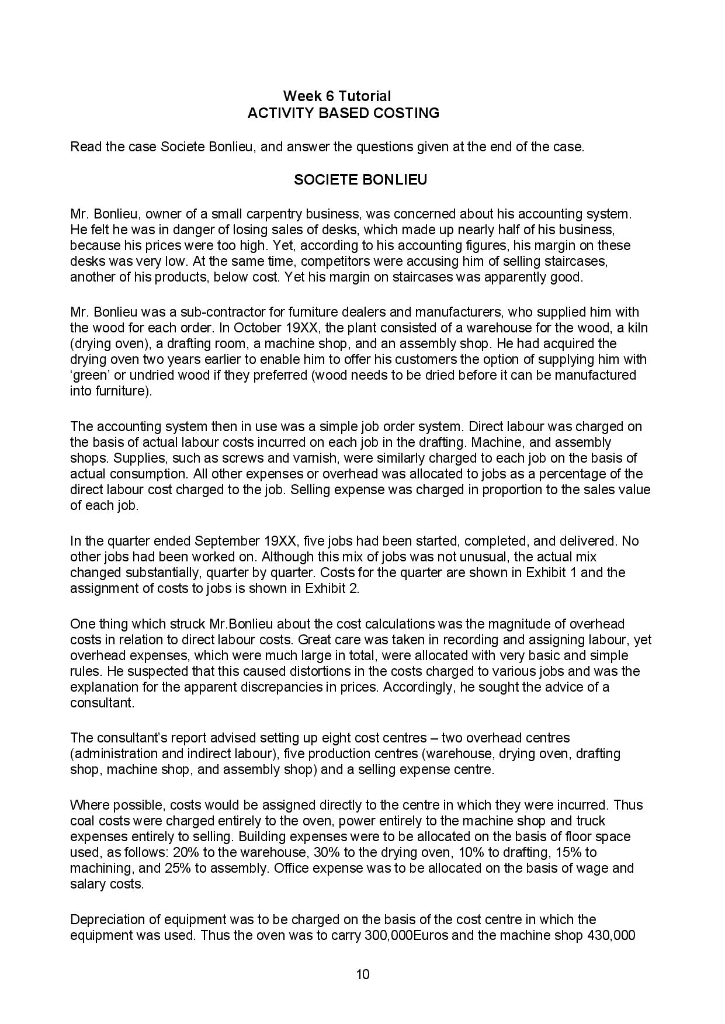

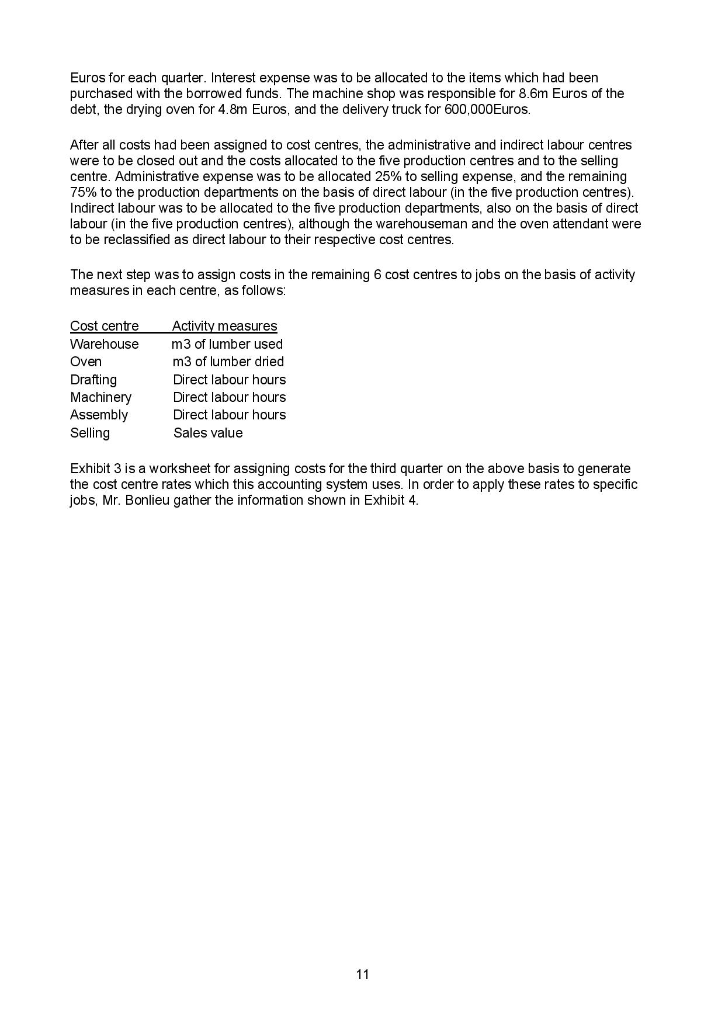

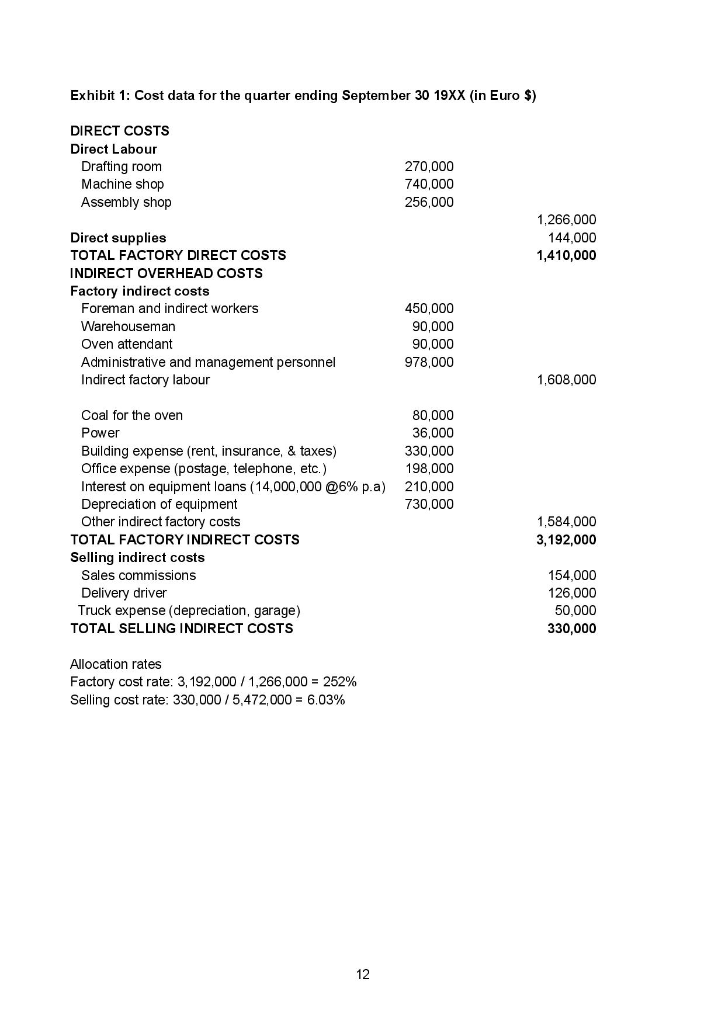

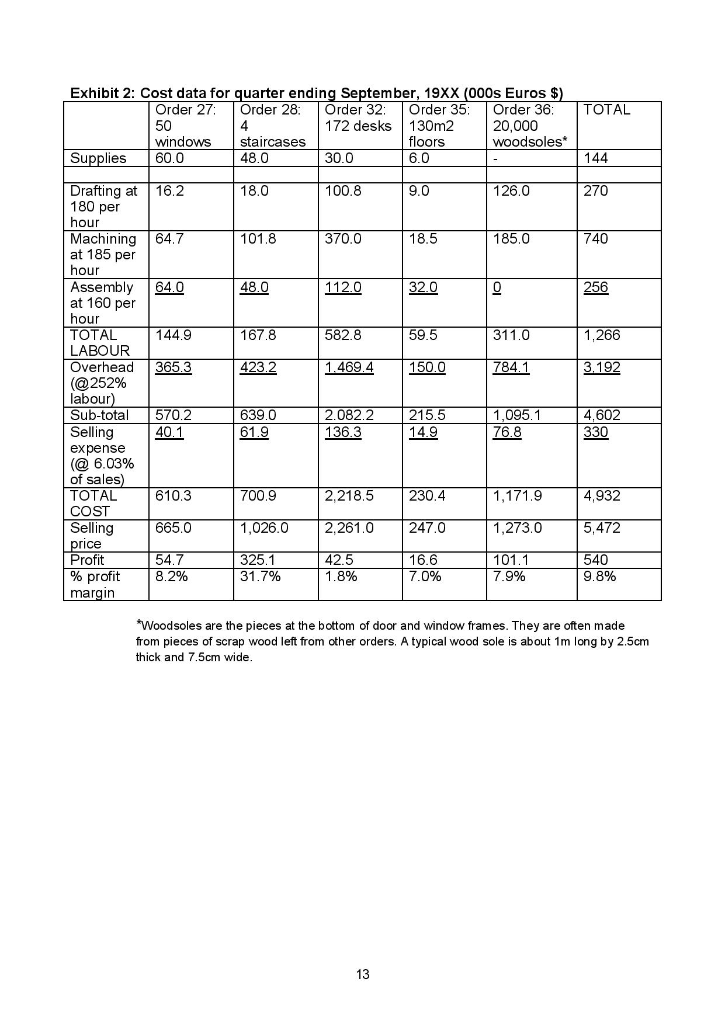

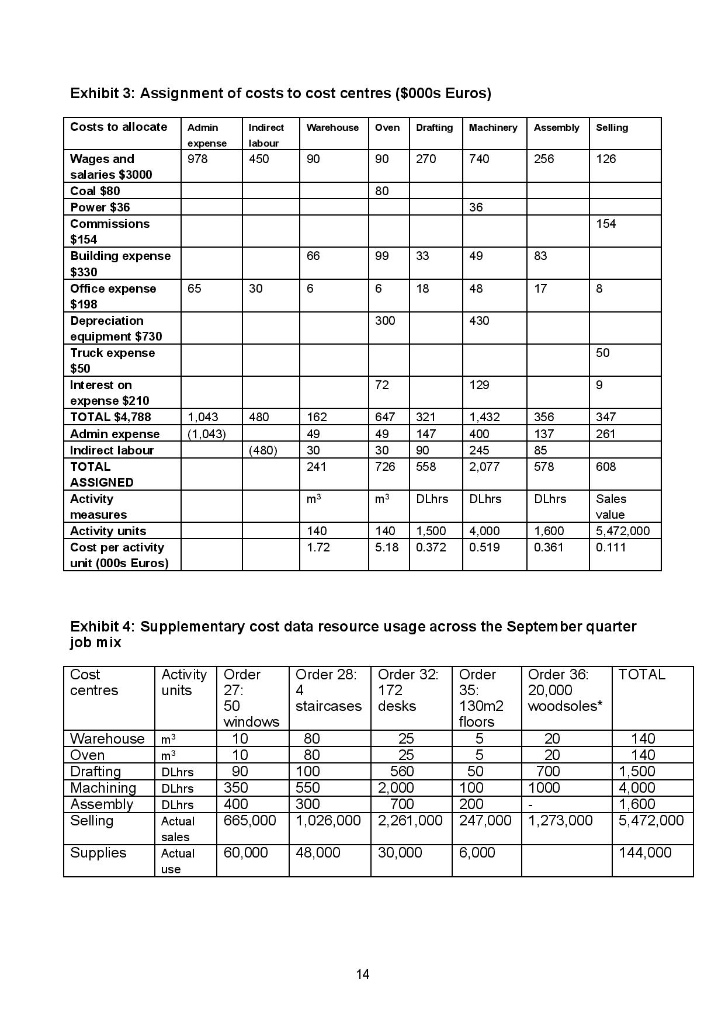

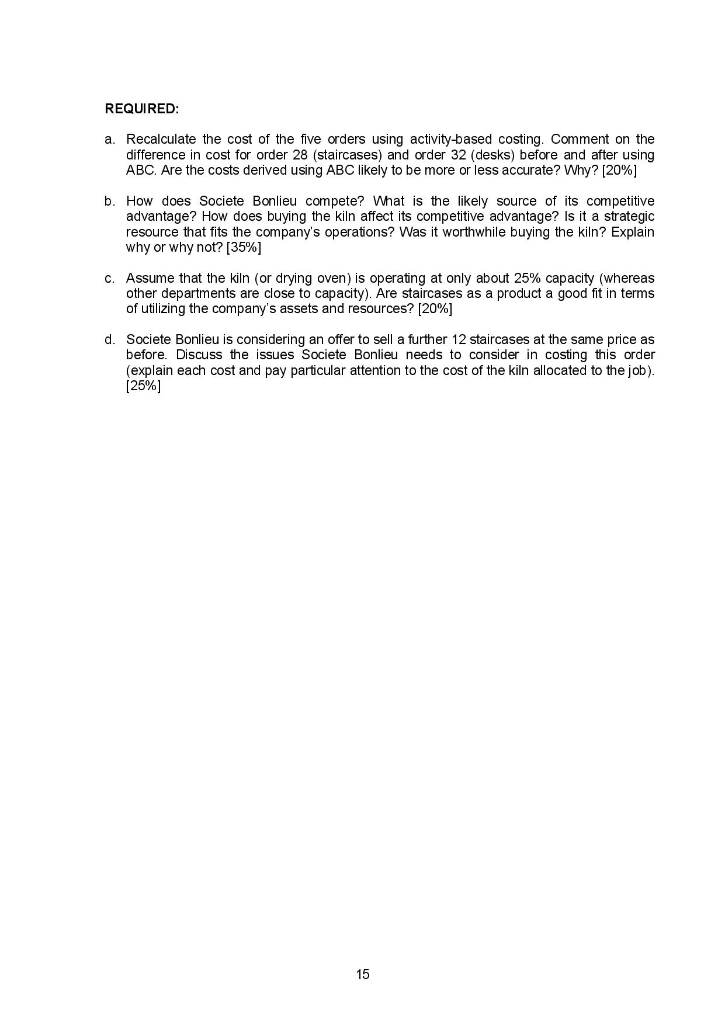

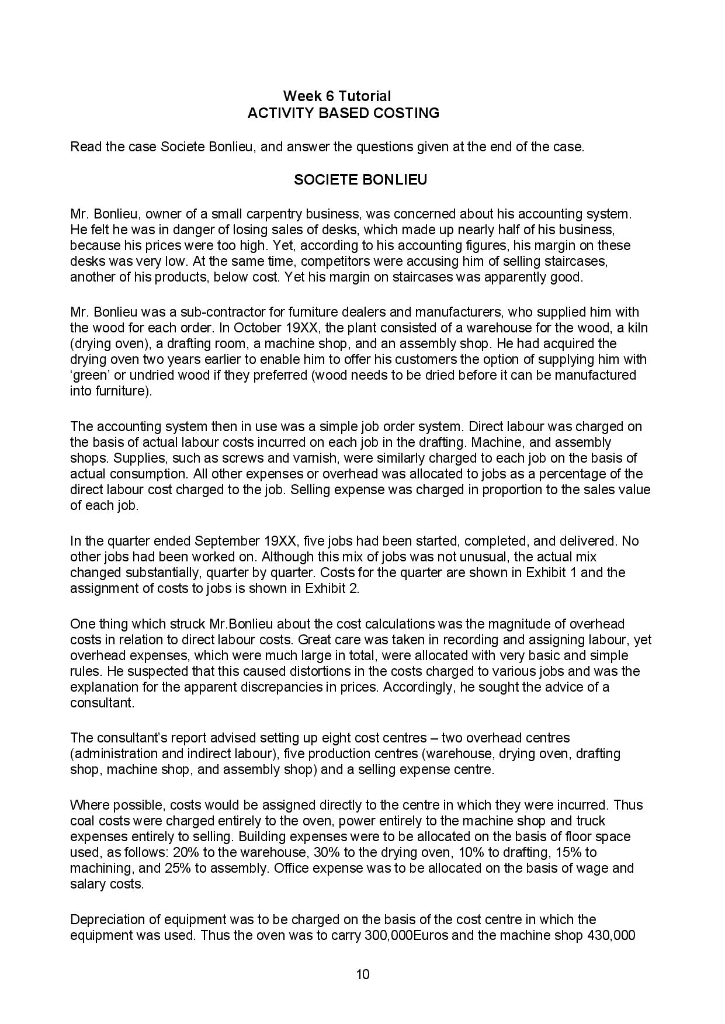

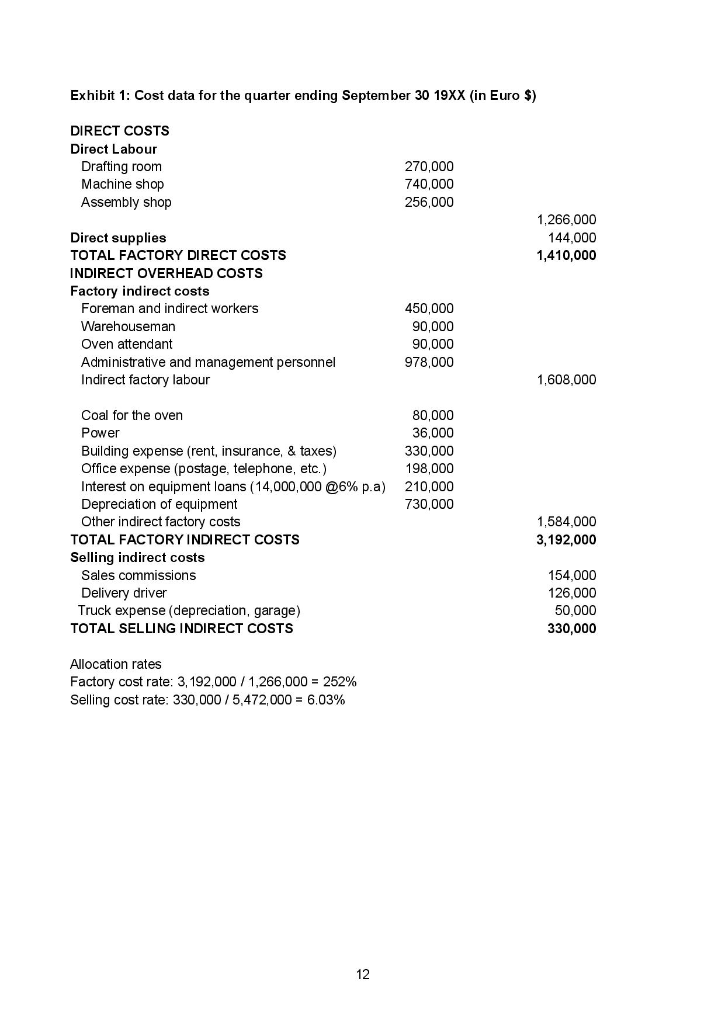

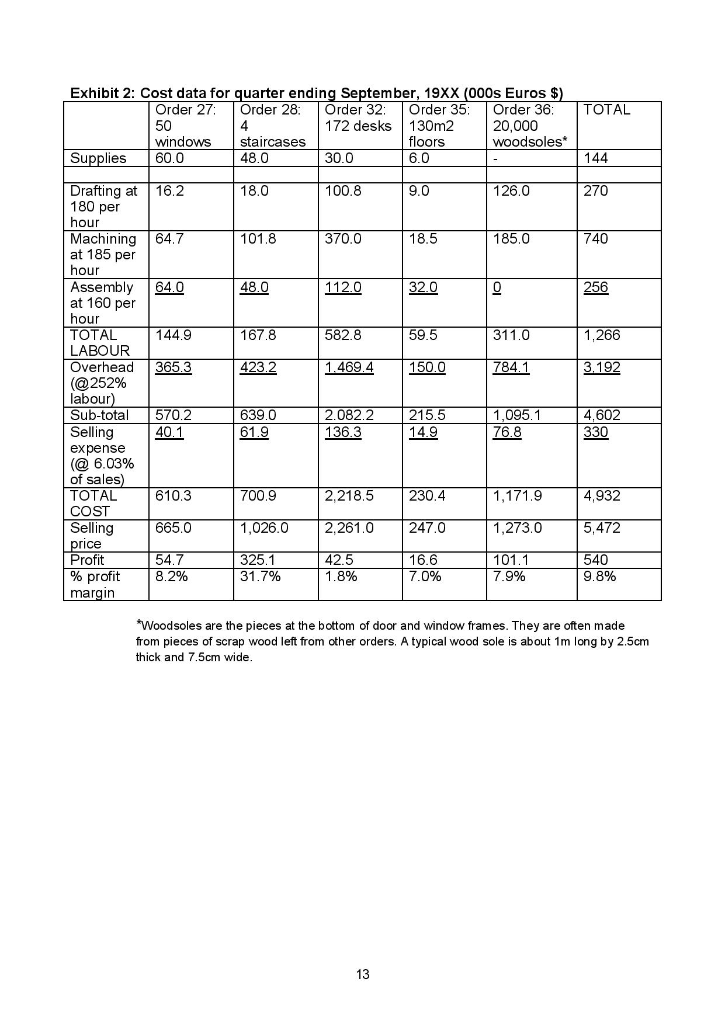

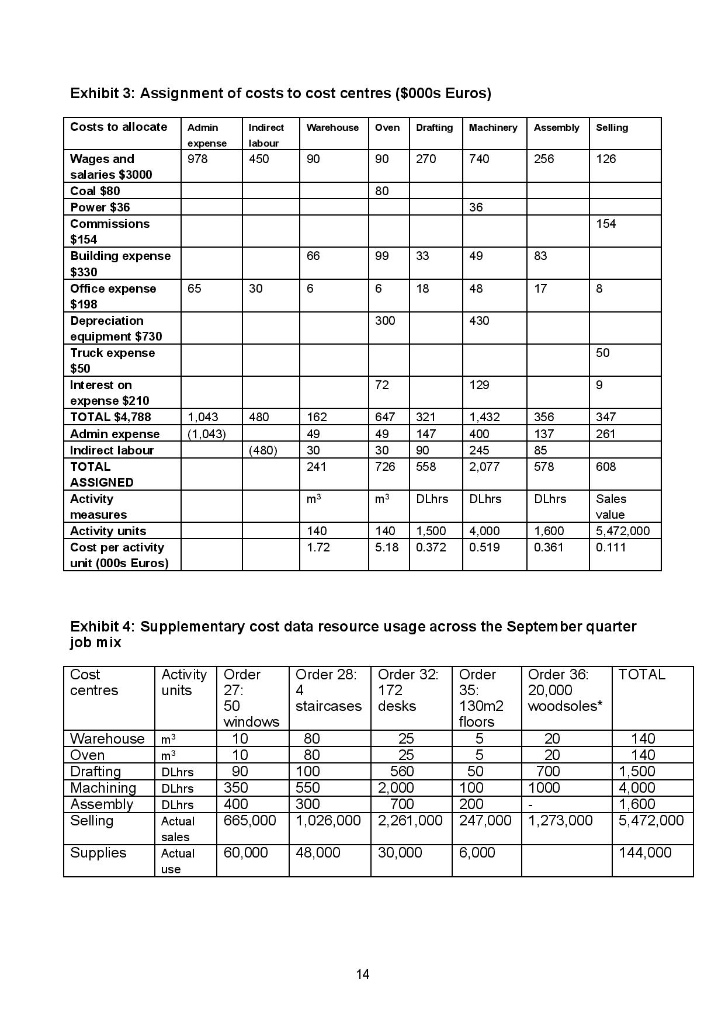

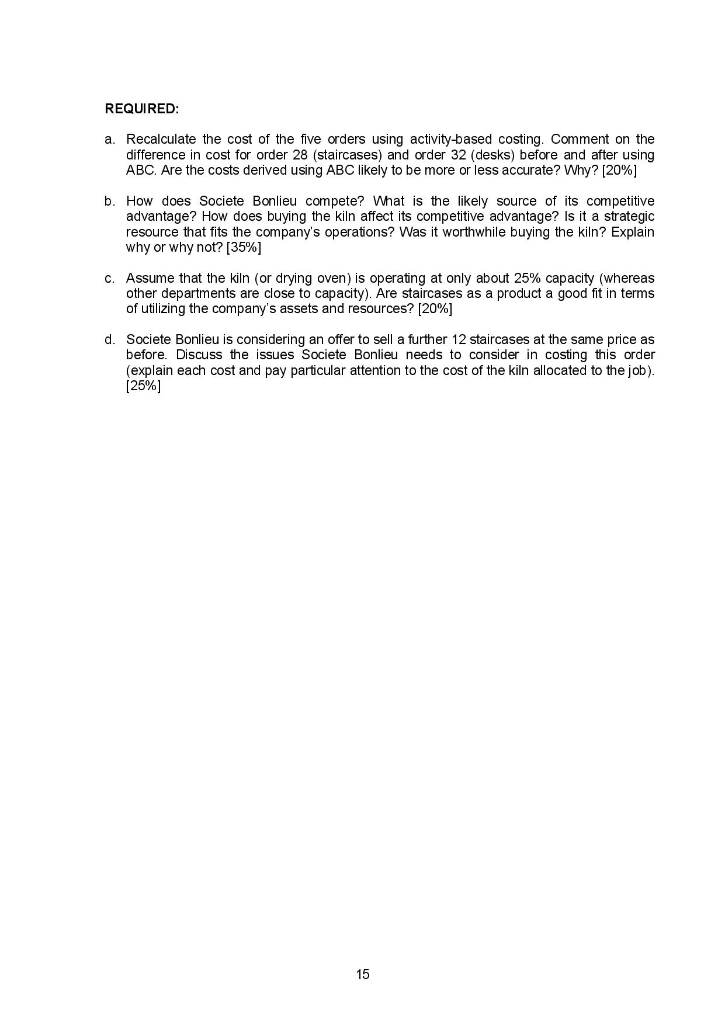

Week 6 Tutorial ACTIVITY BASED COSTING Read the case Societe Bonlieu, and answer the questions given at the end of the case. SOCIETE BONLIEU Mr. Bonlieu, owner of a small carpentry business, was concerned about his accounting system. He felt he was in danger of losing sales of desks, which made up nearly half of his business, because his prices were too high. Yet, according to his accounting figures, his margin on these desks was very low. At the same time, competitors were accusing him of selling staircases, another of his products, below cost. Yet his margin on staircases was apparently good. Mr. Bonlieu was a sub-contractor for furniture dealers and manufacturers, who supplied him with the wood for each order. In October 19XX, the plant consisted of a warehouse for the wood, a kiln (drying oven), a drafting room, a machine shop, and an assembly shop. He had acquired the drying oven two years earlier to enable him to offer his customers the option of supplying him with 'green' or undried wood if they preferred (wood needs to be dried before it can be manufactured into furniture). The accounting system then in use was a simple job order system. Direct labour was charged on the basis of actual labour costs incurred on each job in the drafting. Machine, and assembly shops. Supplies, such as screws and varish, were similarly charged to each job on the basis of actual consumption. All other expenses or overhead was allocated to jobs as a percentage of the direct labour cost charged to the job. Selling expense was charged in proportion to the sales value of each job. In the quarter ended September 19XX, five jobs had been started, completed, and delivered. No other jobs had been worked on. Although this mix of jobs was not unusual, the actual mix changed substantially, quarter by quarter. Costs for the quarter are shown in Exhibit 1 and the assignment of costs