Answered step by step

Verified Expert Solution

Question

1 Approved Answer

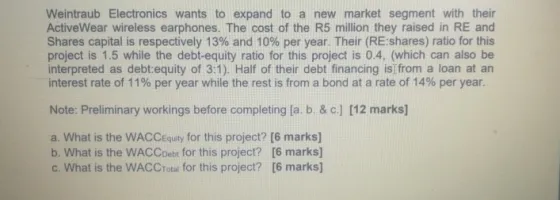

Weintraub Electronics wants to expand to a new market segment with their ActiveWear wireless earphones. The cost of the R5 million they raised in

Weintraub Electronics wants to expand to a new market segment with their ActiveWear wireless earphones. The cost of the R5 million they raised in RE and Shares capital is respectively 13% and 10% per year. Their (RE:shares) ratio for this project is 1.5 while the debt-equity ratio for this project is 0.4, (which can also be interpreted as debt:equity of 3:1). Half of their debt financing is from a loan at an interest rate of 11% per year while the rest is from a bond at a rate of 14% per year.. Note: Preliminary workings before completing [a. b. & c.] [12 marks] a. What is the WACCEquity for this project? [6 marks] b. What is the WACCDebe for this project? [6 marks] c. What is the WACCTotal for this project? [6 marks]

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Weighted Average Cost of Capital WACC for the project we need to consider the diffe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started