Question

WeDig considers the following five hedging strategies for managing commodity price risk: Strategy I: No hedge at all. Strategy II: Hedging 100% of the mining

-

WeDig considers the following five hedging strategies for managing commodity price risk:

Strategy I: No hedge at all. Strategy II: Hedging 100% of the mining output with a forward contract. Strategy III: Hedging 40% of the mining output with a forward contract and leaving the remaining 60% unhedged. Strategy IV: A strategy using one of the options given above to meet the target rate and benefit from favourable movements in the copper price. Strategy V: A strategy using one of the options given above for worst-case protection only (meet critical rate).

For each of these strategies:

-

Calculate the profit margin for the following two scenarios:

a) The copper spot price on 1 Nov 2022 is $10,500 per ton.

b) The copper spot price on 1 Nov 2022 is $8,300 per ton.

-

Explain the advantages and disadvantages of each hedging strategy.

-

If a strategy includes options, state clearly which option contract should be used, whether

as a long or short position, and why.

NOTES:

For the sake of simplicity, assume that copper doesnt cause storage costs. For the sake of simplicity, assume that each option is on one ton of copper. For the sake of simplicity, assume that all amounts are given in USD and the company is not concerned about currency risk. If a hedging strategy uses options, the option premium needs to be considered as an expense (added to Cost of Goods Sold) for profit margin calculations.

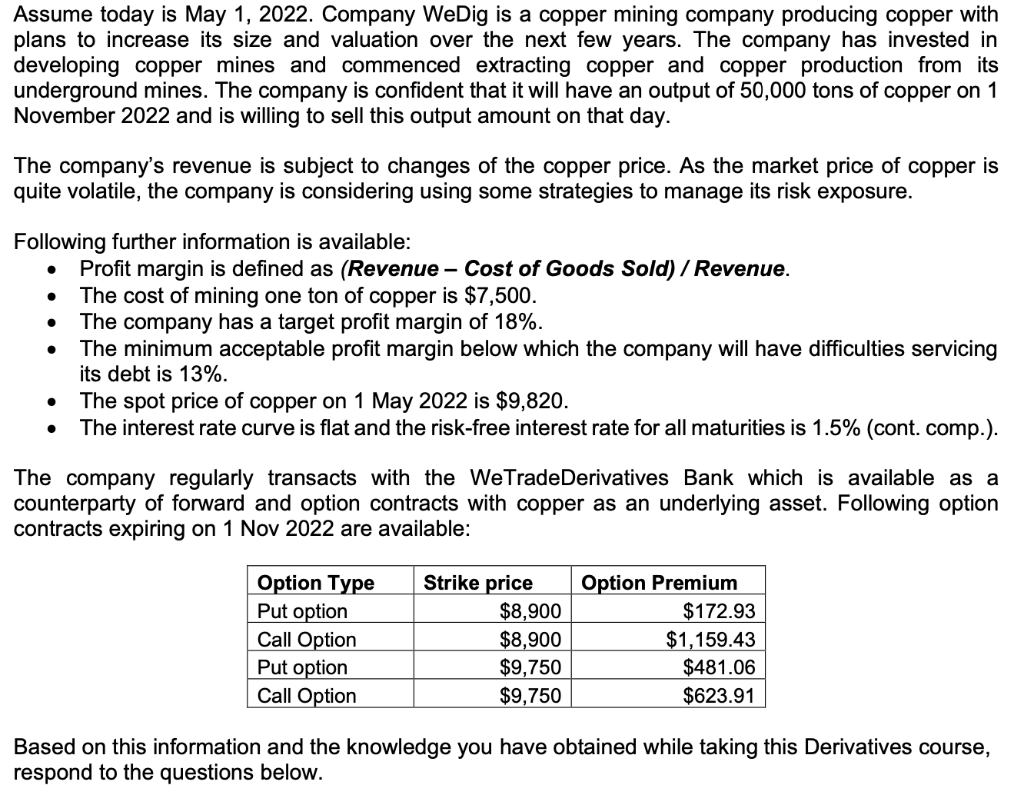

Assume today is May 1, 2022. Company WeDig is a copper mining company producing copper with plans to increase its size and valuation over the next few years. The company has invested in developing copper mines and commenced extracting copper and copper production from its underground mines. The company is confident that it will have an output of 50,000 tons of copper on 1 November 2022 and is willing to sell this output amount on that day. The company's revenue is subject to changes of the copper price. As the market price of copper is quite volatile, the company is considering using some strategies to manage its risk exposure. Following further information is available: Profit margin is defined as (Revenue - Cost of Goods Sold) / Revenue. The cost of mining one ton of copper is $7,500. The company has a target profit margin of 18%. The minimum acceptable profit margin below which the company will have difficulties servicing its debt is 13%. The spot price of copper on 1 May 2022 is $9,820. The interest rate curve is flat and the risk-free interest rate for all maturities is 1.5% (cont. comp.). The company regularly transacts with the WeTradeDerivatives Bank which is available as a counterparty of forward and option contracts with copper as an underlying asset. Following option contracts expiring on 1 Nov 2022 are available: Option Type Strike price Option Premium Put option $8,900 $172.93 Call Option $8,900 $1,159.43 Put option $9,750 $481.06 Call Option $9,750 $623.91 Based on this information and the knowledge you have obtained while taking this Derivatives course, respond to the questions belowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started