Wempe Co. sold $3,128,000, 9%, 10-year bonds on January 1, 2014. The bonds were dated January 1, 2014, and pay interest on January 1. The

Wempe Co. sold $3,128,000, 9%, 10-year bonds on January 1, 2014. The bonds were dated January 1, 2014, and pay interest on January 1. The company uses straight-line amortization on bond premiums and discounts. Financial statements are prepared annually.

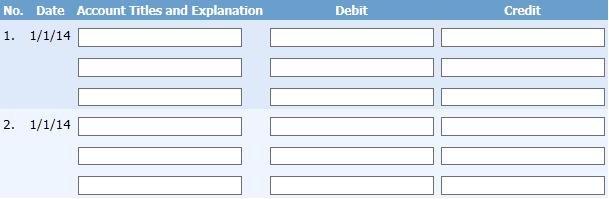

Prepare the journal entries to record the issuance of the bonds assuming they sold at: (1) 102 and (2) 97.

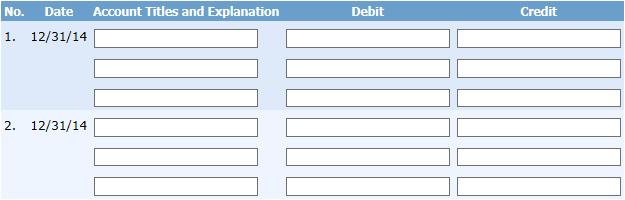

Prepare the journal entries to record interest expense for 2014 under both of the bond issuances assuming they sold at: (1) 102 and (2) 97

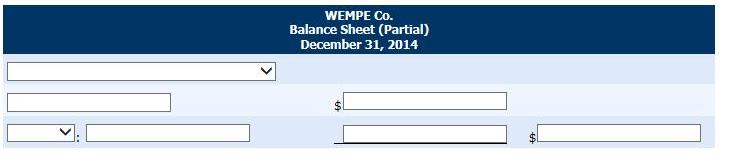

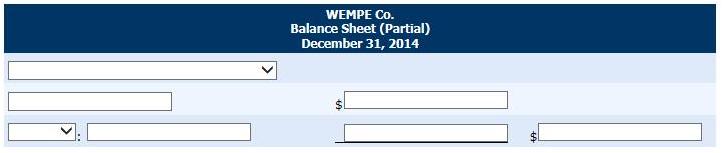

Show the long-term liabilities balance sheet presentation for issuance of the bonds sold at 102 at December 31, 2014.

Show the long-term liabilities balance sheet presentation for issuance of the bonds sold at 97 at December 31, 2014.

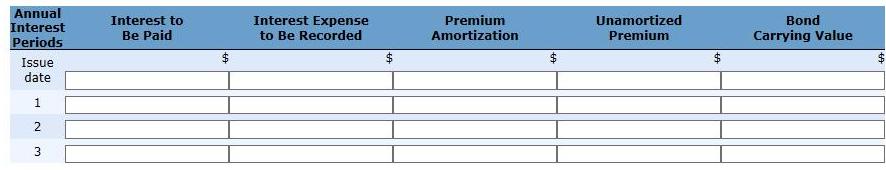

Prepare amortization tables for issuance of the bond sold at 102 for the first three interest payments.

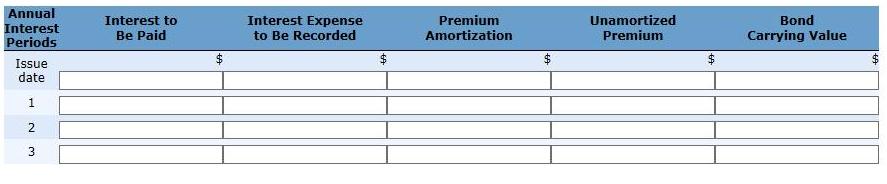

Prepare amortization tables for issuance of the bond sold at 97 for the first three interest payments.

No. Date Account Titles and Explanation 1. 1/1/14 2. 1/1/14 JU Debit Credit

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

NO Date 1 1114 F n 2 No 1 2 1114 Journal Entries to record Bond Issues Account titles and Explanatio...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started