to jobs is shown in Exhibit 2. One thing which struck Mr. Bonlieu about the cost calculations was the magnitude of overhead costs in relation to direct labour costs. Great care was taken in recording and assigning labour, yet overhead expenses, which were much large in total, were allocated with very basic and simple rules. He suspected that this caused distortions in the costs charged to various jobs and was the explanation for the apparent discrepancies in prices. Accordingly, he sought the advice of a consultant The consultant's report advised setting up eight cost centres - two overhead centres (administration and indirect labour), five production centres (warehouse, drying oven, drafting shop, machine shop, and assembly shop) and a selling expense centre. Where possible, costs would be assigned directly to the centre in which they were incurred. Thus coal costs were charged entirely to the oven, power entirely to the machine shop and truck expenses entirely to selling. Building expenses were to be allocated on the basis of floor space used, as follows: 20% to the warehouse, 30% to the drying oven, 10% to drafting, 15% to machining, and 25% to assembly. Office expense was to be allocated on the basis of wage and salary costs. Depreciation of equipment was to be charged on the basis of the cost centre in which the equipment was used. Thus the oven was to carry 300,000Euros and the machine shop 430,000 10 Euros for each quarter. Interest expense was to be allocated to the items which had been purchased with the borrowed funds. The machine shop was responsible for 8.6m Euros of the debt, the drying oven for 4.8m Euros, and the delivery truck for 600,000Euros. After all costs had been assigned to cost centres, the administrative and indirect labour centres were to be closed out and the costs allocated to the five production centres and to the selling centre. Administrative expense was to be allocated 25% to selling expense, and the remaining 75% to the production departments on the basis of direct labour in the five production centres). Indirect labour was to be allocated to the five production departments, also on the basis of direct labour in the five production centres), although the warehouseman and the oven attendant were to be reclassified as direct labour to their respective cost centres. The next step