Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Week 11 Exrel Assignment - CVP Use the origind dota, along with the chonges in opelon 1 for quections d e Shally's Beutiques and Crats

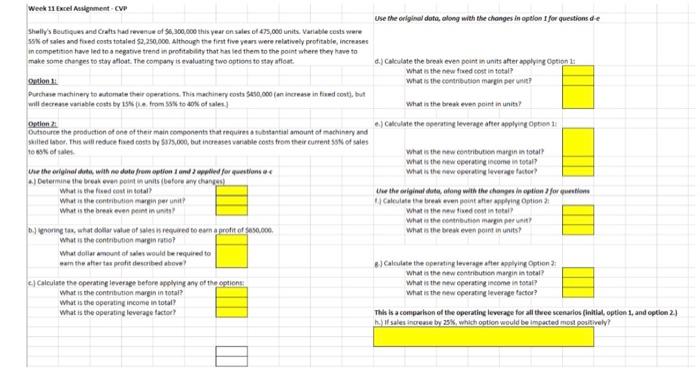

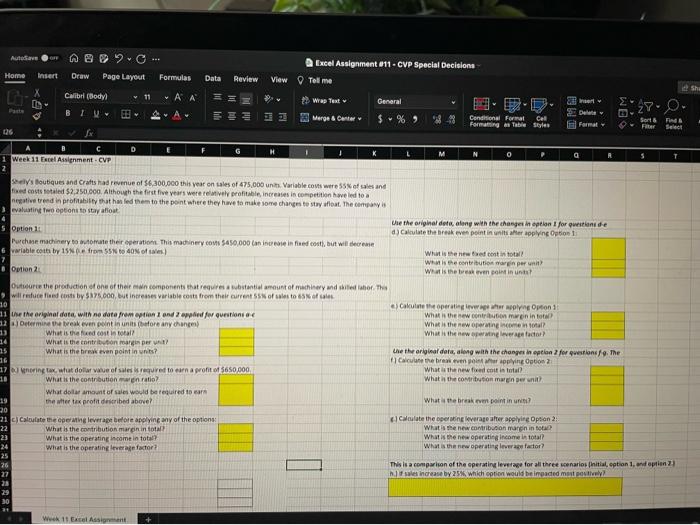

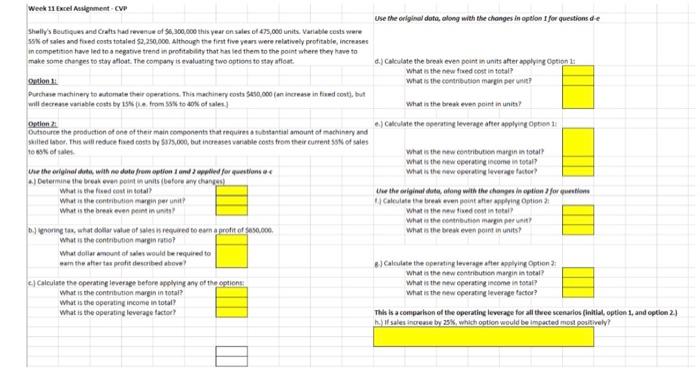

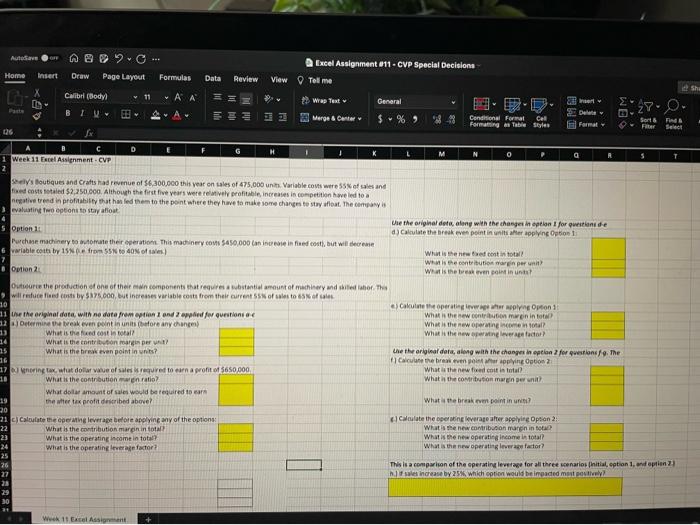

Week 11 Exrel Assignment - CVP Use the origind dota, along with the chonges in opelon 1 for quections d e Shally's Beutiques and Crats had revenue of $6,300,000 this year en sales of 475,000 units. Vatiatile cests ware S5K of ales and ficed costs totaled $2,250,000. slthough the first tive yearn were relatively protitable, increases in competition have led to a regative trend in protitability that has led them to the point ahere they have to make some cherges to stary allost. The company is evalusting two options to stay afloat. d.) Calculate the break eves point in units after applyirg Cotion 1t Oation 1. Purchase machinery to estomate their operations. This machinery costs Stso coo can increase in fived tosti, but What in the bresk even peint in units? OMilen 2. What a the new fiaed cost in total? Outsourte the produttion of one of their main components that requeret stibtiantial amount of machinery and to ssk of aler. e.) Calculate the operaticy leverige after applyind Opbess 1! What a the new contribution margin in total? What w the new eperatire income is tecal? What is the now eperativa leverage tater? the the originul duta, alang with the changes in optien J for gesentors 1. Calculate the brewt even point after sppleing Option 2t What a the now tised test in tetail? What it the ceetnbutien magh per weit? What a the twest even point in units? What is the conterbution margin ratso? What dotiar w wownt at alet would te required to asm the atter tas pratit described abevel 8) Calculate the operating leverage atter applying Option ?. What it the new eentributien margin in total? c.) Calculase the operating ieverage befere anplying any of the coptions: What it the new speratieg income in tocal? What is the contribution margin in total? What is the operating income in total? What is the operating leverage factor? What is the new eperating itiverage tictor? \begin{tabular}{|} \\ \hline \\ \hline \end{tabular} Thh is a comparison of the operating leverage for all twee scenwios finitial, option 1, and option 2.) h.) If sales incese by 3 s. which option would be impacted