Answered step by step

Verified Expert Solution

Question

1 Approved Answer

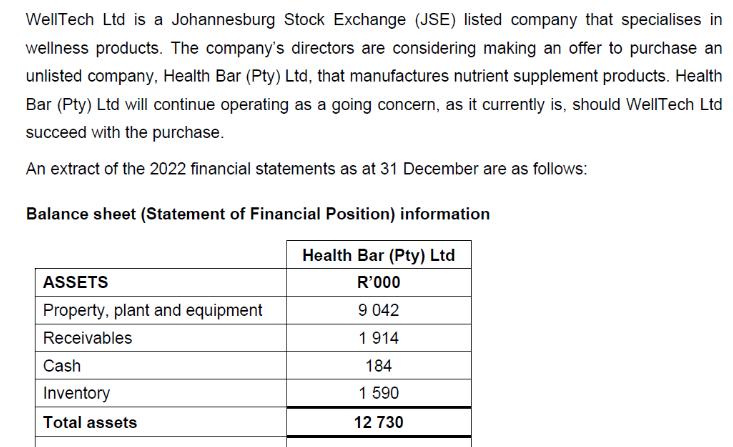

WellTech Ltd is a Johannesburg Stock Exchange (JSE) listed company that specialises in wellness products. The company's directors are considering making an offer to