was to assign costs in the remaining 6 cost centres to jobs on the basis of activity measures in each centre, as follows: Cost centre Warehouse Oven Drafting Machinery Assembly Selling Activity measures m3 of lumber used m3 of lumber dried Direct labour hours Direct labour hours Direct labour hours Sales value Exhibit 3 is a worksheet for assigning costs for the third quarter on the above basis to generate the cost centre rates which this accounting system uses. In order to apply these rates to specific jobs, Mr. Bonlieu gather the information shown in Exhibit 4. Exhibit 1: Cost data for the quarter ending September 30 19XX (in Euro $) DIRECT COSTS Direct Labour Drafting room Machine shop Assembly shop 270,000 740,000 256,000 1,266,000 144,000 1,410,000 Direct supplies TOTAL FACTORY DIRECT COSTS INDIRECT OVERHEAD COSTS Factory indirect costs Foreman and indirect workers Warehouseman Oven attendant Administrative and management personnel Indirect factory labour 450,000 90,000 90,000 978,000 1,608,000 80,000 36,000 330,000 198,000 210,000 730,000 Coal for the oven Power Building expense (rent, insurance, & taxes) Office expense (postage, telephone, etc.) Interest on equipment loans (14,000,000 @6% p.a) Depreciation of equipment Other indirect factory costs TOTAL FACTORY INDIRECT COSTS Selling indirect costs Sales commissions Delivery driver Truck expense (depreciation, garage) TOTAL SELLING INDIRECT COSTS 1,584,000 3,192,000 154,000 126,000 50,000 330,000 Allocation rates Factory cost rate: 3,192,000 / 1,266,000 = 252% Selling cost rate: 330,000 / 5,472,000 = 6.03% 1 18.5 32.0 256 1678 Exhibit 2: Cost data for quarter ending September, 19XX (000s Euros $) Order 27: Order 28: Order 32: Order 35: Order 36: TOTA 172 desks 130m2 20,000 windows staircases floors woodsoles* Supplies 60.0 48.0 30.0 6.0 144 Drafting at 16.2 18.0 100.8 9.0 126.0 1270 180 per hour Machining 64.7 101.8 370.0 185.0 740 at 185 per hour Assembly 64.0 48.0 112.0 at 160 per hour TOTAL 144.9 582.8 59.5 311.0 1,266 LABOUR Overhead 365.3 423.2 11.469.4 150.0 784.1 3.192 @252% labour) Sub-total 570.2 639.0 2.082.2 215.5 1,095.1 4.602 Selling 61.9 136.3 76.8 330 expense (@ 6.03% of sales) TOTAL | 610.3 700.9 2,218.5 230.4 1,171. 9 4 ,932 COST Selling 1,026.0 2,261.0 247.0 1,273.0 5,472 price Profit 54.7 325. 