Question

We want to estimate the value of the CBC Inc. company, as of the end of 2020, and the after-tax cashflow from assets (FCFF)

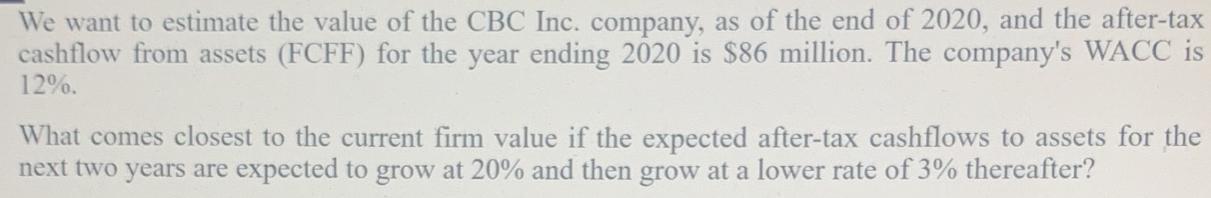

We want to estimate the value of the CBC Inc. company, as of the end of 2020, and the after-tax cashflow from assets (FCFF) for the year ending 2020 is $86 million. The company's WACC is 12%. What comes closest to the current firm value if the expected after-tax cashflows to assets for the next two years are expected to grow at 20% and then grow at a lower rate of 3% thereafter?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To estimate the value of CBC Inc at the end of 2020 using the Free Cash Flow to the Firm FCFF model ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Entrepreneurial Finance

Authors: J. Chris Leach, Ronald W. Melicher

6th edition

1305968352, 978-1337635653, 978-1305968356

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App