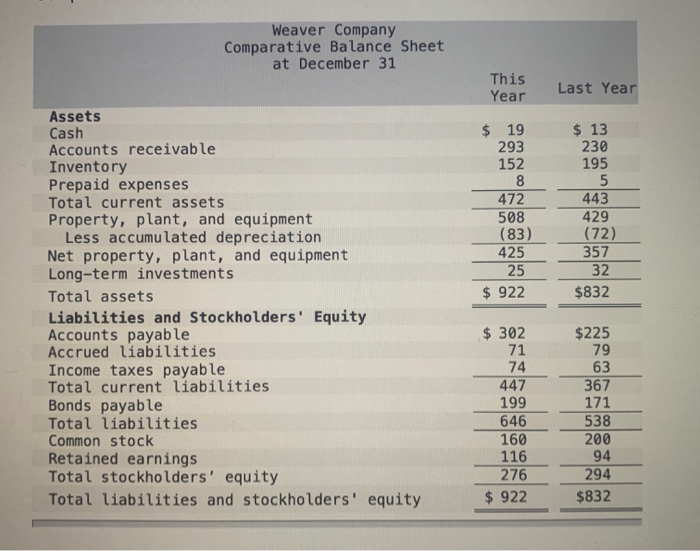

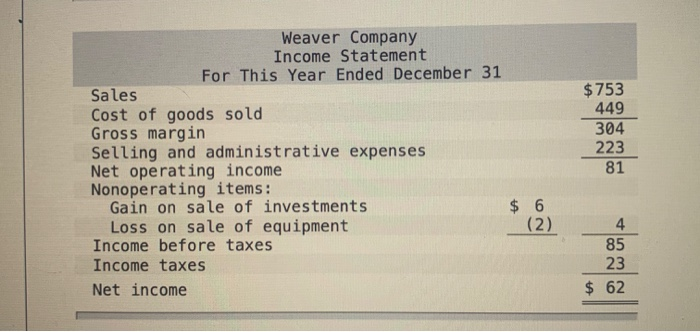

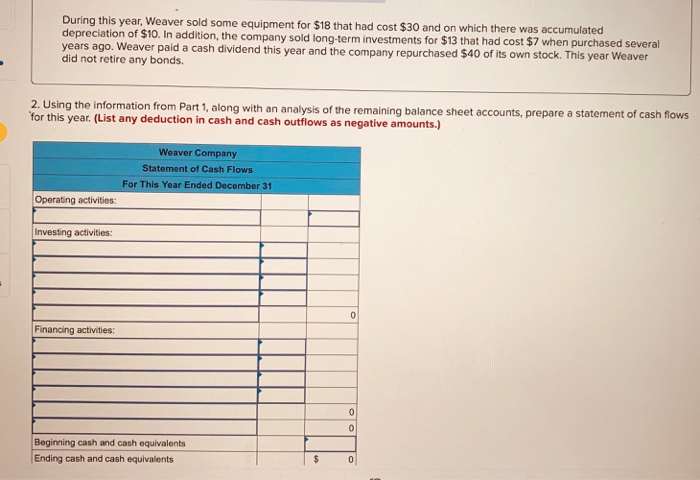

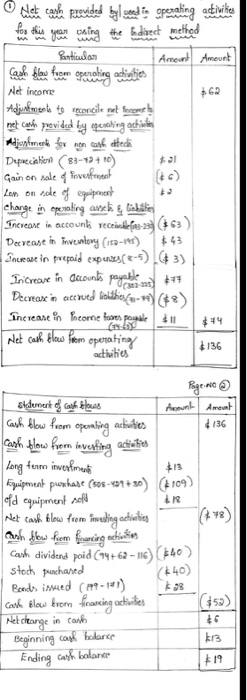

Weaver Company Comparative Balance Sheet at December 31 This Year Last Year $ 19 293 152 8 472 508 (83) 425 25 $ 922 $ 13 230 195 5 443 429 (72) 357 32 $832 Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Long-term investments Total assets Liabilities and Stockholders' Equity Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 302 71 74 447 199 646 160 116 276 $ 922 $225 79 63 367 171 538 200 94 294 $832 Weaver Company Income Statement For This Year Ended December 31 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: Gain on sale of investments $ 6 Loss on sale of equipment (2) Income before taxes Income taxes Net income $ 753 449 304 223 81 4 85 23 $ 62 During this year, Weaver sold some equipment for $18 that had cost $30 and on which there was accumulated depreciation of $10. In addition, the company sold long-term investments for $13 that had cost $7 when purchased several years ago. Weaver paid a cash dividend this year and the company repurchased $40 of its own stock. This year Weaver did not retire any bonds 2. Using the information from Part 1, along with an analysis of the remaining balance sheet accounts, prepare a statement of cash flows "for this year. (List any deduction in cash and cash outflows as negative amounts.) Weaver Company Statement of Cash Flows For This Year Ended December 31 Operating activities: Investing activities: 0 Financing activities: 0 0 Beginning cash and cash equivalents Ending cash and cash equivalents $ 0 $62 Nel cash revided by used is operating activities for this you thing the bedact method Particular Amount Amount Cash bilans foco operating esticities Net income Adjunkments to reconcileret fecombe met cartin provided by penting achines Adjunkment for non catheted Depreciation (83-19+ o) Gain on sale overeen Lon on sode of equipment change in operating avek glabile Therease in accounts receinde fes-25 (63) Decrease in Inventory (152-195) $ 43 Increase in prepaid expuses(-5) (43) Inicreoue in decounts payable *** Decrease in acewed Bolthies(4-6) (48) Increase in frcome fare penale $44 Net cash flow from operating $136 activities Pagrind skdunart of cash belowes Arun Ament cash flow from operating activities #136 Cash blow from investing actiles Long term investment $13 Equipment puuhase (608-439+30) (109) ofd equipment sold Net cash blow frono investing activities Thursh How frem financing achouten Cash dividend poid (94+62 - 116) (140) stock purchased Beeds inued (1-11) 98 cash flow from financing activibes $6 kr3 4 ve) (+40) Net change in canh Beginning cash balance Ending cash balance