1 42.5 16.6 101.1 540 % profit 8.2% 31.7% 1.8% 7.0% 7.9% 9.8% margin 40. *Woodsoles are the pieces at the bottom of door and window frames. They are often made from pieces of scrap wood left from other orders. A typical wood sole is about 1m long by 2.5cm thick and 7.5cm wide. Exhibit 3: Assignment of costs to cost centres ($000s Euros) Costs to allocate Warehouse Oven Drafting Machinery Assembly selling Admin expense 978 Indirect labour 450 90 90 270 740 256 126 80 33 49 83 18 48 17 300 Wages and salaries $3000 Coal $80 Power $36 Commissions $154 Building expense $330 Office expense $198 Depreciation equipment $730 Truck expense $50 Interest on expense $210 TOTAL $4,788 Admin expense Indirect labour TOTAL ASSIGNED Activity measures Activity units Cost per activity unit (000s Euros) 72 480 1,043 |(1,043) 647 49 347 261 162 49 30 241 321 | 147 90 558 1,432 400 245 2,077 356 137 85 578 (480) 726 608 m3 m3 DLhrs DLhrs DLhrs Sales value 5,472,000 0.111 140 1.72 140 5.18 1,500 0.372 4,000 0.519 1,600 0.361 Exhibit 4: Supplementary cost data resource usage across the September quarter job mix . Cost centres Activity units Order 28: Order 32 172 staircases desks Order 35: 130m2 floors Order 36: 20,000 woodsoles Warehouse Oven Drafting Machining Assembly Selling Order 27 50 windows 10 10 90 350 400 665,000 m? m? DLhrs DLhrs DLhrs Actual sales Actual use 80 80 100 550 300 1,026,000 25 25 560 2.000 700 2,261,000 20 20 700 | 1000 50 100 200 247,000 140 140 1,500 4.000 1.600 5,472,000 1,273,000 Supplies 60,000 48,000 30,000 6,000 144,000 14 REQUIRED: a. Recalculate the cost of the five orders using activity-based costing. Comment on the difference in cost for order 28 (staircases) and order 32 (desks) before and after using ABC. Are the costs derived using ABC likely to be more or less accurate? Why? (20%) b. How does Societe Bonlieu compete? What is the likely source of its competitive advantage? How does buying the kiln affect its competitive advantage? Is it a strategic resource that fits the company's operations? Was it worthwhile buying the kiln? Explain why or why not? [35%] c. Assume that the kiln (or drying oven) is operating at only about 25% capacity (whereas other departments are close to capacity). Are staircases as a product a good fit in terms of utilizing the company's assets and resources? [20%] d. Societe Bonlieu is considering an offer to