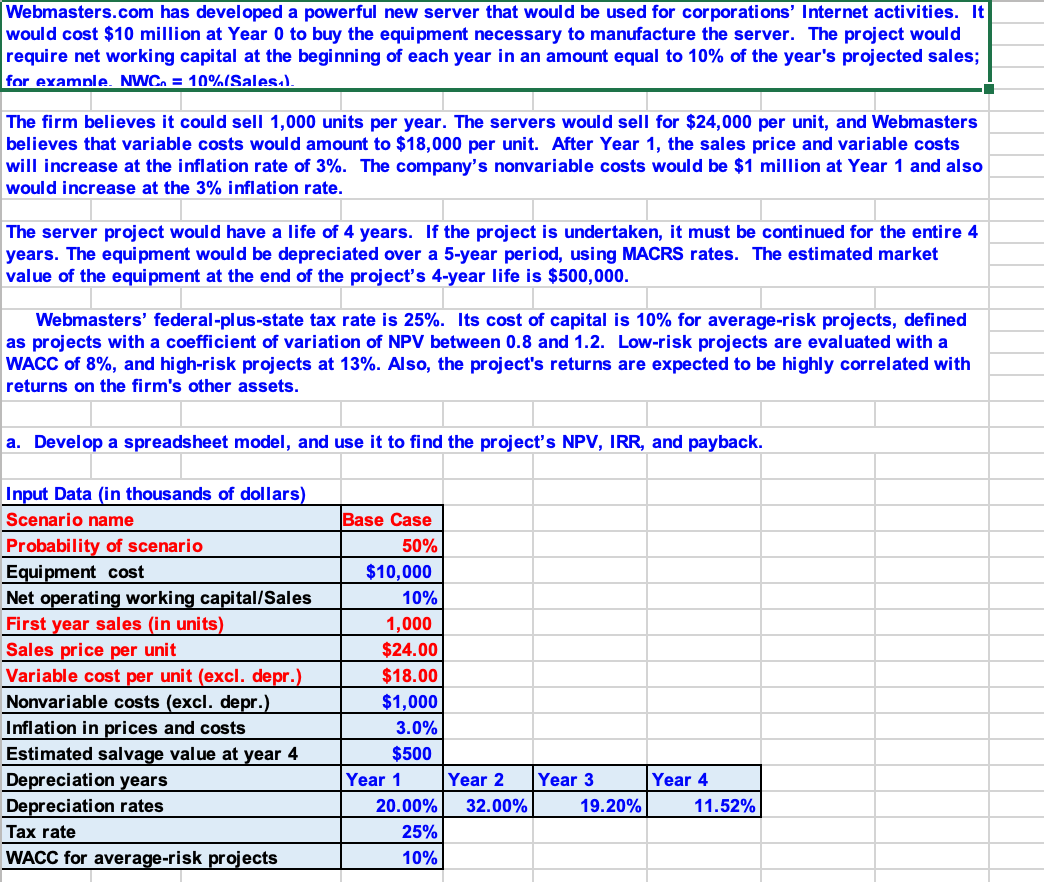

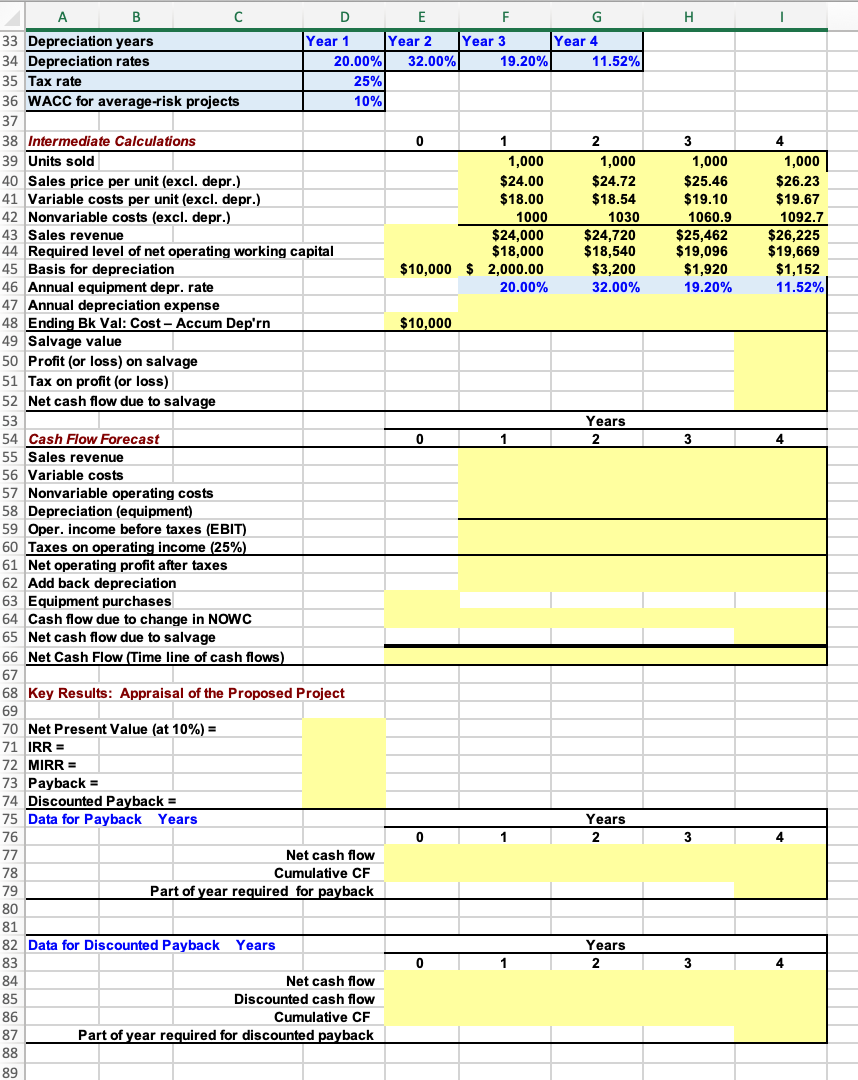

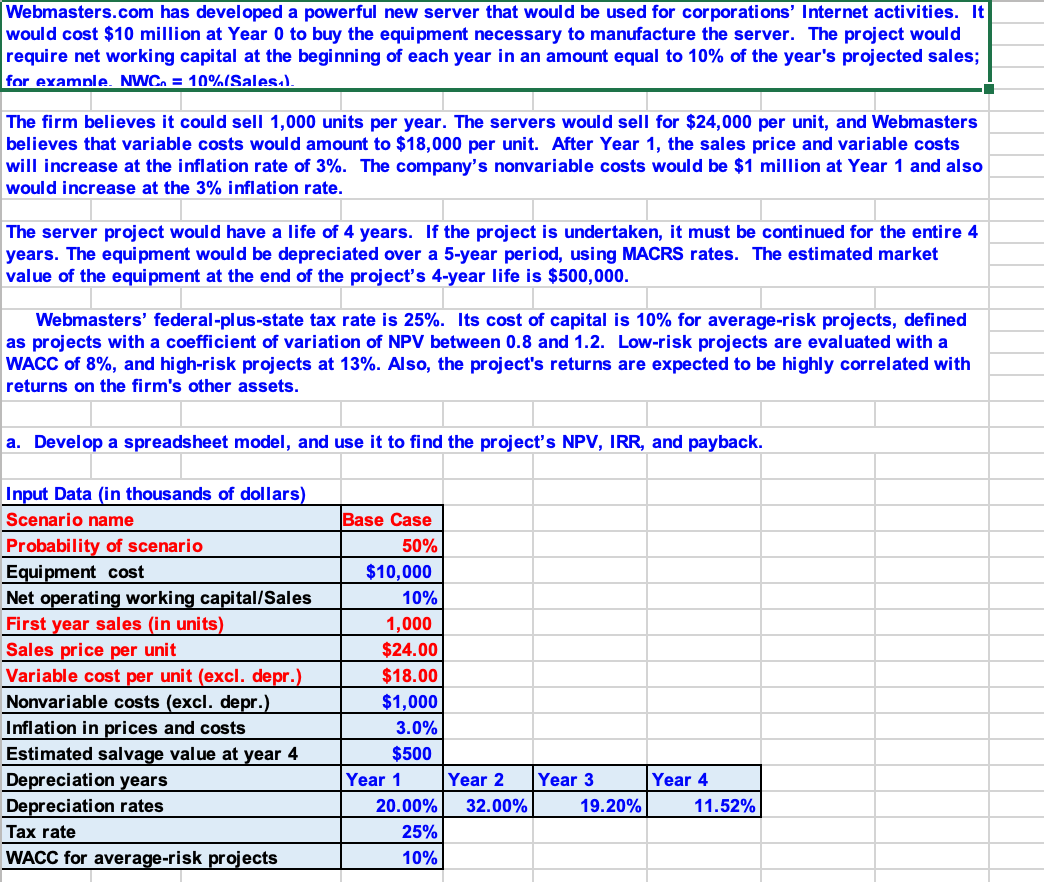

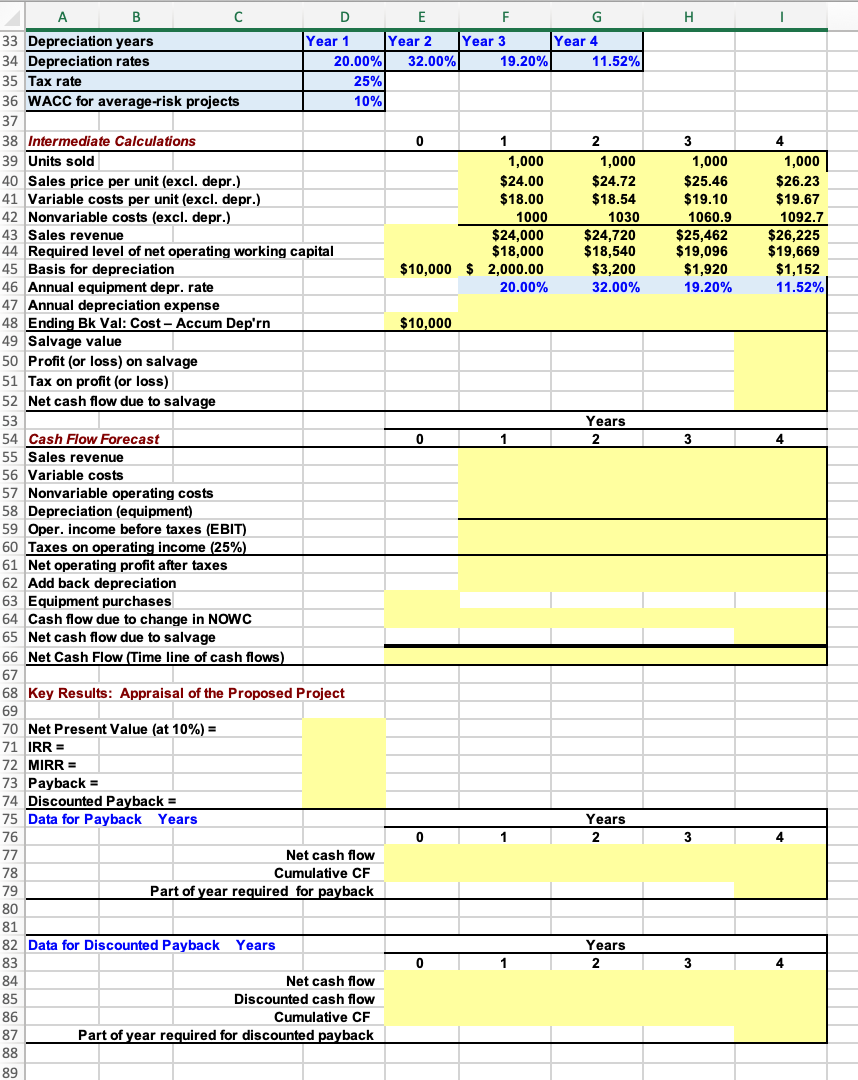

Webmasters.com has developed a powerful new server that would be used for corporations Internet activities. It would cost $10 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 10% of the year's projected sales; for example. NWC. = 10%(Sales.). . The firm believes it could sell 1,000 units per year. The servers would sell for $24,000 per unit, and Webmasters believes that variable costs would amount to $18,000 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 3%. The company's nonvariable costs would be $1 million at Year 1 and also would increase at the 3% inflation rate. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. The equipment would be depreciated over a 5-year period, using MACRS rates. The estimated market value of the equipment at the end of the project's 4-year life is $500,000. Webmasters' federal-plus-state tax rate is 25%. Its cost of capital is 10% for average-risk projects, defined as projects with a coefficient of variation of NPV between 0.8 and 1.2. Low-risk projects are evaluated with a WACC of 8%, and high-risk projects at 13%. Also, the project's returns are expected to be highly correlated with returns on the firm's other assets. a. Develop a spreadsheet model, and use it to find the project's NPV, IRR, and