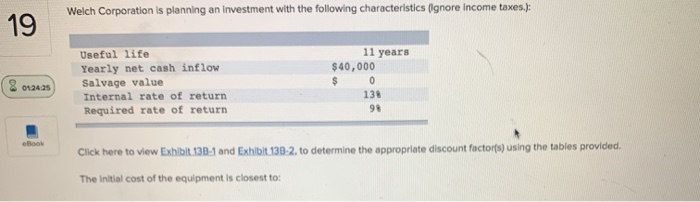

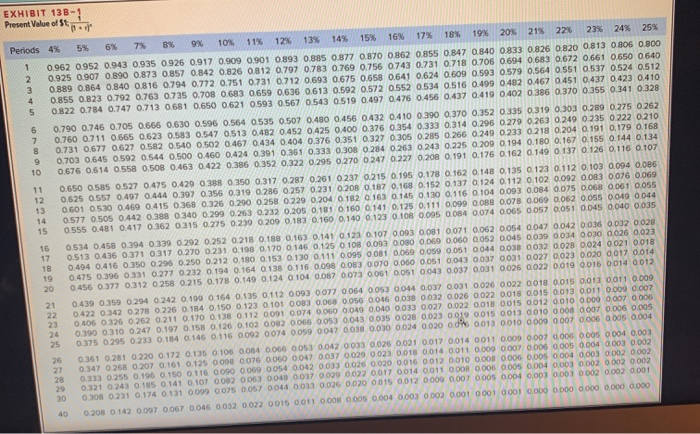

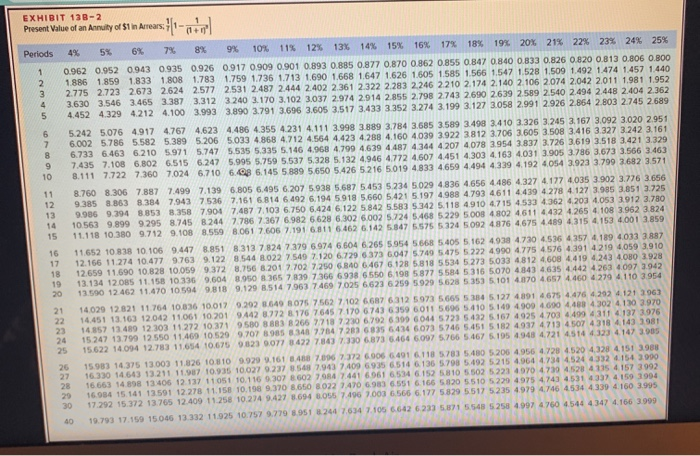

Welch Corporation is planning an investment with the following characteristics ignore income taxes.): Useful life Yearly net cash inflow Salvage value Internal rate of return Required rate of return 11 years $40,000 $ 0. 8 01.24 Click here to view Exhibit 130-1 and Exhibit 130-2. to determine the appropriate discount factors) using the tables provided. The initial cost of the equipment is closest to: Present Value est nec Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 1 0.962 0.952 0.943 0.935 0926 0.917 0.909 0.901 0.893 0.35 0877 0370 0862 0855 0.847 0.840 0833 0826 0820 0.813 O 806 O.BOO 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.707 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.683 0,672 0.661 0.650 0.640 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.564 0.551 0537 0.524 0512 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.467 0.451 0.437 0.423 0410 0822 0.784 0.747 0.713 0.681 0.650 0.621 0 593 0 567 0543 0519 0497 0476 0456 0.437 0.419 0.402 0 386 0.370 0.355 0.341 0.328 3 4 5 6 7 B 9 10 0 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0 262 0.750 0.711 0.665 0.623 0583 0.547 0513 0.482 0 452 0425 0.400 0.375 0.354 0333 0.314 0295 0279 0.263 0.249 0 235 0 222 0.210 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0376 0.351 0.327 0305 0.285 0.266 0.249 0233 0.218 0.204 0.191 0.179 0.168 0.703 0.645 0.592 0544 0.500 0.460 0.424 0.391 0 351 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.180 0.167 0.155 0.144 0.134 .676 0.614 0.558 0.508 0. 43 0.422 0.386 0352 0.322 0.295 0.270 0247 0.227 0.20 0.191 0.176 0.162 0149 0.137 0.126 0.116 0.107 0.650 0.585 0.527 0.475 0.429 0388 0 350 0.317 0.27 0.261 0237 0.215 0.195 0.178 0.162 0.148 0.135 0.123 0.112 0.103 0.094 0.086 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0286 0.257 0.231 0208 0.187 0.168 0.152 0.137 0124 0.112 0.102 0.092 0.083 0.076 0.069 0.601 0530 0.460 0.415 0368 0326 0 290 0 258 0229 0204 612 616 0145 0 130 0.116 0 104 0.003 0.084 0.075 0.068 0061 0.055 0.577 0.505 0.442 038 0340 0.299 0.263 0232 0.205 0.181 160 141 0.125 0.1110 099 00 00 00 0062 0 055 00:49 0006 0555 0.481 0.417 0.362 0315 0.275 0.20 0.200 0.13 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.057 0.051 0.045 0.040 0.035 12 13 14 15 16 0.534 0.458 0.394 0.319 0292 0.252 0.218 0.188 0.16 0.141 011 107 0001 0.01 0.021 0.062 0054 0047 0042 OOM 002 0028 17 0513 0.436 0371 0317 0.270 0231 0 198 0.170 0.146 0.125 0 10 0.00 0.00 0.00 0.060 0,052 0.045 000 0014 0000 0026 0.023 18 0.494 0.416 0 350 0295 