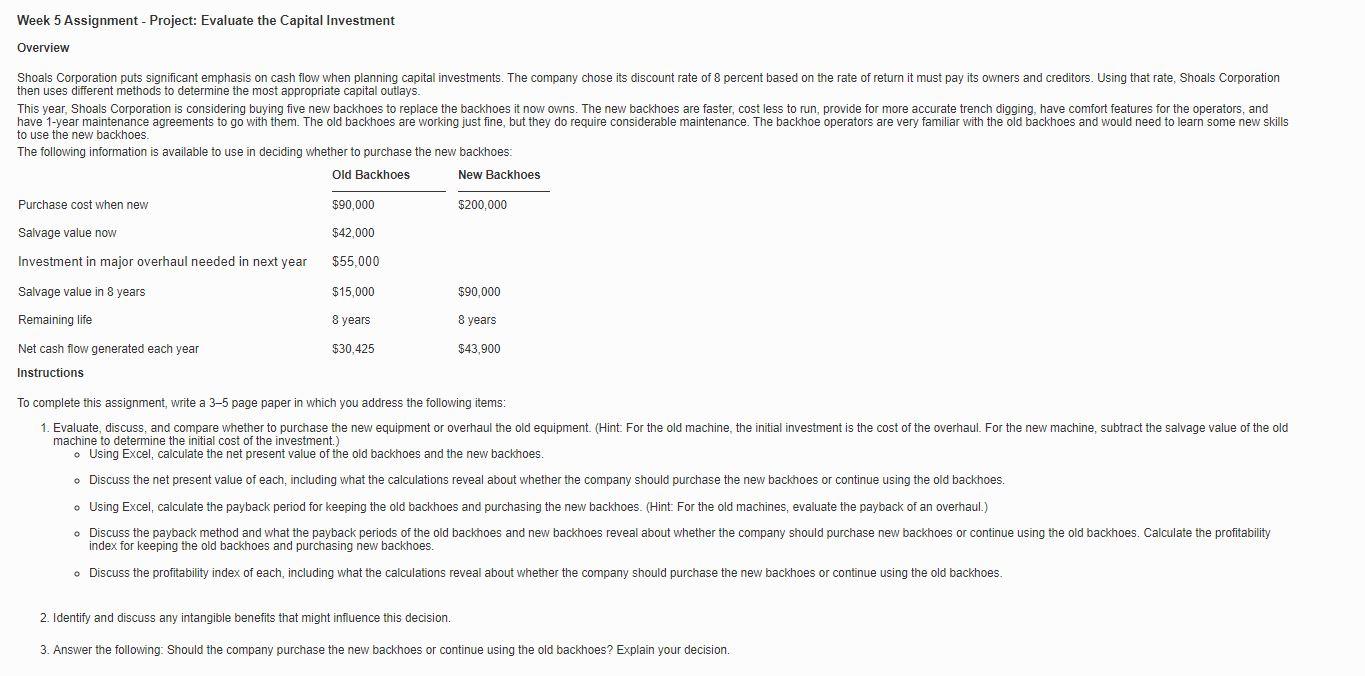

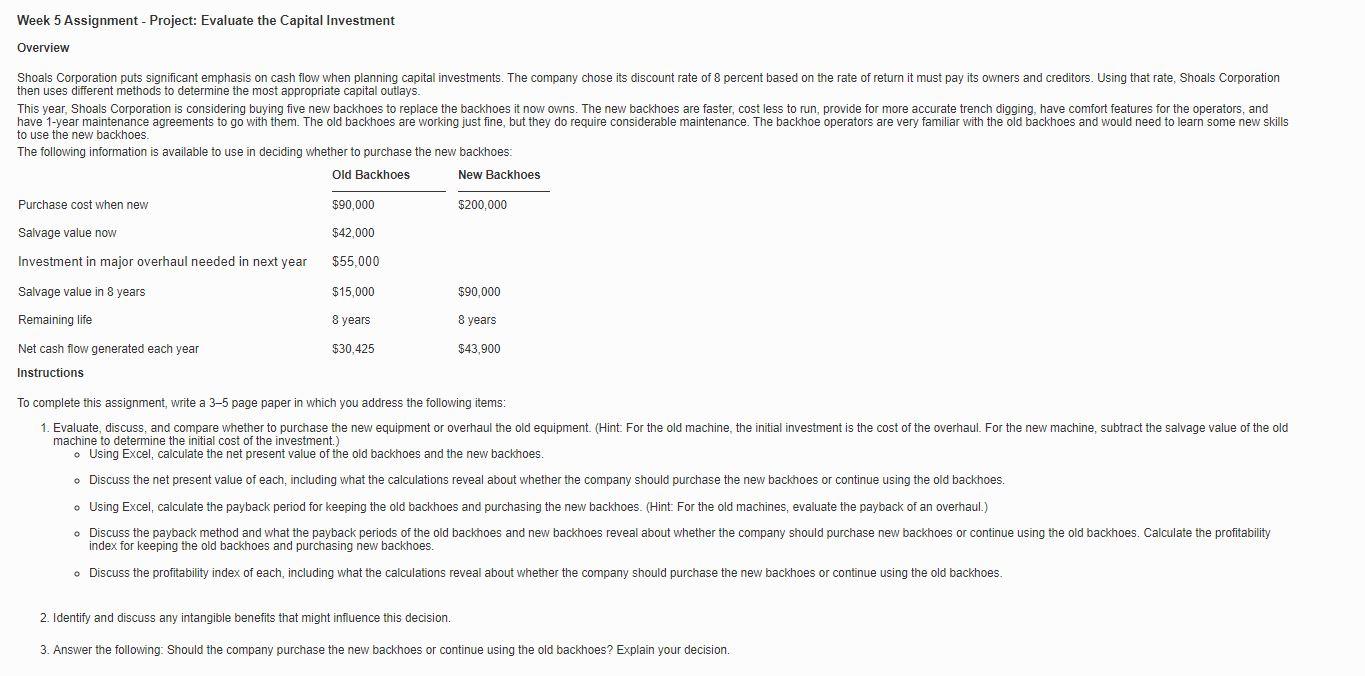

Week 5 Assignment - Project: Evaluate the Capital Investment Overview Shoals Corporation puts significant emphasis on cash flow when planning capital investments. The company chose its discount rate of 8 percent based on the rate of return it must pay its owners and creditors. Using that rate, Shoals Corporation then uses different methods to determine the most appropriate capital outlays. This year. Shoals Corporation is considering buying five new backhoes to replace the backhoes it now owns. The new backhoes are faster, cost less to run, provide for more accurate trench digging, have comfort features for the operators, and have 1-year maintenance agreements to go with them. The old backhoes are working just fine, but they do require considerable maintenance. The backhoe operators are very familiar with the old backhoes and would need to learn some new skills to use the new backhoes. The following information is available to use in deciding whether to purchase the new backhoes: Old Backhoes New Backhoes Purchase cost when new $90,000 $200.000 Salvage value now $42,000 Investment in major overhaul needed in next year $55.000 Salvage value in 8 years $15,000 $90,000 Remaining life 8 years 8 years Net cash flow generated each year $30,425 $43,900 Instructions To complete this assignment, write a 3-5 page paper in which you address the following items: 1. Evaluate, discuss, and compare whether to purchase the new equipment or overhaul the old equipment. (Hint: For the old machine, the initial investment is the cost of the overhaul. For the new machine, subtract the salvage value of the old machine to determine the initial cost of the investment.) o Using Excel, calculate the net present value of the old backhoes and the new backhoes. Discuss the net present value of each, including what the calculations reveal about whether the company should purchase the new backhoes or continue using the old backhoes. . Using Excel, calculate the payback period for keeping the old backhoes and purchasing the new backhoes. (Hint: For the old machines, evaluate the payback of an overhaul.) Discuss the payback method and what the payback periods of the old backhoes and new backhoes reveal about whether the company should purchase new backhoes or continue using the old backhoes. Calculate the profitability index for keeping the old backhoes and purchasing new backhoes. o Discuss the profitability index of each, including what the calculations reveal about whether the company should purchase the new backhoes or continue using the old backhoes. 2. Identify and discuss any intangible benefits that might influence this decision. 3. Answer the following: Should the company purchase the new backhoes or continue using the old backhoes? Explain your decision