payback. Input Data (in thousands of dollars) Scenario name Probability of scenario Equipment cost Net operating working capital/Sales First year sales (in units) Sales price per unit Variable cost per unit (excl. depr.). Nonvariable costs (excl. depr.) Inflation in prices and costs Estimated salvage value at year 4 Depreciation years Depreciation rates Tax rate WACC for average-risk projects Base Case 50% $10,000 10% 1,000 $24.00 $18.00 $1,000 3.0% $500 Year 1 Year 2 Year 3 Year 4 20.00% 32.00% 19.20% 11.52% 25% 10% H 3 1,000 $25.46 $19.10 1060.9 $25,462 $19,096 $1,920 19.20% 4 1,000 $26.23 $19.67 1092.7 $26,225 $19,669 $1,152 11.52% 3 4 A B B D E F G 33 Depreciation years Year 1 Year 2 Year 3 Year 4 34 Depreciation rates 20.00% 32.00% 19.20% 11.52% 35 Tax rate 25% 36 WACC for average-risk projects 10% 37 38 Intermediate Calculations 0 1 2 39 Units sold 1,000 1,000 40 Sales price per unit (excl. depr.) $24.00 $24.72 41 Variable costs per unit (excl. depr.) $18.00 $18.54 42 Nonvariable costs (excl. depr.) 1000 1030 43 Sales revenue $24,000 $24,720 44 Required level of net operating working capital $18,000 $18,540 45 Basis for depreciation $10,000 $ 2,000.00 $3,200 46 Annual equipment depr. rate 20.00% 32.00% 47 Annual depreciation expense 48 Ending Bk Val: Cost - Accum Depirn $10,000 49 Salvage value 50 Profit (or loss) on salvage 51 Tax on profit (or loss) 52 Net cash flow due to salvage 53 Years 54 Cash Flow