sell a further 12 staircases at the same price as before. Discuss the issues Societe Bonlieu needs to consider in costing this order (explain each cost and pay particular attention to the cost of the kiln allocated to the job). (25%) Week 6 Tutorial ACTIVITY BASED COSTING Read the case Societe Bonlieu, and answer the questions given at the end of the case. SOCIETE BONLIEU Mr. Bonlieu, owner of a small carpentry business, was concerned about his accounting system. He felt he was in danger of losing sales of desks, which made up nearly half of his business, because his prices were too high. Yet, according to his accounting figures, his margin on these desks was very low. At the same time, competitors were accusing him of selling staircases, another of his products, below cost. Yet his margin on staircases was apparently good. Mr. Bonlieu was a sub-contractor for furniture dealers and manufacturers, who supplied him with the wood for each order. In October 19XX, the plant consisted of a warehouse for the wood, a kiln (drying oven), a drafting room, a machine shop, and an assembly shop. He had acquired the drying oven two years earlier to enable him to offer his customers the option of supplying him with 'green' or undried wood if they preferred (wood needs to be dried before it can be manufactured into furniture). The accounting system then in use was a simple job order system. Direct labour was charged on the basis of actual labour costs incurred on each job in the drafting. Machine, and assembly shops. Supplies, such as screws and varish, were similarly charged to each job on the basis of actual consumption. All other expenses or overhead was allocated to jobs as a percentage of the direct labour cost charged to the job. Selling expense was charged in proportion to the sales value of each job. In the quarter ended September 19XX, five jobs had been started, completed, and delivered. No other jobs had been worked on. Although this mix of jobs was not unusual, the actual mix changed substantially, quarter by quarter. Costs for the quarter are shown in Exhibit 1 and the assignment of costs to jobs is shown in Exhibit 2. One thing which struck Mr. Bonlieu about the cost calculations was the magnitude of overhead costs in relation to direct labour costs. Great care was taken in recording and assigning labour, yet