Answered step by step

Verified Expert Solution

Question

1 Approved Answer

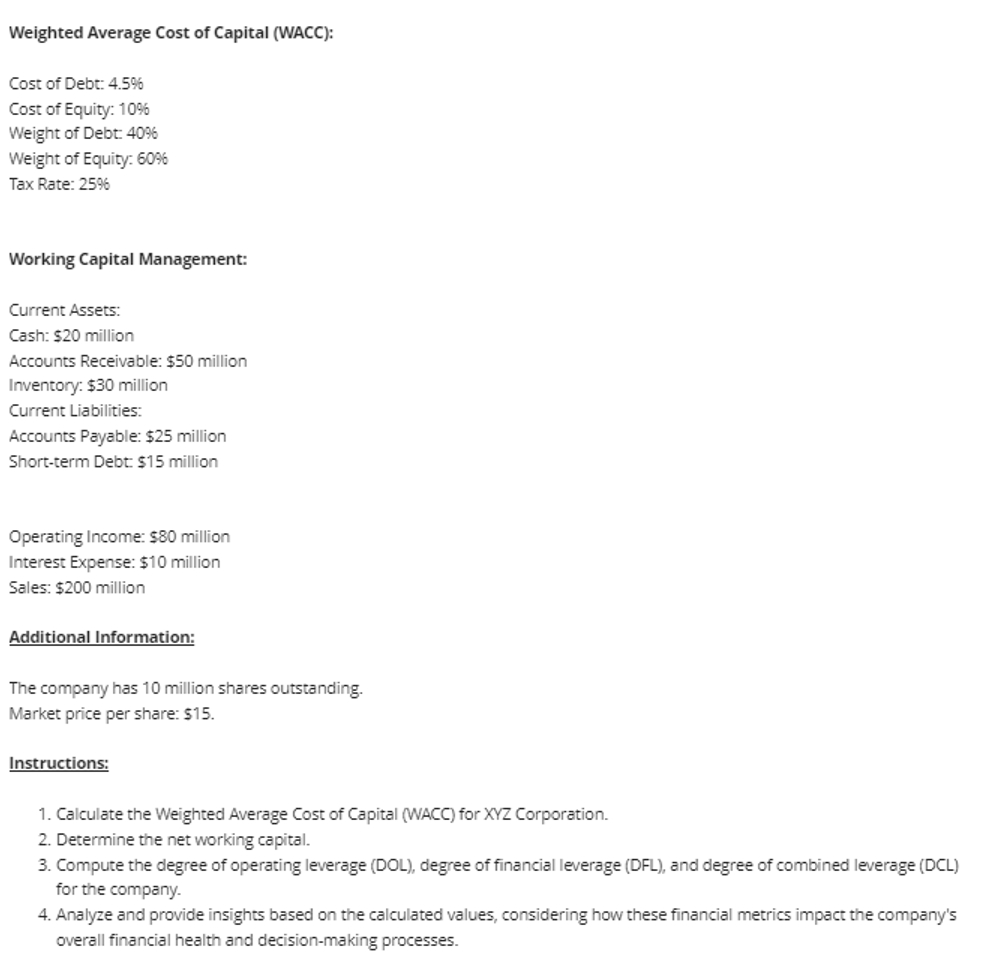

Weighted Average Cost of Capital ( WACC ) : Cost of Debt: 4 . 5 % Cost of Equity: 1 0 % Weight of Debt:

Weighted Average Cost of Capital WACC:

Cost of Debt:

Cost of Equity:

Weight of Debt:

Weight of Equity:

Tax Rate:

Working Capital Management:

Current Assets:

Cash: $ million

Accounts Receivable: $ million

Inventory: $ million

Current Liabilities:

Accounts Payable: $ million

Shortterm Debt: $ million

Operating Income: $ million

Interest Expense: $ million

Sales: $ million

Additional Information:

The company has million shares outstanding.

Market price per share: $

Instructions:

Calculate the Weighted Average Cost of Capital WACC for XYZ Corporation.

Determine the net working capital.

Compute the degree of operating leverage DOL degree of financial leverage DFL and degree of combined leverage DCL

for the company.

Analyze and provide insights based on the calculated values, considering how these financial metrics impact the company's

overall financial health and decisionmaking processes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started