most positively? Seelys loubique and Cratts has revenue of 36,300,000 this vear on wes of 475,000 unth. Variable cons were 55 of wes and evaluatine two eptons to stay afiout Week 11 Exrel Assignment - CVP Use the origind dota, along with the chonges in opelon 1 for quections d e Shally's Beutiques and Crats had revenue of $6,300,000 this year en sales of 475,000 units. Vatiatile cests ware S5K of ales and ficed costs totaled $2,250,000. slthough the first tive yearn were relatively protitable, increases in competition have led to a regative trend in protitability that has led them to the point ahere they have to make some cherges to stary allost. The company is evalusting two options to stay afloat. d.) Calculate the break eves point in units after applyirg Cotion 1t Oation 1. Purchase machinery to estomate their operations. This machinery costs Stso coo can increase in fived tosti, but What in the bresk even peint in units? OMilen 2. What a the new fiaed cost in total? Outsourte the produttion of one of their main components that requeret stibtiantial amount of machinery and to ssk of aler. e.) Calculate the operaticy leverige after applyind Opbess 1! What a the new contribution margin in total? What w the new eperatire income is tecal? What is the now eperativa leverage tater? the the originul duta, alang with the changes in optien J for gesentors 1. Calculate the brewt even point after sppleing Option 2t What a the now tised test in tetail? What it the ceetnbutien magh per weit? What a the twest even point in units? What is the conterbution margin ratso? What dotiar w wownt at alet would te required to asm the atter tas pratit described abevel 8) Calculate the operating leverage atter applying Option ?. What it the new eentributien margin in total? c.) Calculase the operating ieverage befere anplying any of the coptions: What it the new speratieg income in tocal? What is the contribution margin in total? What is the operating income in total? What is the operating leverage factor? What is the new eperating itiverage tictor? \begin{tabular}{|} \\ \hline \\ \hline \end{tabular} Thh is a comparison of the operating leverage for all twee scenwios finitial, option 1, and option 2.) h.) If sales incese by 3 s. which option would be impacted most positively? Seelys loubique and Cratts has revenue of 36,300,000 this vear on wes of 475,000 unth. Variable cons were 55 of wes and evaluatine two eptons to stay afiout

