Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Weighting: 5% (marked out of 100) Due Date: Sunday 14th March 2021 Objective: The objective of the assignment is to test your understanding of

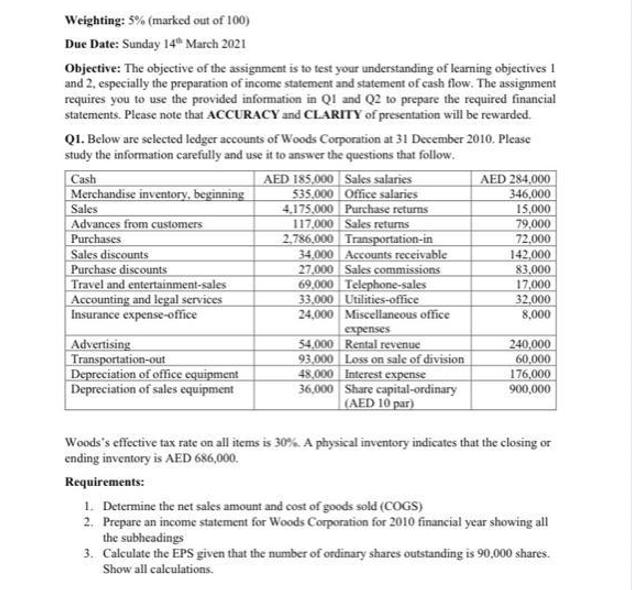

Weighting: 5% (marked out of 100) Due Date: Sunday 14th March 2021 Objective: The objective of the assignment is to test your understanding of learning objectives 1 and 2, especially the preparation of income statement and statement of cash flow. The assignment requires you to use the provided information in Q1 and Q2 to prepare the required financial statements. Please note that ACCURACY and CLARITY of presentation will be rewarded. Q1. Below are selected ledger accounts of Woods Corporation at 31 December 2010. Please study the information carefully and use it to answer the questions that follow. Cash Merchandise inventory, beginning Sales Advances from customers Purchases Sales discounts Purchase discounts AED 185,000 Sales salaries 535,000 Office salaries 4,175,000 Purchase returns 117,000 Sales returns 2,786,000 Transportation-in 34,000 Accounts receivable 27,000 Sales commissions AED 284,000 346,000 15,000 79,000 72,000 142,000 83,000 69,000 Telephone-sales 17,000 33.000 Utilities-office 32.000 24,000 Miscellaneous office 8,000 expenses Advertising 54,000 Rental revenue 240,000 Transportation-out 93,000 Loss on sale of division 60,000 Depreciation of office equipment Depreciation of sales equipment 48,000 Interest expense 176,000 36,000 Share capital-ordinary 900,000 (AED 10 par) Travel and entertainment-sales Accounting and legal services Insurance expense-office Woods's effective tax rate on all items is 30%. A physical inventory indicates that the closing or ending inventory is AED 686,000. Requirements: 1. Determine the net sales amount and cost of goods sold (COGS) 2. Prepare an income statement for Woods Corporation for 2010 financial year showing all the subheadings 3. Calculate the EPS given that the number of ordinary shares outstanding is 90,000 shares. Show all calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 calculation of Net sales Sales 1475000 Less Sales Discount 34000 Sales retum 79000 Net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started