Forecast 0 1 2 55 Sales revenue 56 Variable costs 57 Nonvariable operating costs 58 Depreciation (equipment) 59 Oper. income before taxes (EBIT) 60 Taxes on operating income (25%) 61 Net operating profit after taxes 62 Add back depreciation 63 Equipment purchases 64 Cash flow due to change in NOWC 65 Net cash flow due to salvage 66 Net Cash Flow (Time line of cash flows) 67 68 Key Results: Appraisal of the Proposed Project 69 70 Net Present Value (at 10%) = 71 IRR = 72 MIRR = 73 Payback = 74 Discounted Payback = 75 Data for Payback Years Years 76 0 1 2 77 Net cash flow 78 Cumulative CF 79 Part of year required for payback 80 81 82 Data for Discounted Payback Years Years 83 0 1 2 84 Net cash flow 85 Discounted cash flow 86 Cumulative CF 87 Part of year required for discounted payback 88 89 3 8 3 Webmasters.com has developed a powerful new server that would be used for corporations Internet activities. It would cost $10 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 10% of the year's projected sales; for example. NWC. = 10%(Sales.). . The firm believes it could sell 1,000 units per year. The servers would sell for $24,000 per unit, and Webmasters believes that variable costs would amount to $18,000 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 3%. The company's nonvariable costs would be $1 million at Year 1 and also would increase at the 3% inflation rate. