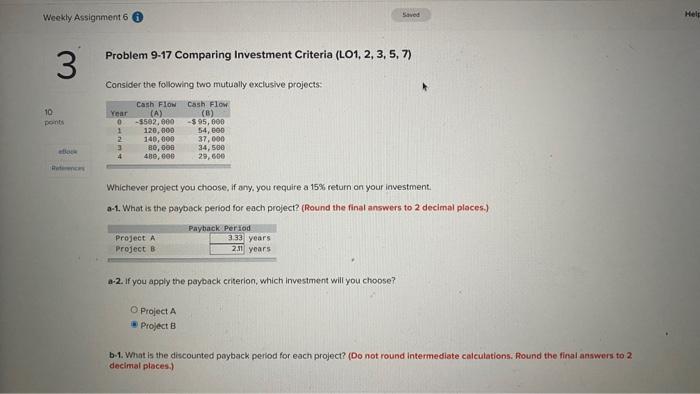

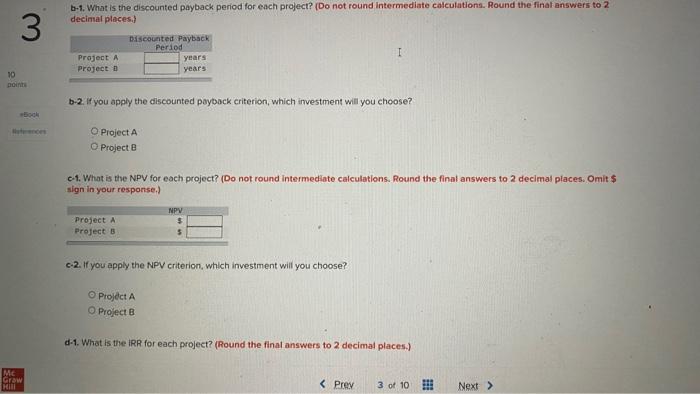

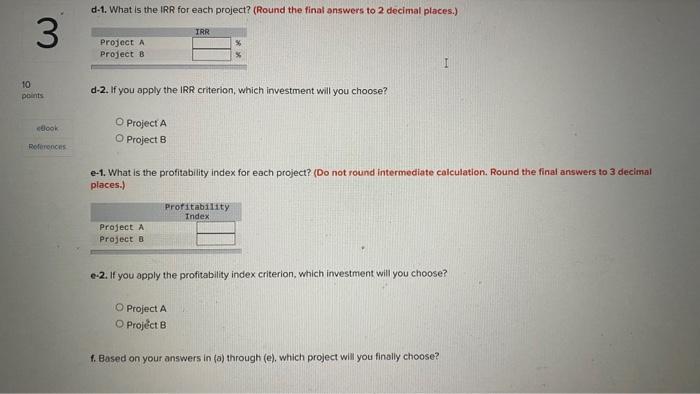

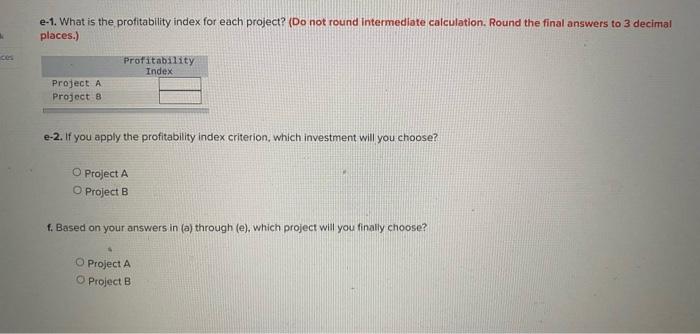

Weekly Assignment 66 3 10 points ebook References Saved Problem 9-17 Comparing Investment Criteria (LO1, 2, 3, 5, 7) Consider the following two mutually exclusive projects: Cash Flow Cash Flow Year (8) 0 (A) -$502,000 120,000 -$ 95,000 1 54,000 2 140,000 37,000 3 80,000 34,500 480,000 29,600 Whichever project you choose, if any, you require a 15% return on your investment. a-1. What is the payback period for each project? (Round the final answers to 2 decimal places.) Payback Period Project A Project B 3.33 years 2.11 years a-2. If you apply the payback criterion, which investment will you choose? O Project A Project B b-1. What is the discounted payback period for each project? (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Help b-1. What is the discounted payback period for each project? (Do not round intermediate calculations. Round the final answers to 2 decimal places.) 3 Discounted Payback Period I Project A years years Project B b-2. If you apply the discounted payback criterion, which investment will you choose? Book O Project A O Project B c-1. What is the NPV for each project? (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) NPV $ Project A Project B c-2. If you apply the NPV criterion, which investment will you choose? O Project A O Project B d-1. What is the IRR for each project? (Round the final answers to 2 decimal places.) 10 points Mc Graw Hill 3 10 points eBook References d-1. What is the IRR for each project? (Round the final answers to 2 decimal places.) IRR Project A Project B d-2. If you apply the IRR criterion, which investment will you choose? O Project A O Project B e-1. What is the profitability index for each project? (Do not round intermediate calculation. Round the final answers to 3 decimal places.) Profitability Index Project A Project B e-2. If you apply the profitability index criterion, which investment will you choose? O Project A O Project B f. Based on your answers in (a) through (e), which project will you finally choose? e-1. What is the profitability index for each project? (Do not round intermediate calculation. Round the final answers to 3 decimal places.) k ces Profitability Index Project A Project B e-2. If you apply the profitability index criterion, which investment will you choose? O Project A O Project B f. Based on your answers in (a) through (e), which project will you finally choose? O Project A O Project B