overhead expenses, which were much large in total, were allocated with very basic and simple rules. He suspected that this caused distortions in the costs charged to various jobs and was the explanation for the apparent discrepancies in prices. Accordingly, he sought the advice of a consultant The consultant's report advised setting up eight cost centres - two overhead centres (administration and indirect labour), five production centres (warehouse, drying oven, drafting shop, machine shop, and assembly shop) and a selling expense centre. Where possible, costs would be assigned directly to the centre in which they were incurred. Thus coal costs were charged entirely to the oven, power entirely to the machine shop and truck expenses entirely to selling. Building expenses were to be allocated on the basis of floor space used, as follows: 20% to the warehouse, 30% to the drying oven, 10% to drafting, 15% to machining, and 25% to assembly. Office expense was to be allocated on the basis of wage and salary costs. Depreciation of equipment was to be charged on the basis of the cost centre in which the equipment was used. Thus the oven was to carry 300,000Euros and the machine shop 430,000 10 Euros for each quarter. Interest expense was to be allocated to the items which had been purchased with the borrowed funds. The machine shop was responsible for 8.6m Euros of the debt, the drying oven for 4.8m Euros, and the delivery truck for 600,000Euros. After all costs had been assigned to cost centres, the administrative and indirect labour centres were to be closed out and the costs allocated to the five production centres and to the selling centre. Administrative expense was to be allocated 25% to selling expense, and the remaining 75% to the production departments on the basis of direct labour in the five production centres). Indirect labour was to be allocated to the five production departments, also on the basis of direct labour in the five production centres), although the warehouseman and the oven attendant were to be reclassified as direct labour to their respective cost centres. The next step was to assign costs in the remaining 6 cost centres to jobs on the basis of activity measures in each centre, as follows: Cost centre Warehouse Oven Drafting Machinery Assembly Selling Activity measures m3 of lumber used m3 of