Answered step by step

Verified Expert Solution

Question

1 Approved Answer

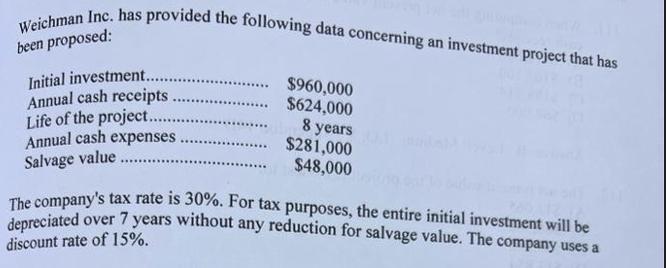

Weichman Inc. has provided the following data concerning an investment project that has been proposed: Initial investment.......... Annual cash receipts Life of the project......

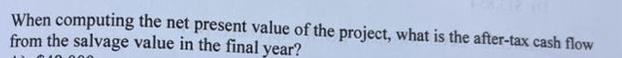

Weichman Inc. has provided the following data concerning an investment project that has been proposed: Initial investment.......... Annual cash receipts Life of the project...... Annual cash expenses Salvage value ********* $960,000 $624,000 8 years $281,000 $48,000 The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 7 years without any reduction for salvage value. The company uses a discount rate of 15%. When computing the net present value of the project, what is the after-tax cash flow from the salvage value in the final year? Calculate the net present value of the project

Step by Step Solution

★★★★★

3.25 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

i To calculate the net present value NPV of the project we need to discount the cash flows and subtract the initial investment The formula for NPV is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started