 B. Find the three implied forward 6-month interest rates (1f2-3f4) from the zero-coupon spot rates you calculated in (A) above. 1f 2f3 3f4 C. Find the one-year implied forward interest rate one year from now (2f4) from the zero-coupon spot rates you calculated in (A) above. 2f4 D. Using the rates you found in (A) above, what should be the correct price for a similar bond that matures in 2 years and has a 4.0% coupon rate (face value of 100)? Please carry out your answer four decimal places. Price E. What is the yield to maturity for the bond in (D)? YTM

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A Zerocoupon spot rates Z1 Yield on 6 month bond 42000 Z2 Yield on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started