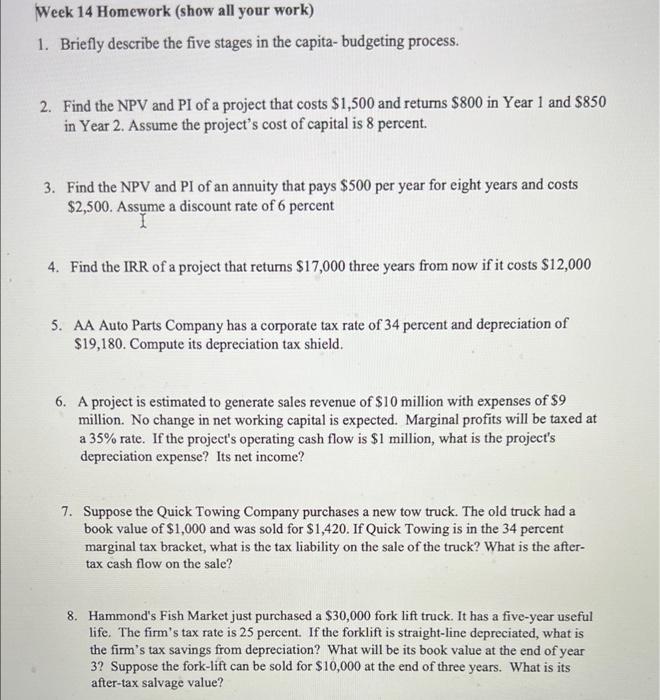

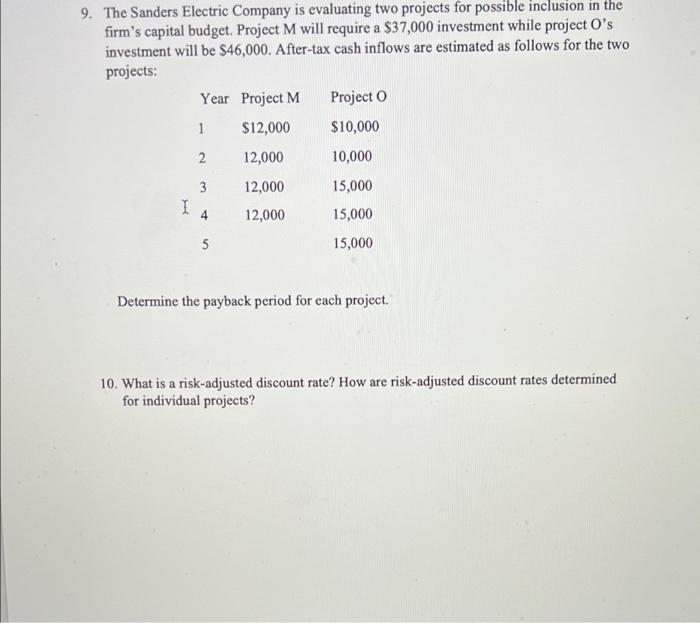

Week 14 Homework (show all your work) 1. Briefly describe the five stages in the capita- budgeting process. 2. Find the NPV and PI of a project that costs $1,500 and returns $800 in Year 1 and $850 in Year 2. Assume the project's cost of capital is 8 percent. 3. Find the NPV and PI of an annuity that pays $500 per year for eight years and costs $2,500. Assume a discount rate of 6 percent 4. Find the IRR of a project that returns $17,000 three years from now if it costs $12,000 5. AA Auto Parts Company has a corporate tax rate of 34 percent and depreciation of $19,180. Compute its depreciation tax shield. 6. A project is estimated to generate sales revenue of $10 million with expenses of $9 million. No change in net working capital is expected. Marginal profits will be taxed at a 35% rate. If the project's operating cash flow is $1 million, what is the project's depreciation expense? Its net income? 7. Suppose the Quick Towing Company purchases a new tow truck. The old truck had a book value of $1,000 and was sold for $1,420. If Quick Towing is in the 34 percent marginal tax bracket, what is the tax liability on the sale of the truck? What is the after- tax cash flow on the sale? 8. Hammond's Fish Market just purchased a $30,000 fork lift truck. It has a five-year useful life. The firm's tax rate is 25 percent. If the forklift is straight-line depreciated, what is the firm's tax savings from depreciation? What will be its book value at the end of year 32 Suppose the fork-lift can be sold for $10,000 at the end of three years. What is its after-tax salvage value? 9. The Sanders Electric Company is evaluating two projects for possible inclusion in the firm's capital budget. Project M will require a $37,000 investment while project O's investment will be $46,000. After-tax cash inflows are estimated as follows for the two projects: Year Project M Project 0 1 $12,000 $10,000 2 12,000 10,000 3 12,000 15,000 1 4 12,000 15,000 5 15,000 Determine the payback period for each project. 10. What is a risk-adjusted discount rate? How are risk-adjusted discount rates determined for individual projects? Week 14 Homework (show all your work) 1. Briefly describe the five stages in the capita- budgeting process. 2. Find the NPV and PI of a project that costs $1,500 and returns $800 in Year 1 and $850 in Year 2. Assume the project's cost of capital is 8 percent. 3. Find the NPV and PI of an annuity that pays $500 per year for eight years and costs $2,500. Assume a discount rate of 6 percent 4. Find the IRR of a project that returns $17,000 three years from now if it costs $12,000 5. AA Auto Parts Company has a corporate tax rate of 34 percent and depreciation of $19,180. Compute its depreciation tax shield. 6. A project is estimated to generate sales revenue of $10 million with expenses of $9 million. No change in net working capital is expected. Marginal profits will be taxed at a 35% rate. If the project's operating cash flow is $1 million, what is the project's depreciation expense? Its net income? 7. Suppose the Quick Towing Company purchases a new tow truck. The old truck had a book value of $1,000 and was sold for $1,420. If Quick Towing is in the 34 percent marginal tax bracket, what is the tax liability on the sale of the truck? What is the after- tax cash flow on the sale? 8. Hammond's Fish Market just purchased a $30,000 fork lift truck. It has a five-year useful life. The firm's tax rate is 25 percent. If the forklift is straight-line depreciated, what is the firm's tax savings from depreciation? What will be its book value at the end of year 32 Suppose the fork-lift can be sold for $10,000 at the end of three years. What is its after-tax salvage value? 9. The Sanders Electric Company is evaluating two projects for possible inclusion in the firm's capital budget. Project M will require a $37,000 investment while project O's investment will be $46,000. After-tax cash inflows are estimated as follows for the two projects: Year Project M Project 0 1 $12,000 $10,000 2 12,000 10,000 3 12,000 15,000 1 4 12,000 15,000 5 15,000 Determine the payback period for each project. 10. What is a risk-adjusted discount rate? How are risk-adjusted discount rates determined for individual projects