lumber dried Direct labour hours Direct labour hours Direct labour hours Sales value Exhibit 3 is a worksheet for assigning costs for the third quarter on the above basis to generate the cost centre rates which this accounting system uses. In order to apply these rates to specific jobs, Mr. Bonlieu gather the information shown in Exhibit 4. Exhibit 1: Cost data for the quarter ending September 30 19XX (in Euro $) DIRECT COSTS Direct Labour Drafting room Machine shop Assembly shop 270,000 740,000 256,000 1,266,000 144,000 1,410,000 Direct supplies TOTAL FACTORY DIRECT COSTS INDIRECT OVERHEAD COSTS Factory indirect costs Foreman and indirect workers Warehouseman Oven attendant Administrative and management personnel Indirect factory labour 450,000 90,000 90,000 978,000 1,608,000 80,000 36,000 330,000 198,000 210,000 730,000 Coal for the oven Power Building expense (rent, insurance, & taxes) Office expense (postage, telephone, etc.) Interest on equipment loans (14,000,000 @6% p.a) Depreciation of equipment Other indirect factory costs TOTAL FACTORY INDIRECT COSTS Selling indirect costs Sales commissions Delivery driver Truck expense (depreciation, garage) TOTAL SELLING INDIRECT COSTS 1,584,000 3,192,000 154,000 126,000 50,000 330,000 Allocation rates Factory cost rate: 3,192,000 / 1,266,000 = 252% Selling cost rate: 330,000 / 5,472,000 = 6.03% 1 18.5 32.0 256 1678 Exhibit 2: Cost data for quarter ending September, 19XX (000s Euros $) Order 27: Order 28: Order 32: Order 35: Order 36: TOTA 172 desks 130m2 20,000 windows staircases floors woodsoles* Supplies 60.0 48.0 30.0 6.0 144 Drafting at 16.2 18.0 100.8 9.0 126.0 1270 180 per hour Machining 64.7 101.8 370.0 185.0 740 at 185 per hour Assembly 64.0 48.0 112.0 at 160 per hour TOTAL 144.9 582.8 59.5 311.0 1,266 LABOUR Overhead 365.3 423.2 11.469.4 150.0 784.1 3.192 @252% labour) Sub-total 570.2 639.0 2.082.2 215.5 1,095.1 4.602 Selling 61.9 136.3 76.8 330 expense (@ 6.03% of sales) TOTAL | 610.3 700.9 2,218.5 230.4 1,171. 9 4 ,932 COST Selling 1,026.0 2,261.0 247.0 1,273.0 5,472 price Profit 54.7 325. 