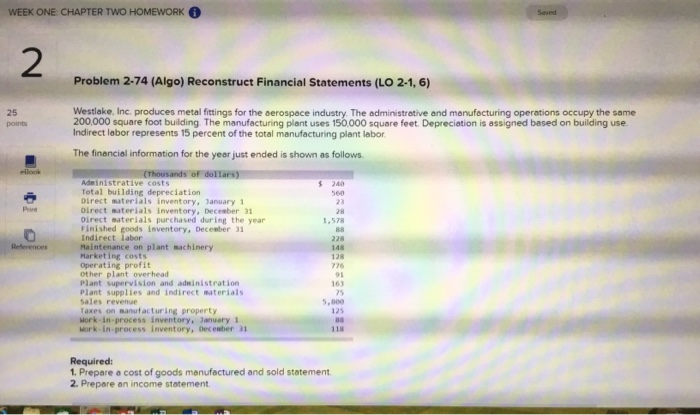

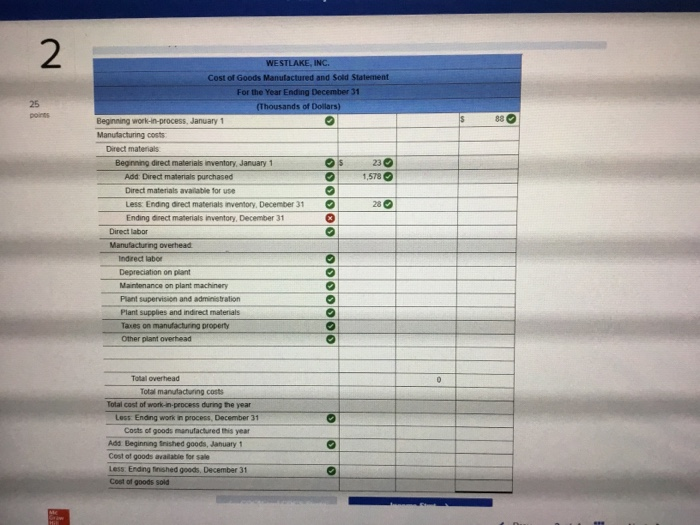

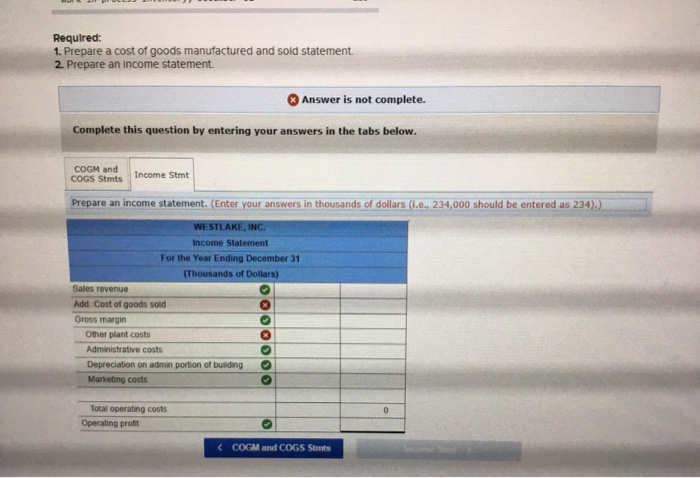

WEEK ONE CHAPTER TWO HOMEWORK Saved Problem 2-74 (Algo) Reconstruct Financial Statements (LO 2-1, 6) Westlake, Inc. produces metal fittings for the aerospace industry. The administrative and manufecturing operations occupy the same 200,000 square foot building. The manufacturing plant uses 150.000 square feet. Depreciation is assigned based on building use. Indirect labor represents 15 percent of the total manufacturing plant labor. 25 points The financial information for the year just ended is shown as follows. ellook (Thousands of dollars) Administrative costs Total building depreciation Direct materials inventory, January 1 Direct materials inventory, Decenber 31 Direct materials purchased during the year Finished goods inventory, Decenber 31 Indirect iabor $ 240 23 Print 28 1,578 88 228 Haintenance on plant machinery Harket ing costs Operating profit other plant overhead Plant supervision and administration Plant supplies and indirect materials Sales revenue Taxes on manufacturing property References 148 128 776 91 163 75 5,800 125 Mork-in-process inventory, Decentber 31 118 Required: 1. Prepare a cost of goods manufactured and sold statement. 2. Prepare an income statement. WESTLAKE, INC. Cost Goods Manufactured and Sold Statement For the Year Ending December 31 25 (Thousands of Dollars) points Is Beginning work-in-process, January 1 Manutacturing costs Direct materials 23 O 1,578 O Beginning direct materials inventory, January 1 Add: Direct materials purchased Direct materials available for use 28 O Less Ending direct materials inventory, December 31 Ending direct materials inventory, December 31 Direct labor Manufacturing overhead Indirect labor Depreciation on plant Maintenance on plant machinery Plant supervision and administration Plant supplies and indirect materials Taxes on manufacturing property Other plant overhead Total overhead Total manutacturing costs Total cost of work-in-process during the year Less: Ending work in process, December 31 Costs of goods manufactured this year Add Beginning trished goods, January 1 Cost of goods available for sale Less. Ending finished goods, December 31 Cost of goods sold O00000O 2. Required: 1. Prepare a cost of goods manufactured and sold statement. 2. Prepare an Income statement. Answer is not complete. Complete this question by entering your answers in the tabs below. COGM and COGS Stmts Income Stmt Prepare an income statement. (Enter your answers in thousands of dollars (i.e., 234,000 should be entered as 234).) WESTLAKE, INC. Income Statement For the Year Ending December 31 (Thousands of Dollars) Sales revenue Add. Cost of goods sold Gross margin Other plant costs Administrative costs Depreciation on admin portion of building Marketing costs Total operating costs Operating profit ( COGM and COGS Stmts