Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We purchase a property for 250 MNOK (million kroner). We assume that the value V(t) of the property in MNOK) is given by V(t) =

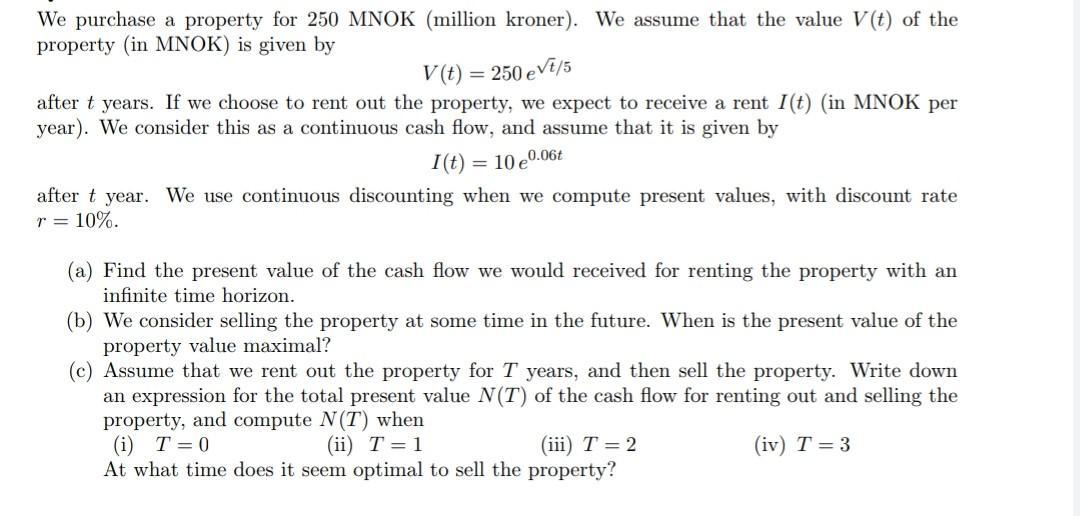

We purchase a property for 250 MNOK (million kroner). We assume that the value V(t) of the property in MNOK) is given by V(t) = 250 eV7/5 after t years. If we choose to rent out the property, we expect to receive a rent I(t) (in MNOK per year). We consider this as a continuous cash flow, and assume that it is given by I(t) = 10 e0.06 after t year. We use continuous discounting when we compute present values, with discount rate r = 10%. (a) Find the present value of the cash flow we would received for renting the property with an infinite time horizon. (b) We consider selling the property at some time in the future. When is the present value of the property value maximal? (c) Assume that we rent out the property for T years, and then sell the property. Write down an expression for the total present value N(T) of the cash flow for renting out and selling the property, and compute N(T) when (i) T=0 (ii) T=1 (iii) T=2 (iv) T=3 At what time does it seem optimal to sell the property? We purchase a property for 250 MNOK (million kroner). We assume that the value V(t) of the property in MNOK) is given by V(t) = 250 eV7/5 after t years. If we choose to rent out the property, we expect to receive a rent I(t) (in MNOK per year). We consider this as a continuous cash flow, and assume that it is given by I(t) = 10 e0.06 after t year. We use continuous discounting when we compute present values, with discount rate r = 10%. (a) Find the present value of the cash flow we would received for renting the property with an infinite time horizon. (b) We consider selling the property at some time in the future. When is the present value of the property value maximal? (c) Assume that we rent out the property for T years, and then sell the property. Write down an expression for the total present value N(T) of the cash flow for renting out and selling the property, and compute N(T) when (i) T=0 (ii) T=1 (iii) T=2 (iv) T=3 At what time does it seem optimal to sell the property

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started