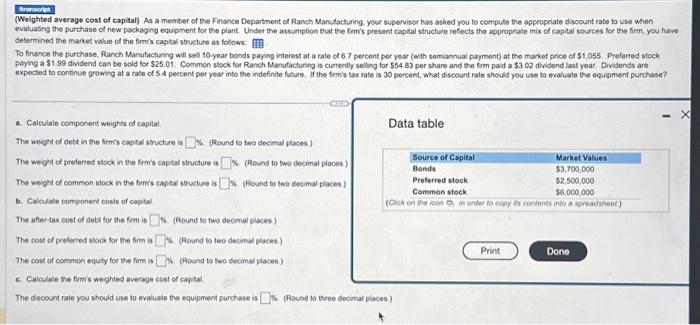

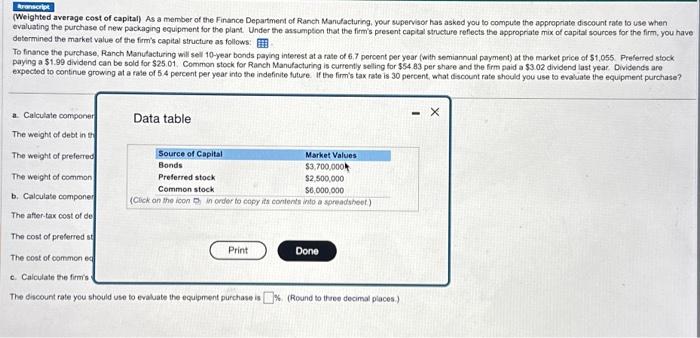

(Welghted average cost of capital) As a member of the Finance Department of Ranch Manutacturing. your supervisor has asked you to computo the approprate discount rate to use when evaluating the purchase of new pockoging equipment for the plant. Under the assumption that the fermis present capital structure refects the appropriate mix of capdal sources for the firm. you have determined the market value of the firmis capital structure as follows: To finance the purchase, Ranch Manufacturing will sell 10-year bonds paying interest at a rate of 6.7 percent por year (with semiannual paymont) at the markot price of 51,055 . Preferred stock paying a $1.99 dividend can be sold for $25.01. Common stock for Ranch Manufacturing is cumrenty seling for $54 s3 per shane and the frm paid a $3.02 dividend last year. Dividends are expected to continue growing at a rate of 5.4 peccent por year into the indefinite fulure. If the femis tax tate is 30 percent, what discount rale sheuld you bse to evaluate the equpment purchase? a. Calculate component weights of capital Data table The weight of debe in the firmis capeal structure is is. (Round to two decimal places) The weight of preferred wock in the frmb captal structure is 14. (Round to two decimal places) The weight of common stock in the fem's capalal structure is W. (Round to twe deemal paces) b. Calculate component costs of captal The aftectax cost of dobt for the frm is W. (Round to two decimal places ) The cost of prefered sock tor bie firm is W. (Round to teo decimul places) The cost of comnon equity for the fim is W. (Round to two decimal places.) c. Caloulate the firmis weghted averege cost of capalal, The dscount rate you should use to evaluate the equipmem purchase is 5 . (Round to throe decimat places) Weighted average cost of capital) As a member of the Finance Department of Ranch Manufacturing. your supervisor has asked you to compule the apgropriate discount rate to use when evaluating the purchase of new pockaging equipment for the plant. Under the assumption that the frmis present capital stucture refiects the apperopriate mix of capital sources for the firm, you have determined the market value of the fimis copital structure as follows To finance the purchase, Ranch Manutacturing will sell 10-year bonds paying interest at a rate of 67 percent per year (weh semiannual payment) at the markat price of $1,055. Prolerred siock paying a $1.99 dividend can be sold for $25.01. Common stock for Ranch Manulacturing is currently seling for $54.83 per share and the frm paid a $3.02 dividend last year. Oividends are expected to conbeue growing at a rate of 5.4 percent per year into the indefinte future. If the frmis tax rate is 30 percent, what discount rate should you use to evaluate the equipment purchase? a. Calculate component weights of capital The weght of debt in the frrm's captal structure is 1 . (Round to two decimal places.) The weight of preferred stock in the frem's capital structure is 1 (Round to two decimal places) The weight of coenmon stock in the frmis captal stroture is X. (Round to two decimal places) b. Calculate component costs of capial. The after-tax cost of debt for the firm is 16. (Round to two decimal places.) The cost of preferred stock for the frm is % (Round to two decimal places) The cost of common equity for the firm is \%. (Round to two decimal places.) c. Calculate the fim's weighted average cost of capital The discount rate you should use to evaluate the equipment purchase is 6 (Round to three decimwl places.) (Weighted average cost of capital) As a member of the Finance Department of Ranch Manufacturing, your supervisor has asked you to compute the approprate discount rate to use when evaluating the purchase of new packaging equipment for the plant. Under the assumpton that the firm's present captal structure reflects the appropriate mix of capitat sourcos for the firm, you have determined the market value of the firm's capital structure as follows: To finance the purchase, Ranch Manutacturing will sell 10-year bonds paying intecest at a rate of 6,7 percent per year (with semiannual payment) at the market price of $1,055. Preferred stock paying a $1.99 dividend can be sold for $25.01. Common stock for Ranch Manufacturing is curnertly seling for $54.83 per share and the firm paid a $3.02 dividend last year. Dividends are expected to continue growng at a rale of 5.4 percent per year into the indefinite future. If the firm's tax rate is 30 percent, whast discount rate sheuld you use to evaluate the equipment purchase? a. Calculate componer Data table The weight of debt in 1 th The weight of prefested The weight of common b. Calculate componer The after-tax cost of de The cost of preserred st The cost of common ed c. Calculate the firm's The dicount rate you should use to evaluate the equipment purchase is 6 (Round to thee decimal places.)