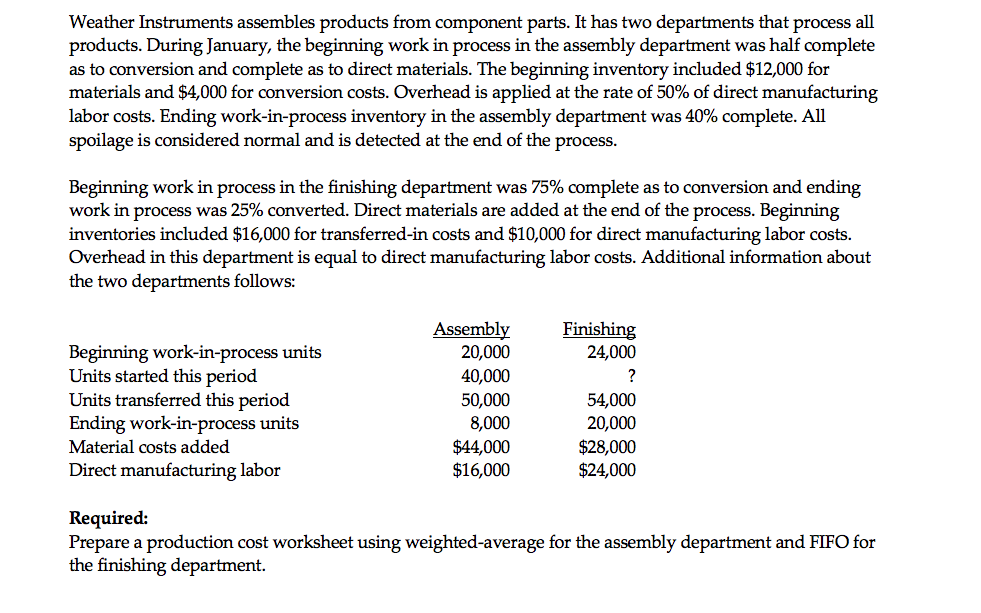

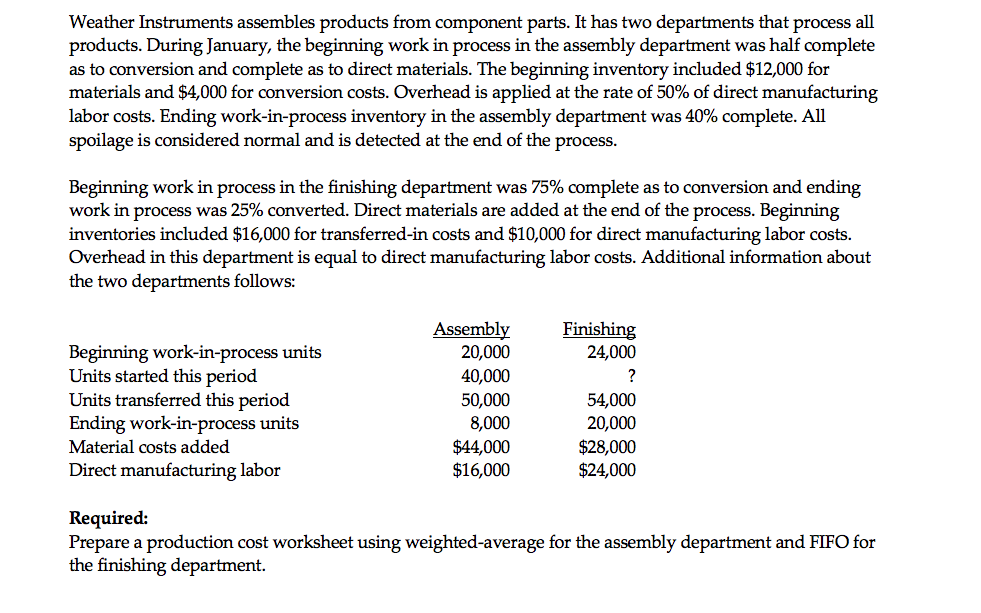

Weather Instruments assembles products from component parts. It has two departments that process all products. During January, the beginning work in process in the assembly department was half complete as to conversion and complete as to direct materials. The beginning inventory included $12,000 for materials and $4,000 for conversion costs. Overhead is applied at the rate of 50% of direct manufacturing labor costs. Ending work-in-process inventory in the assembly department was 40% complete. All spoilage is considered normal and is detected at the end of the process. Beginning work in process in the finishing department was 75% complete as to conversion and ending work in process was 25% converted. Direct materials are added at the end of the process. Beginning inventories included $16,000 for transferred-in costs and $10,000 for direct manufacturing labor costs. Overhead in this department is equal to direct manufacturing labor costs. Additional information about the two departments follows: Beginning work-in-process units Units started this period Units transferred this period Ending work-in-process units Material costs added Direct manufacturing labor Assembly 20,000 40,000 50,000 8,000 $44,000 $16,000 Finishing 24,000 ? 54,000 20,000 $28,000 $24,000 Required: Prepare a production cost worksheet using weighted average for the assembly department and FIFO for the finishing department. Weather Instruments assembles products from component parts. It has two departments that process all products. During January, the beginning work in process in the assembly department was half complete as to conversion and complete as to direct materials. The beginning inventory included $12,000 for materials and $4,000 for conversion costs. Overhead is applied at the rate of 50% of direct manufacturing labor costs. Ending work-in-process inventory in the assembly department was 40% complete. All spoilage is considered normal and is detected at the end of the process. Beginning work in process in the finishing department was 75% complete as to conversion and ending work in process was 25% converted. Direct materials are added at the end of the process. Beginning inventories included $16,000 for transferred-in costs and $10,000 for direct manufacturing labor costs. Overhead in this department is equal to direct manufacturing labor costs. Additional information about the two departments follows: Beginning work-in-process units Units started this period Units transferred this period Ending work-in-process units Material costs added Direct manufacturing labor Assembly 20,000 40,000 50,000 8,000 $44,000 $16,000 Finishing 24,000 ? 54,000 20,000 $28,000 $24,000 Required: Prepare a production cost worksheet using weighted average for the assembly department and FIFO for the finishing department