Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2020, O'Hura Corporation purchased $55,000, 5 %, 11-year bonds as a long-term investment, paying $52,800 cash. The bonds pay interest semi-annually

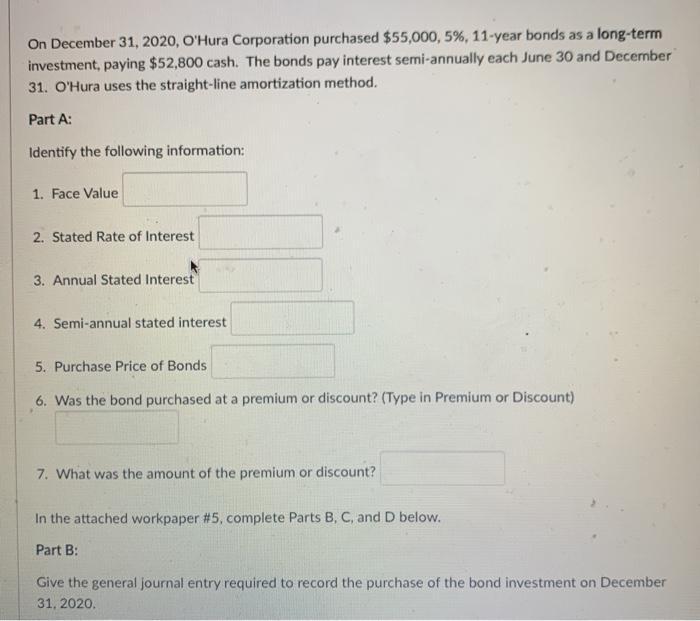

On December 31, 2020, O'Hura Corporation purchased $55,000, 5 %, 11-year bonds as a long-term investment, paying $52,800 cash. The bonds pay interest semi-annually each June 30 and December 31. O'Hura uses the straight-line amortization method. Part A: Identify the following information: 1. Face Value 2. Stated Rate of Interest 3. Annual Stated Interest 4. Semi-annual stated interest 5. Purchase Price of Bonds 6. Was the bond purchased at a premium or discount? (Type in Premium or Discount) 7. What was the amount of the premium or discount? In the attached workpaper # 5, complete Parts B, C, and D below. Part B: Give the general journal entry required to record the purchase of the bond investment on December 31, 2020. Part C: Give all of the general journal entries required to record the bond investment transactions for 2021. Part D: Indicate the names and balances of the accounts to be reported on O'Hura's 2021 financial statements. Part E: What would the book value of the bond investment be on December 31, 2030? Workpaper #5 in both PDF and Excel format. Be sure to save your completed file. You will uploaded your file in the next question.

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Calculations No Particulars 1 Face Value Stated Rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started