Question

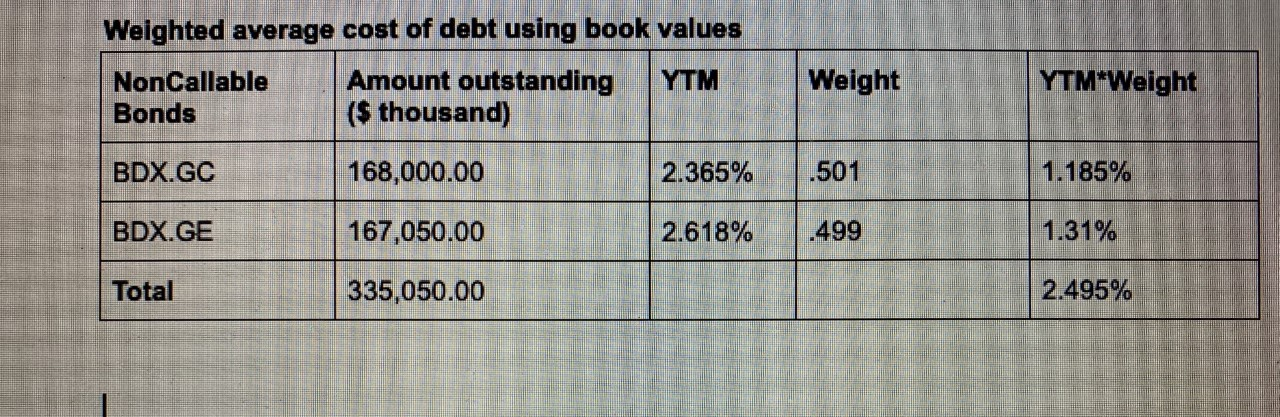

Weighted average cost of debt using book values NonCallable Bonds Amount outstanding ($ thousand) YTM Weight YTM*Weight BDX.GC 168,000.00 2.365% .501 1.185% BDX.GE 167,050.00 2.618%

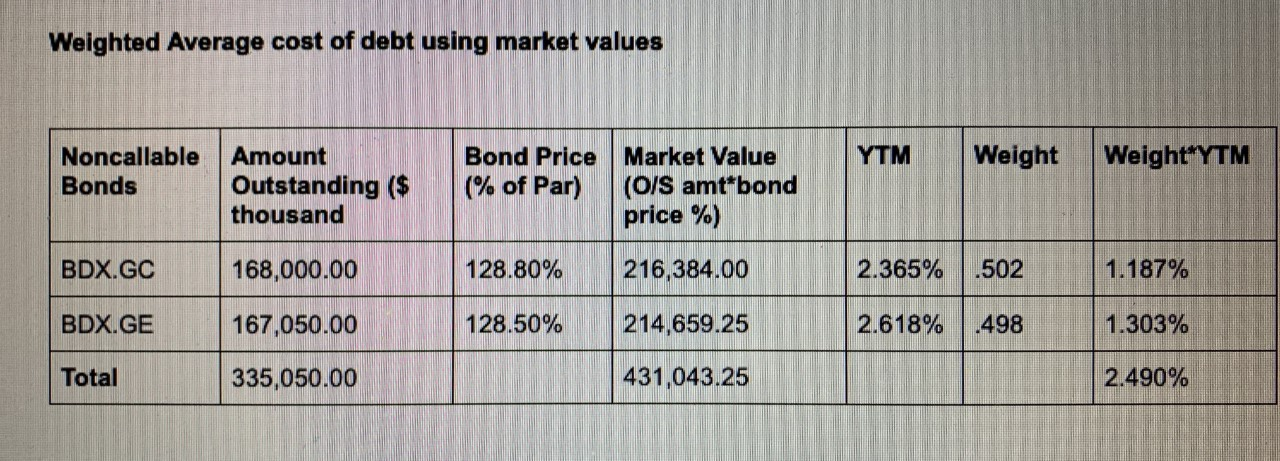

Weighted average cost of debt using book values NonCallable Bonds Amount outstanding ($ thousand) YTM Weight YTM*Weight BDX.GC 168,000.00 2.365% .501 1.185% BDX.GE 167,050.00 2.618% .499 1.31% Total 335,050.00 2.495% Weighted Average cost of debt using market values Noncallable Bonds Amount Outstanding ($ thousand Bond Price (% of Par) Market Value (O/S amt*bond price %) YTM Weight Weight*YTM BDX.GC 168,000.00 128.80% 216,384.00 2.365% .502 1.187% BDX.GE 167,050.00 128.50% 214,659.25 2.618% .498 1.303% Total 335,050.00 431,043.25 2.490%

Weighted average cost of debt using book values NonCallable Bonds Amount outstanding ($ thousand) YTM Weight YTM*Weight BDX.GC 168,000.00 2.365% .501 1.185% BDX.GE 167,050.00 2.618% .499 1.31% Total 335,050.00 2.495% Weighted Average cost of debt using market values Noncallable Bonds Amount Outstanding ($ thousand Bond Price (% of Par) Market Value (O/S amt*bond price %) YTM Weight Weight*YTM BDX.GC 168,000.00 128.80% 216,384.00 2.365% .502 1.187% BDX.GE 167,050.00 128.50% 214,659.25 2.618% .498 1.303% Total 335,050.00 431,043.25 2.490%

5. You now have all the necessary information to calculate the weighted average cost of capital (WACC) for What are the weighted average costs of debt for Becton, Dickenson and Company using the book value weights of the bonds.

a) Calculate the weighted average cost of capital for Becton, Dickenson and Company using the book value of equity and book value of debt weights, assuming Becton, Dickenson and Company has a 25 percent marginal tax rate. Then redo the calculation using the market value of equity and book value of debt weights. For this question, use the longterm debt value reported in the balance sheet to calculate the book value of debt weight relative to equity weight.

b) Which cost of capital number in part (5a) is more relevant?

Weighted average cost of debt using book values NonCallable Amount outstanding YTM Bonds (s thousand) Weight YTM*Weight BDX.GC 168,000.00 2.365% .501 1.185% BDX.GE 167,050.00 2.618% .499 1.31% Total 335,050.00 2.495% Weighted Average cost of debt using market values YTM Noncallable Bonds Weight Weight YTM Amount Outstanding ($ thousand Bond Price (% of Par) Market Value (O/S amt*bond price %) BDX.GC 168,000.00 128.80% 216,384.00 2.365% .502 1.187% BDX.GE 167,050.00 128.50% 214,659.25 2.618% 498 1.303% Total 335,050.00 431,043.25 2.490% Weighted average cost of debt using book values NonCallable Amount outstanding YTM Bonds (s thousand) Weight YTM*Weight BDX.GC 168,000.00 2.365% .501 1.185% BDX.GE 167,050.00 2.618% .499 1.31% Total 335,050.00 2.495% Weighted Average cost of debt using market values YTM Noncallable Bonds Weight Weight YTM Amount Outstanding ($ thousand Bond Price (% of Par) Market Value (O/S amt*bond price %) BDX.GC 168,000.00 128.80% 216,384.00 2.365% .502 1.187% BDX.GE 167,050.00 128.50% 214,659.25 2.618% 498 1.303% Total 335,050.00 431,043.25 2.490%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started