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. The equipment would be depreciated over a 5-year period, using MACRS rates. The estimated market value of the equipment at the end of the project's 4-year life is $500,000. Webmasters' federal-plus-state tax rate is 25%. Its cost of capital is 10% for average-risk projects, defined as projects with a coefficient of variation of NPV between 0.8 and 1.2. Low-risk projects are evaluated with a WACC of 8%, and high-risk projects at 13%. Also, the project's returns are expected to be highly correlated with returns on the firm's other assets. a. Develop a spreadsheet model, and use it to find the project's NPV, IRR, and payback. Input Data (in thousands of dollars) Scenario name Probability of scenario Equipment cost Net operating working capital/Sales First year sales (in units) Sales price per unit Variable cost per unit (excl. depr.). Nonvariable costs (excl. depr.) Inflation in prices and costs Estimated salvage value at year 4 Depreciation years Depreciation rates Tax rate WACC for average-risk projects Base Case 50% $10,000 10% 1,000 $24.00 $18.00 $1,000 3.0% $500 Year 1 Year 2 Year 3 Year 4 20.00% 32.00% 19.20% 11.52% 25% 10% H 3 1,000 $25.46 $19.10 1060.9 $25,462 $19,096 $1,920 19.20% 4 1,000 $26.23 $19.67 1092.7 $26,225 $19,669 $1,152 11.52% 3 4 A B B D E F G 33 Depreciation years Year 1 Year 2 Year 3 Year 4 34 Depreciation rates 20.00% 32.00% 19.20% 11.52% 35 Tax rate 25% 36 WACC for average-risk