Answered step by step

Verified Expert Solution

Question

1 Approved Answer

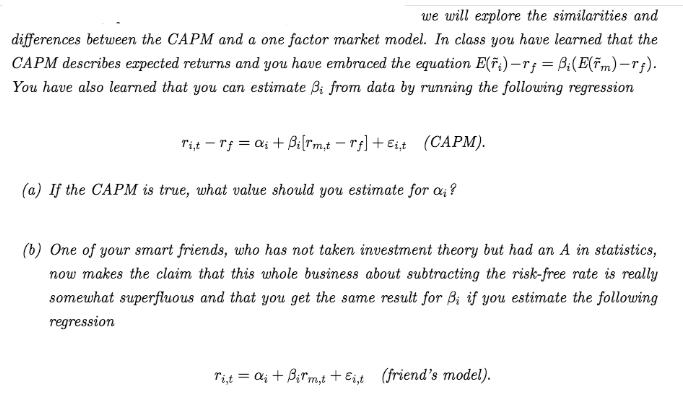

we will explore the similarities and differences between the CAPM and a one factor market model. In class you have learned that the CAPM

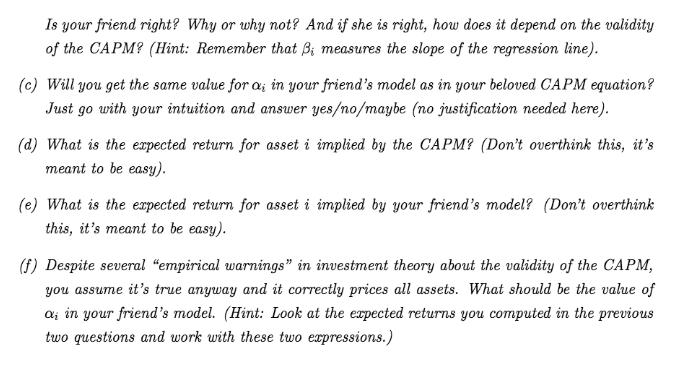

we will explore the similarities and differences between the CAPM and a one factor market model. In class you have learned that the CAPM describes expected returns and you have embraced the equation E(F)-r; = B(E(Tm) - r). You have also learned that you can estimate Bi from data by running the following regression Tit-Tf = a + Bi[rmt -rf]+Eit (CAPM). (a) If the CAPM is true, what value should you estimate for a? (b) One of your smart friends, who has not taken investment theory but had an A in statistics, now makes the claim that this whole business about subtracting the risk-free rate is really somewhat superfluous and that you get the same result for B; if you estimate the following regression Tit = a + Birm,t + Ei,t (friend's model). Is your friend right? Why or why not? And if she is right, how does it depend on the validity of the CAPM? (Hint: Remember that B; measures the slope of the regression line). (c) Will you get the same value for a; in your friend's model as in your beloved CAPM equation? Just go with your intuition and answer yes/no/maybe (no justification needed here). (d) What is the expected return for asset i implied by the CAPM? (Don't overthink this, it's meant to be easy). (e) What is the expected return for asset i implied by your friend's model? (Don't overthink this, it's meant to be easy). (f) Despite several "empirical warnings" in investment theory about the validity of the CAPM, you assume it's true anyway and it correctly prices all assets. What should be the value of ai in your friend's model. (Hint: Look at the expected returns you computed in the previous two questions and work with these two expressions.)

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a If the CAPM is true the value of the intercept term a in the regression equation Titrf a Birmitrf should be zero This is because the CAPM assumes th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started