1 42.5 16.6 101.1 540 % profit 8.2% 31.7% 1.8% 7.0% 7.9% 9.8% margin 40. *Woodsoles are the pieces at the bottom of door and window frames. They are often made from pieces of scrap wood left from other orders. A typical wood sole is about 1m long by 2.5cm thick and 7.5cm wide. Exhibit 3: Assignment of costs to cost centres ($000s Euros) Costs to allocate Warehouse Oven Drafting Machinery Assembly selling Admin expense 978 Indirect labour 450 90 90 270 740 256 126 80 33 49 83 18 48 17 300 Wages and salaries $3000 Coal $80 Power $36 Commissions $154 Building expense $330 Office expense $198 Depreciation equipment $730 Truck expense $50 Interest on expense $210 TOTAL $4,788 Admin expense Indirect labour TOTAL ASSIGNED Activity measures Activity units Cost per activity unit (000s Euros) 72 480 1,043 |(1,043) 647 49 347 261 162 49 30 241 321 | 147 90 558 1,432 400 245 2,077 356 137 85 578 (480) 726 608 m3 m3 DLhrs DLhrs DLhrs Sales value 5,472,000 0.111 140 1.72 140 5.18 1,500 0.372 4,000 0.519 1,600 0.361 Exhibit 4: Supplementary cost data resource usage across the September quarter job mix . Cost centres Activity units Order 28: Order 32 172 staircases desks Order 35: 130m2 floors Order 36: 20,000 woodsoles Warehouse Oven Drafting Machining Assembly Selling Order 27 50 windows 10 10 90 350 400 665,000 m? m? DLhrs DLhrs DLhrs Actual sales Actual use 80 80 100 550 300 1,026,000 25 25 560 2.000 700 2,261,000 20 20 700 | 1000 50 100 200 247,000 140 140 1,500 4.000 1.600 5,472,000 1,273,000 Supplies 60,000 48,000 30,000 6,000 144,000 14 REQUIRED: a. Recalculate the cost of the five orders using activity-based costing. Comment on the difference in cost for order 28 (staircases) and order 32 (desks) before and after using ABC. Are the costs derived using ABC likely to be more or less accurate? Why? (20%) b. How does Societe Bonlieu compete? What is the likely source of its competitive advantage? How does buying the kiln affect its competitive advantage? Is it a strategic resource that fits the company's operations? Was it worthwhile buying the kiln? Explain why or why not? [35%] c. Assume that the kiln (or drying oven) is operating at only about 25% capacity (whereas other departments are close to capacity). Are staircases as a product a good fit in terms of utilizing the company's assets and resources? [20%] d. Societe Bonlieu is considering an offer to sell a further 12 staircases at the same price as before. Discuss the issues Societe Bonlieu needs to consider in costing this order (explain each cost and pay particular attention to the cost of the kiln allocated to the job). (25%)