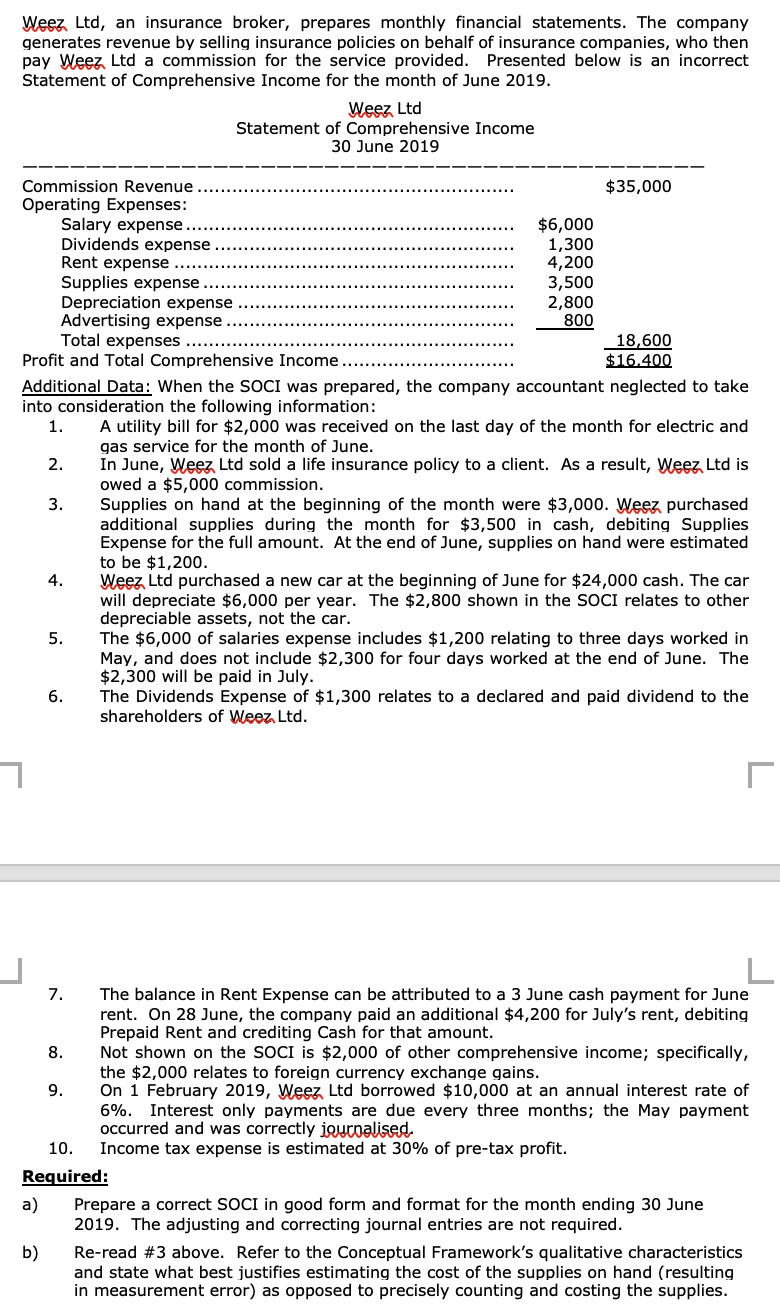

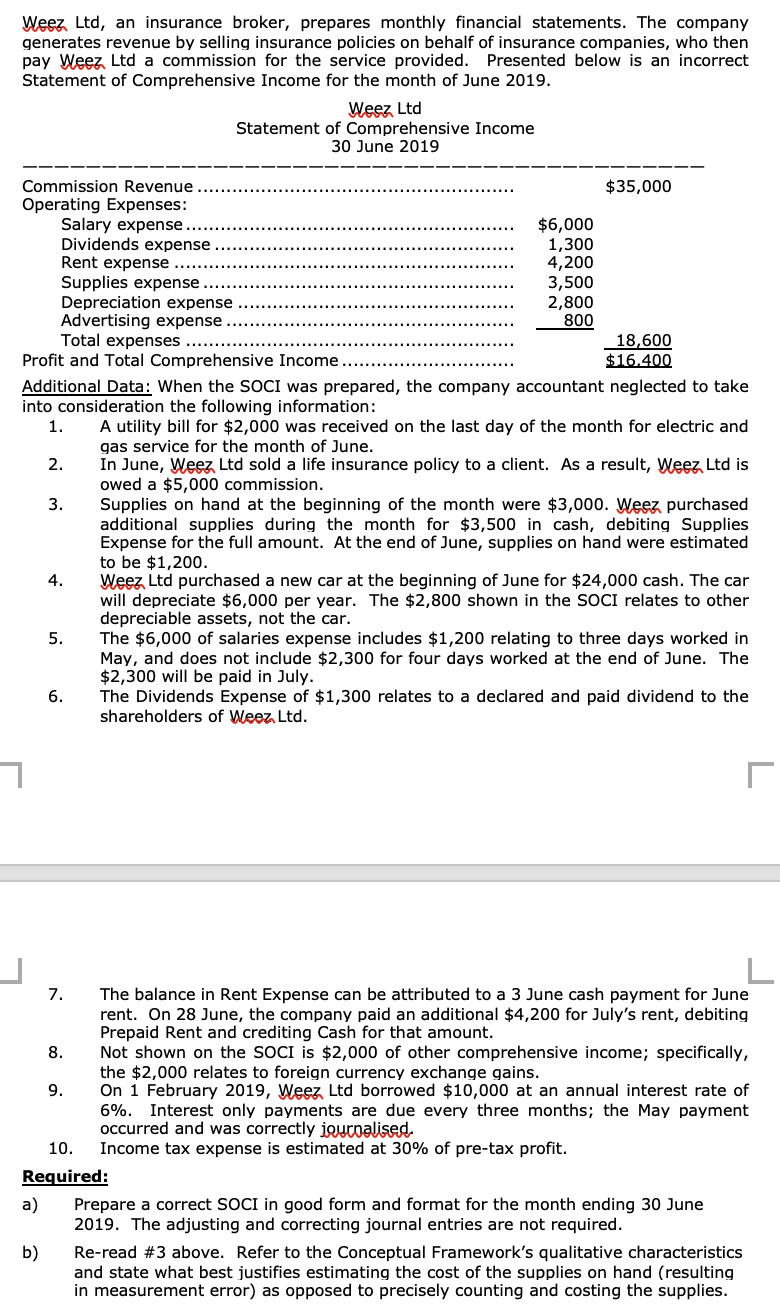

Weez Ltd, an insurance broker, prepares monthly financial statements. The company generates revenue by selling insurance policies on behalf of insurance companies, who then pay Weez Ltd a commission for the service provided. Presented below is an incorrect Statement of Comprehensive Income for the month of June 2019. Weez Ltd Statement of Comprehensive Income 30 June 2019 : : Commission Revenue ......... $35,000 Operating Expenses: Salary expense ......... ..... $6,000 Dividends expense ........... 1,300 Rent expense .................................. 4,200 Supplies expense ....................... ........................... 3,500 Depreciation expense ......................... 2,800 Advertising expense .................... 800 Total expenses ......... 18,600 Profit and Total Comprehensive Income ............ $16.400 Additional Data: When the SOCI was prepared, the company accountant neglected to take into consideration the following information: A utility bill for $2,000 was received on the last day of the month for electric and gas service for the month of June. In June, Weez Ltd sold a life insurance policy to a client. As a result, Weez Ltd is owed a $5,000 commission. Supplies on hand at the beginning of the month were $3,000. Weez purchased additional supplies during the month for $3,500 in cash, debiting Supplies Expense for the full amount. At the end of June, supplies on hand were estimated