Question

Weiss, Inc. began operations in 2021. Included in its 2021 financial statements were bad debts expense of P140,000 and profit from installment sales of

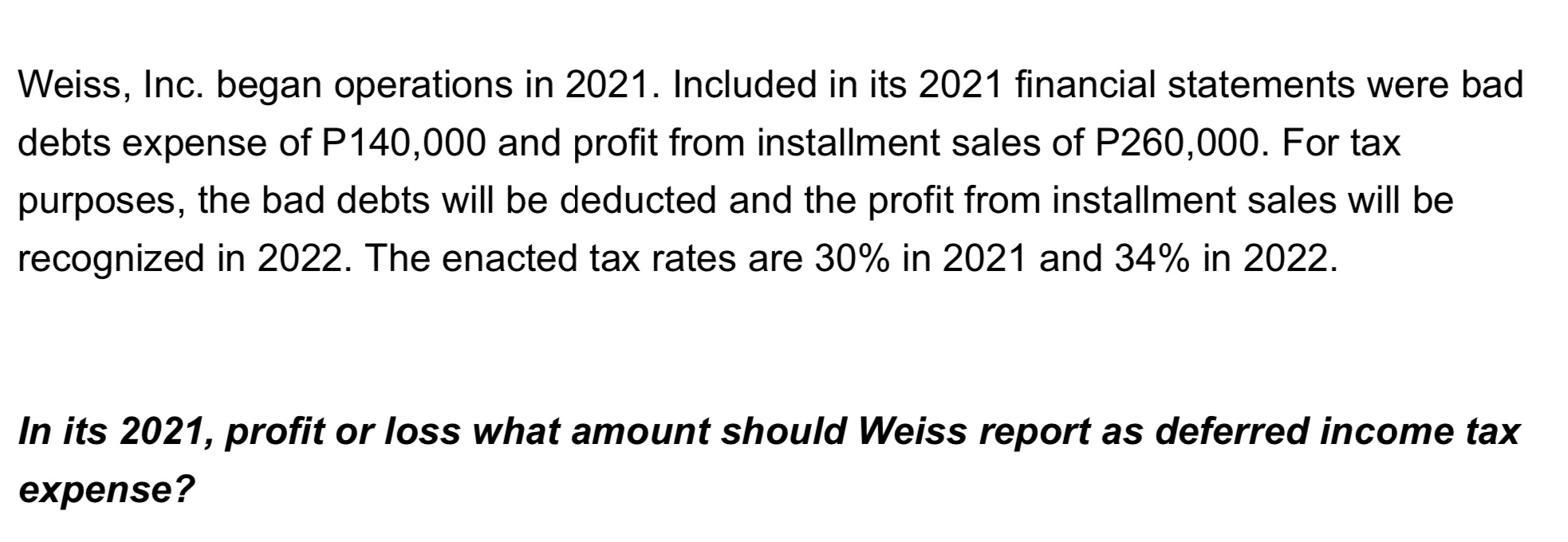

Weiss, Inc. began operations in 2021. Included in its 2021 financial statements were bad debts expense of P140,000 and profit from installment sales of P260,000. For tax purposes, the bad debts will be deducted and the profit from installment sales will be recognized in 2022. The enacted tax rates are 30% in 2021 and 34% in 2022. In its 2021, profit or loss what amount should Weiss report as deferred income tax expense?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the deferred income tax expense for 2021 we need to consider the temporary differences ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

6th edition

978-0077328894, 71313974, 9780077395810, 77328892, 9780071313971, 77395816, 978-0077400163

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App