Answered step by step

Verified Expert Solution

Question

1 Approved Answer

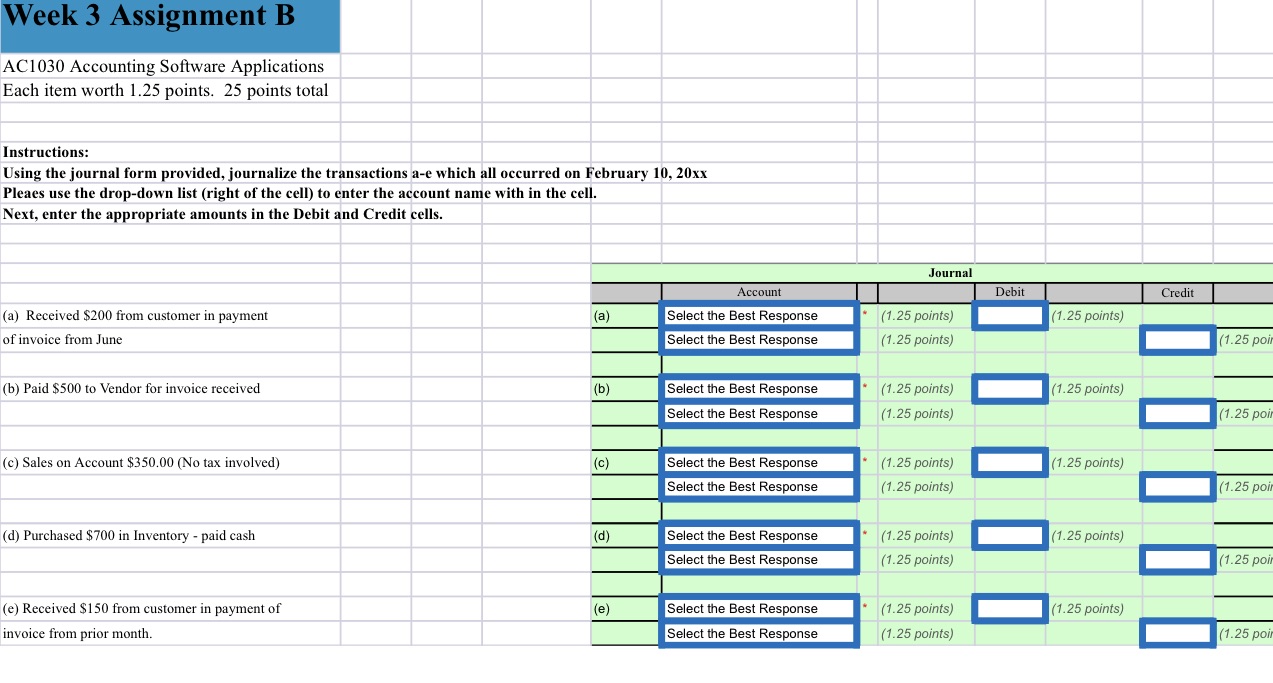

Week 3 Assignment B AC1030 Accounting Software Applications Each item worth 1.25 points. 25 points total Instructions: Using the journal form provided, journalize the

Week 3 Assignment B AC1030 Accounting Software Applications Each item worth 1.25 points. 25 points total Instructions: Using the journal form provided, journalize the transactions a-e which all occurred on February 10, 20xx Pleaes use the drop-down list (right of the cell) to enter the account name with in the cell. Next, enter the appropriate amounts in the Debit and Credit cells. Account (a) Received $200 from customer in payment of invoice from June (a) Select the Best Response Select the Best Response (1.25 points) Journal Debit Credit (1.25 points) (1.25 points) (1.25 poin (b) Paid $500 to Vendor for invoice received (b) Select the Best Response (1.25 points) (1.25 points) Select the Best Response (1.25 points) (1.25 poin (c) Sales on Account $350.00 (No tax involved) (c) Select the Best Response (1.25 points) (1.25 points) Select the Best Response (1.25 points) (1.25 poin (d) Purchased $700 in Inventory - paid cash (d) Select the Best Response (1.25 points) (1.25 points) Select the Best Response (1.25 points) (1.25 poin (e) Received $150 from customer in payment of invoice from prior month. (e) Select the Best Response (1.25 points) (1.25 points) Select the Best Response (1.25 points) (1.25 poin

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Received 200 from customer in prenest of invoice from Jre Journal Entry Debit Cash Received from c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started