projects 10% 37 38 Intermediate Calculations 0 1 2 39 Units sold 1,000 1,000 40 Sales price per unit (excl. depr.) $24.00 $24.72 41 Variable costs per unit (excl. depr.) $18.00 $18.54 42 Nonvariable costs (excl. depr.) 1000 1030 43 Sales revenue $24,000 $24,720 44 Required level of net operating working capital $18,000 $18,540 45 Basis for depreciation $10,000 $ 2,000.00 $3,200 46 Annual equipment depr. rate 20.00% 32.00% 47 Annual depreciation expense 48 Ending Bk Val: Cost - Accum Depirn $10,000 49 Salvage value 50 Profit (or loss) on salvage 51 Tax on profit (or loss) 52 Net cash flow due to salvage 53 Years 54 Cash Flow Forecast 0 1 2 55 Sales revenue 56 Variable costs 57 Nonvariable operating costs 58 Depreciation (equipment) 59 Oper. income before taxes (EBIT) 60 Taxes on operating income (25%) 61 Net operating profit after taxes 62 Add back depreciation 63 Equipment purchases 64 Cash flow due to change in NOWC 65 Net cash flow due to salvage 66 Net Cash Flow (Time line of cash flows) 67 68 Key Results: Appraisal of the Proposed Project 69 70 Net Present Value (at 10%) = 71 IRR = 72 MIRR = 73 Payback = 74 Discounted Payback = 75 Data for Payback Years Years 76 0 1 2 77 Net cash flow 78 Cumulative CF 79 Part of year required for payback 80 81 82 Data for Discounted Payback Years Years 83 0 1 2 84 Net cash flow 85 Discounted cash flow 86 Cumulative CF 87 Part of year required for discounted payback 88 89 3 8 3