0.250 0.212 ORO 0.153 0130 0.11 0.095 081 0050 0 059 0.051 0044 00 00 00 0024 0.021 0018 0475 0.396 0331 02770232 0194 0 164 0 138 0 116 0.098 0.083 0070 000 0.051 0.043 0037 0031 0027 002 0020 0017 0.014 0.456 0.377 0312 0.258 0.215 0.178 0.149 0.124 104 0.087 0.073 0.061 0.051 0043 0.037 0.031 0.025 0.022 0.019 0016 0.014 0.012 0.439 0.359 0.204 0 242 0.190 0164 0.135 0.112 0.093 0077 0.064 0.053 0.044 0.037 0.031 0.026 0022 0018 0.015 0011 0011 0009 22 0.422 0342 023 0226 184 0.150 0 123 101 0083 0068 0.056 0.046 0.038 0032 0.026 0022 0.018 0015 0.013 0.01 0.000 0.007 23 0.406 0326 0.262 0.211 0.170 0.38 0 112 0.091 0.074 060 004 0.040 0.033 0.027 0.022 0018 0015 0012 0010 0000 007 006 0390 03100247 0.197 0.15 0.126 0.102 002 006 0053 0.043 0.035 0.028 0.023 0.019 0015 0013 00 10 000 000 0005 0.005 25 0.375 0.295 0.233 0.184 0.146 0.116 0092 0074 0059 0047 0.038 0.030 0.024 0020 0.0 0.013 0010 0000 0007 0006 0.005 0.004 0361 0281 0.220 0.172 0.135 0.106 0064 066 0053 0.042 0033 0.026 0.021 0.017 0.014 0011 0.000 0.007 0.006 0005 0.004 0.003 047 026 0207 0161 0125 000 0076 0000 0047 0.037 0.029 0023 0.018 0010011 0000 000 000 000 0004 0.003 0.002 280 0 25 0.06 0.150 116 0000 0069 0054 0.042 0.033 0.025 0.020 0016 0012 000 000 000 000 0004 000 000 000 20 321 0241 015 0141 0101 002 003 004 003 0029 0.022 0017 0614 0011 O OOR 0.00 0.00 0.004 0.00 0.00 0.002 0.002 30 0.308 0.231 0.174 0.131 0099 0075 0.057 004 0033 0.025 0.020 0015 0012 0.000 0.007 0005 0004 0.00 0.00 0.00 0.00 0.001 40 200 0 142 0097 0.067 004 0032 0.022 0015 0011 000 0.00 0.00 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 EXHIBIT 13-2 Present Value of an Annuity of $1 in Arrears: ||1- tol Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.8.33 0.826 0.820 0.313 0.806 0.800 2 1886 1.859 1833 1808 1.783 1.759 1736 1713 1.690 1668 1647 1626 1605 1.585 1.566 1.547 1.528 1.500 1.492 1.474 1.457 1440 3 2.775 2.723 2673 2624 2577 2531 2487 2444 2.402 2361 222 223 2246 2210 2.174 2.140 2.106 2074 2.042 2011 1.981 1952 4 3.630 3.546 3.465 3.387 3.312 3240 3170 3.102 3037 2.974 2914 2.855 2.798 2743 2690 2639 2 589 2540 2494 2448 2.404 2362 5 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991 2.926 2.864 2.803 2.745 2689 8 9 10 5242 5076 4917 4 767 4.623 4 486 4.355 4231 4111 3098 37889 3784 3685 3589 3498 3410 3326 3 245 2 167 3.092 3020 2 951 6.002 5.786 5.582 5.389 5.206 5.033 4868 4712 4.564 4.423 4.288 4.160 4 039 3922 3812 3.706 3.605 3.508 3.416 3327 3.242 3.161 6.733 6.463 6.210 5.971 5.747 5535 5335 5.146 4.068 4.799 4,619 4 407 4.744 4 207 4078 2954 3837 3.726 3.619 3.518 3.421 3.329 7.435 7.108 6.802 6515 6.247 5.995 5.759 5 537 5328 