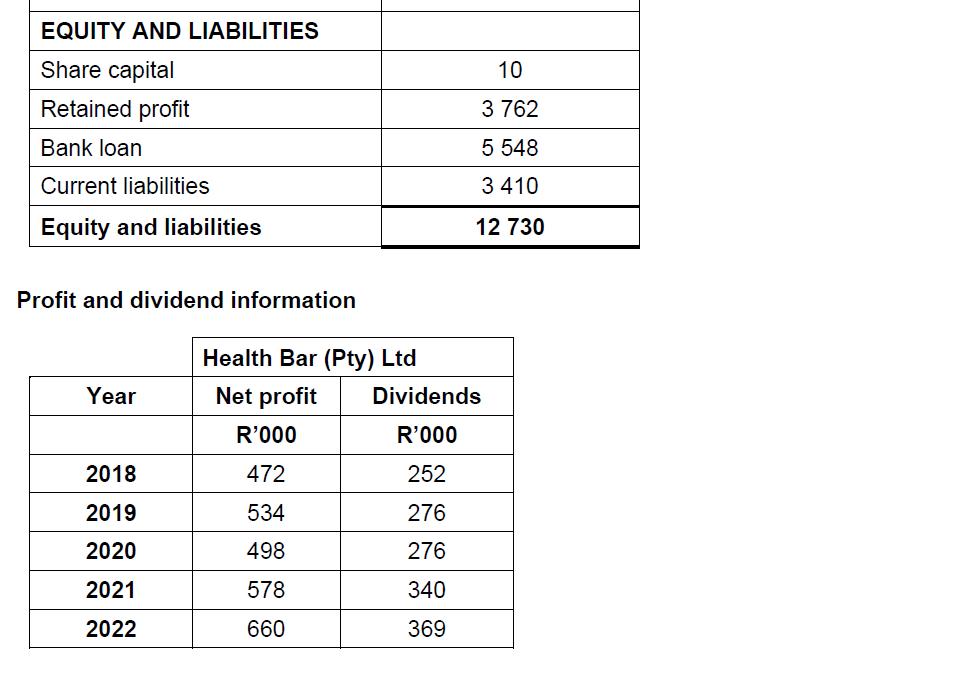

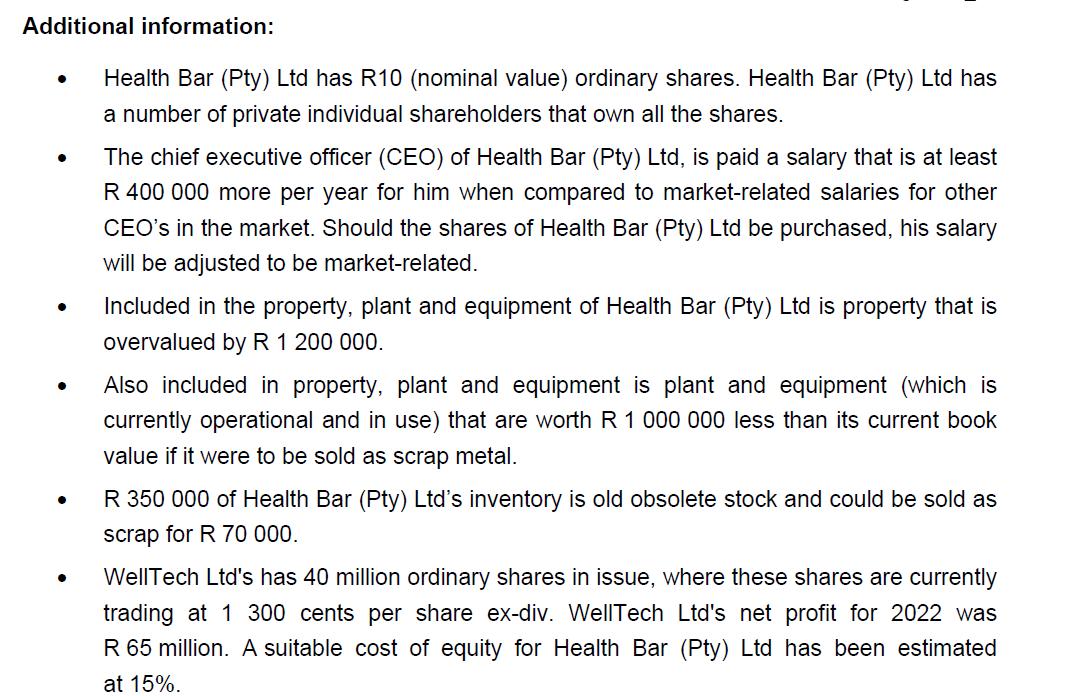

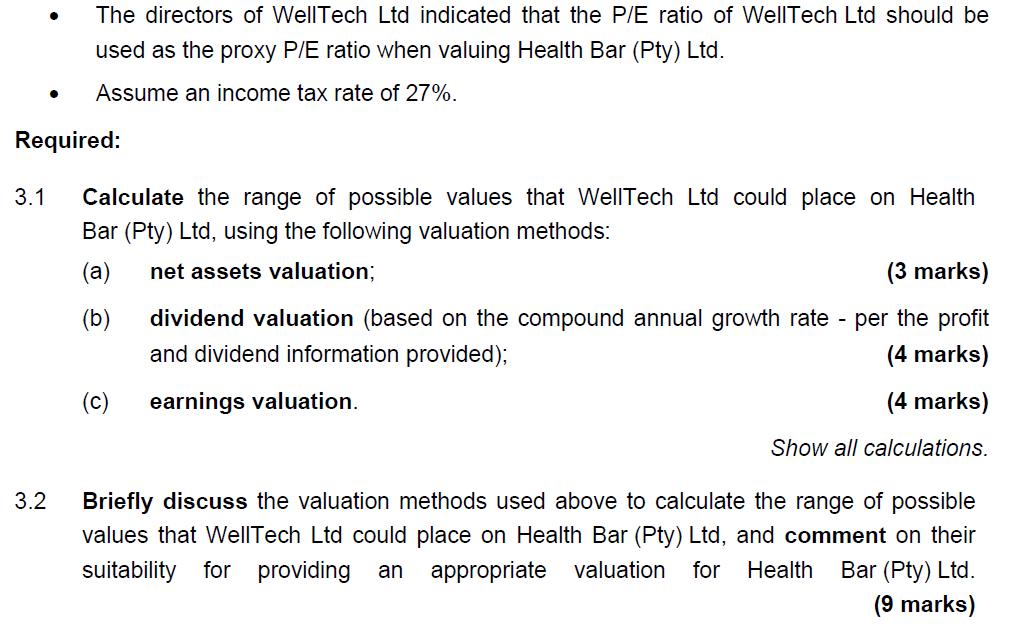

WellTech Ltd is a Johannesburg Stock Exchange (JSE) listed company that specialises in wellness products. The company's directors are considering making an offer to purchase an unlisted company, Health Bar (Pty) Ltd, that manufactures nutrient supplement products. Health Bar (Pty) Ltd will continue operating as a going concern, as it currently is, should WellTech Ltd succeed with the purchase. An extract of the 2022 financial statements as at 31 December are as follows: Balance sheet (Statement of Financial Position) information Health Bar (Pty) Ltd R'000 9 042 1914 184 1 590 12 730 ASSETS Property, plant and equipment Receivables Cash Inventory Total assets EQUITY AND LIABILITIES Share capital Retained profit Bank loan Current liabilities Equity and liabilities Profit and dividend information Year 2018 2019 2020 2021 2022 10 3 762 5 548 3 410 12 730 Health Bar (Pty) Ltd Net profit Dividends R'000 R'000 472 252 534 276 498 276 578 340 660 369 Additional information: Health Bar (Pty) Ltd has R10 (nominal value) ordinary shares. Health Bar (Pty) Ltd has a number of private individual shareholders that own all the shares. The chief executive officer (CEO) of Health Bar (Pty) Ltd, is paid a salary that is at least R 400 000 more per year for him when compared to market-related salaries for other CEO's in the market. Should the shares of Health Bar (Pty) Ltd be purchased, his salary will be adjusted to be market-related. Included in the property, plant and equipment of Health Bar (Pty) Ltd is property that is overvalued by R 1 200 000. Also included in property, plant and equipment is plant and equipment (which is currently operational and in use) that are worth R 1 000 000 less than its current book value if it were to be sold as scrap metal. R 350 000 of Health Bar (Pty) Ltd's inventory is old obsolete stock and could be sold as scrap for R 70 000. WellTech Ltd's has 40 million ordinary shares in issue, where these shares are currently trading at 1 300 cents per share ex-div. WellTech Ltd's net profit for 2022 was R 65 million. A suitable cost of equity for Health Bar (Pty) Ltd has been estimated at 15%. Required: 3.1 The directors of WellTech Ltd indicated that the P/E ratio of WellTech Ltd should be used as the proxy P/E ratio when valuing Health Bar (Pty) Ltd. Assume an income tax rate of 27%. 3.2 Calculate the range of possible values that WellTech Ltd could place on Health Bar (Pty) Ltd, using the following valuation methods: (a) net assets valuation; (b) (c) (3 marks) dividend valuation (based on the compound annual growth rate - per the profit and dividend information provided); (4 marks) earnings valuation. (4 marks) Show all calculations. Briefly discuss the valuation methods used above to calculate the range of possible values that WellTech Ltd could place on Health Bar (Pty) Ltd, and comment on their suitability for providing an appropriate valuation for Health Bar (Pty) Ltd. (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION 31 Valuation calculations a Net assets valuation Reported NAV R12730000 Adjustments Overval...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started