to be $1,200. Weez Ltd purchased a new car at the beginning of June for $24,000 cash. The car will depreciate $6,000 per year. The $2,800 shown in the SOCI relates to other depreciable assets, not the car. The $6,000 of salaries expense includes $1,200 relating to three days worked in May, and does not include $2,300 for four days worked at the end of June. The $2,300 will be paid in July. The Dividends Expense of $1,300 relates to a declared and paid dividend to the shareholders of Weez Ltd. 7. The balance in Rent Expense can be attributed to a 3 June cash payment for June rent. On 28 June, the company paid an additional $4,200 for July's rent, debiting Prepaid Rent and crediting Cash for that amount. Not shown on the SOCI is $2,000 of other comprehensive income; specifically, the $2,000 relates to foreign currency exchange gains. On 1 February 2019, Weez Ltd borrowed $10,000 at an annual interest rate of 6%. Interest only payments are due every three months; the May payment occurred and was correctly journalised. 10. Income tax expense is estimated at 30% of pre-tax profit. Required: a) Prepare a correct SOCI in good form and format for the month ending 30 June 2019. The adjusting and correcting journal entries are not required. b) Re-read #3 above. Refer to the Conceptual Framework's qualitative characteristics and state what best justifies estimating the cost of the supplies on hand (resulting in measurement error) as opposed to precisely counting and costing the supplies