5 132 4946 4772 4 607 4.451 4.303 4.163 4.031 3.905 3.786 3.673 3.566 3.463 8.111 7.722 7.360 7024 6.710 6.695.145 539 5.650 5.426 5 216 5019 4833 4659 4494 4339 4.192 4.054 3.923 3.799 3682 3571 11 12 13 14 15 8.760 8.306 7.887 7.499 7.1396 805 6.495 6 207 5.038 5.687 5.452 5234 5029 48364656 4486 4.327 4127 4.035 3.902 3.776 3.656 9 385 3853 8 384 7043 7536 7.161 6814 6 492 6194 5918 5.660 5.421 5197 4 OAR 4.793 4611 4.439 4.278 4 127 3.985 3.851 3.725 9.986 9.394853 8 7901 74877 102 6.750 6.424 6 122 5842 5583 5 342 5 118 4910 4715 45334362 4203 4052 2912 3.780 10563 9899 9295 8745 244 77867367 692 6 628 6.302 6002 5224 5.468 5229 5003 402 4611 6422 4265 4108 3962 3824 11.118 10.30 9.712 9108 8.559 8061 7 606 7 19168116462 6142 58475575 5124 5092 4876 4,675 4.489 4315 4157 4001 2859 16 11652 10.838 10.105 9.447 8.851 8.313 7.824 7 379 6974 6 604 6 265 5 954 5668 5.405 5.162 493 47304536 4357 4.189 4,033 3 887 17 12.166 11.274 10.477 9763 9.122 8.544 8.022 7549 7.120 6.729 6373 6.047 5.749 5.475 5.222 4.990 4775 4576 4191 4219 4059 3.910 18 12 659 11 690 10 828 10.0590372 8.7568.201 702 7.250 6 R40 6.467 612 5818 5534 5 273 5.033 48124.608 4.419 4.243 4.080 2928 19 13 114 12 OS 11 15 101369604 BOLO 365 709 71666918 60 6.108 377 5 5845 316 5070 443 4635 4.442 4261 4097 3942 2013 500 12 462 11.470 10 594 9818 9.129 514 753 7469 7025 6623 6 259 5 929 562 5353 5101 470 4657 4.4210 4110 3054 21 14020 12 321 11 764 10836 10 0120.202 3.649 075 75627 102 6676312 5973 5.665 5 384 512740914.675 4476 420 4121 2063 22 14.451 13 16 12 042 11 061 10 201 9442 3772 176 7645 7 170 6743 6359 6011 5695 5.410 5.149 4900 4600 4400 430241303970 23 14 57 114 12 303 18272 10371 9500 SBS 265 7718 7230 6792 6 399 6044 572 5432167 4925 4708 409 4111 & 137 1076 24 15 247 13.799 1255011469 10 529 9707 3985 343 77847203 635 6.414 6073 5745 5451 STR 4917 4713 40 4 1 25 15 622 14 094 12.783 11,654 10.67508239.077 422 7863 3 6873 5.464 6.097 5.766 5467 105 494 4.72145144 147 2005 26 15 14 1300311826 1010 00161 348 7096372 60066491 6118 573 5405 206 4066 428 4520 434151 30 27 1633014643 13 211 11.57 10 935 10.027 0237 S 7.90 7409 693565166136 5 798 5.492 5215 496447344524632154 3000 28 16.663 149 13406 12 137 11051 10.116 307 602 74 7441 6061 5 534 5152 5810 5 50 51 70 471 451 157 100 29 16 14 15 141 12501 12 278 11.158 10.198 9.370 8.650 80227.470 6983 6.551 6.166 5.820 5.510 5229 4 975 4.743 4534334159 1094 3017292 15 22 13765 12 409 1158 10 274 9.427 69 BOL 7.496 7.003 6.566 6. 177 5829 5517 5235 4079 4.746 45 44 43 4160 3095 40 19.793 17.15915046 13.332 11.925 10.757 9.779 8951824 7.634 7105 6.642 6233 5.71 5548 528 491 47604 544 4347 4 166 3999