Week 11 Exrel Assignment - CVP Use the origind dota, along with the chonges in opelon 1 for quections d e Shally's Beutiques and Crats had revenue of $6,300,000 this year en sales of 475,000 units. Vatiatile cests ware S5K of ales and ficed costs totaled $2,250,000. slthough the first tive yearn were relatively protitable, increases in competition have led to a regative trend in protitability that has led them to the point ahere they have to make some cherges to stary allost. The company is evalusting two options to stay afloat. d.) Calculate the break eves point in units after applyirg Cotion 1t Oation 1. Purchase machinery to estomate their operations. This machinery costs Stso coo can increase in fived tosti, but What in the bresk even peint in units? OMilen 2. What a the new fiaed cost in total? Outsourte the produttion of one of their main components that requeret stibtiantial amount of machinery and to ssk of aler. e.) Calculate the operaticy leverige after applyind Opbess 1! What a the new contribution margin in total? What w the new eperatire income is tecal? What is the now eperativa leverage tater? the the originul duta, alang with the changes in optien J for gesentors 1. Calculate the brewt even point after sppleing Option 2t What a the now tised test in tetail? What it the ceetnbutien magh per weit? What a the twest even point in units? What is the conterbution margin ratso? What dotiar w wownt at alet would te required to asm the atter tas pratit described abevel 8) Calculate the operating leverage atter applying Option ?. What it the new eentributien margin in total? c.) Calculase the operating ieverage befere anplying any of the coptions: What it the new speratieg income in tocal? What is the contribution margin in total? What is the operating income in total? What is the operating leverage factor? What is the new eperating itiverage tictor? \begin{tabular}{|} \\ \hline \\ \hline \end{tabular} Thh is a comparison of the operating leverage for all twee scenwios finitial, option 1, and option 2.) h.) If sales incese by 3 s. which option would be impacted most positively? Seelys loubique and Cratts has revenue of 36,300,000 this vear on wes of 475,000 unth. Variable cons were 55 of wes and evaluatine two eptons to stay afiout Week 11 Exrel Assignment - CVP Use the origind dota, along with the chonges in opelon 1 for quections d e Shally's Beutiques and Crats had revenue of $6,300,000 this year en sales of 475,000 units. Vatiatile cests ware S5K of ales and ficed costs totaled $2,250,000. slthough the first tive yearn were relatively protitable, increases in competition have led to a regative trend in protitability that has led them to the point ahere they have to make some cherges to stary allost. The company is evalusting two options to stay afloat. d.) Calculate the break eves point in units after applyirg Cotion 1t Oation 1. Purchase machinery to estomate their operations. This machinery costs Stso coo can increase in fived tosti, but What in the bresk even peint in units? OMilen 2. What a the new fiaed cost in total? Outsourte the produttion of one of their main components that requeret stibtiantial amount of machinery and to ssk of aler. e.) Calculate the operaticy leverige after applyind Opbess 1! What a the new contribution margin in total? What w the new eperatire income is tecal? What is the now eperativa leverage tater? the the originul duta, alang with the changes in optien J for gesentors 1. Calculate the brewt even point after sppleing Option 2t What a the now tised test in tetail? What it the ceetnbutien magh per weit? What a the twest even point in units? What is the conterbution margin ratso? What dotiar w wownt at alet would te required to asm the atter tas pratit described abevel 8) Calculate the operating leverage atter applying Option ?. What it the new eentributien margin in total? c.) Calculase the operating ieverage befere anplying any of the coptions: What it the new speratieg income in tocal? What is the contribution margin in total? What is the operating income in total? What is the operating leverage factor? What is the new eperating itiverage tictor? \begin{tabular}{|} \\ \hline \\ \hline \end{tabular} Thh is a comparison of the operating leverage for all twee scenwios finitial, option 1, and option 2.) h.) If sales incese by 3 s. which option would be impacted most positively? Seelys loubique and Cratts has revenue of 36,300,000 this vear on wes of 475,000 unth. Variable cons were 55 of wes and evaluatine two eptons to stay afiout

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started