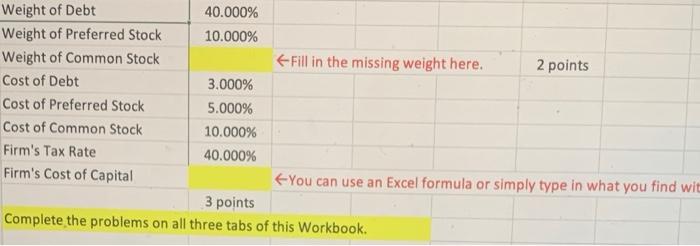

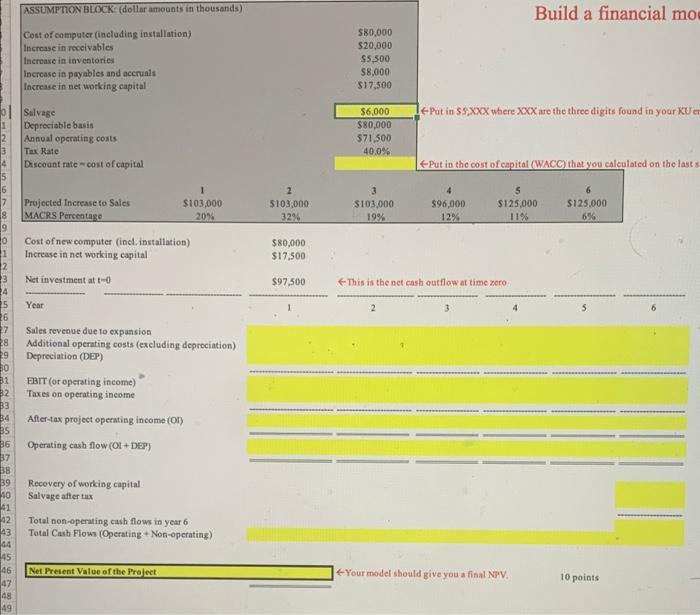

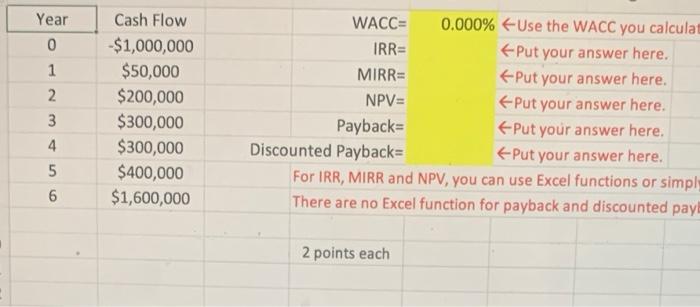

Weight of Debt 40.000% Weight of Preferred Stock 10.000% Weight of Common Stock Fill in the missing weight here. 2 points Cost of Debt 3.000% Cost of Preferred Stock 5.000% Cost of Common Stock 10.000% Firm's Tax Rate 40.000% Firm's Cost of Capital You can use an Excel formula or simply type in what you find wit 3 points Complete the problems on all three tabs of this Workbook. Build a financial mo ASSUMPTION BLOCK (dollar amounts in thousands) Cost of computer (including installation) Increase in receivables Increase in inventories increase in payables and accruals Increase in net working capital ol Salvage Depreciable basis Annual operating costs Tax Rate Discount rate cost of capital $80,000 $20,000 $5.500 $8,000 $17.500 le-Putin 59 xxx where XXX are the three digits found in your KU en $6,000 $80,000 $71,500 40.0% +-Put in the cost of capital (WACC) that you calculated on the lasts 2 5103,000 3294 3 S103,000 19% S125.000 $96,000 12% $125,000 11% 0 1 Projected Increase to Sales S103,000 MACRS Percentage 20% Cost of new computer (incl. installation) Increase in net working capital Net investment at to $80,000 $17,500 $97,500 This is the net cash outflow at time zero 3 4 5 26 Year 2 3 6 Sales revenue due to expansion Additional operating costs (excluding depreciation) Depreciation (DEP) EBIT (or operating income) Taxes on operating income After-tax project operating income (ON) Operating cash flow (OI + DEP) 28 29 30 bi B2 B3 34 35 B6 37 38 39 10 $1 12 43 44 45 46 47 48 49 Recovery of working capital Salvage after tax Total non-operating cash flows in year 6 Total Cash Flows (Operating + Non-operating) Net Present Value of the Project Your model should give you a final NPV 10 points Year 0 1 2 3 4 5 6 Cash Flow $1,000,000 $50,000 $200,000 $300,000 $300,000 $400,000 $1,600,000 WACC= 0.000% Use the WACC you calculat IRR= Put your answer here. MIRR= Put your answer here. NPV= Put your answer here. Payback= Put your answer here. Discounted Payback= Put your answer here. For IRR, MIRR and NPV, you can use Excel functions or simply There are no Excel function for payback and discounted pay 2 points each