Question

Wendy Daze, a 19-year-old college sophomore, wants to purchase a car from Reliable Motors. She tells the sales representative that her payments cannot exceed $400.00

Wendy Daze, a 19-year-old college sophomore, wants to purchase a car from Reliable Motors. She tells the sales representative that her payments cannot exceed $400.00 per month. After looking at several models of cars, she selects a 2014 Sportswagon providing her payments will be under $400.00. The sales rep tells Wendy that the car sells for $16,500, but there is a $1,000 holiday bonus rebate and she will get credit for trading in her old 2008 model Ford. However, there will be taxes and processing fees added to the total. Wendy agrees as long as her payments are under $400. The sales rep takes the paperwork to the financial manager to draw up the contract. When the sales rep comes back, he tells Wendy that the final cost of the car is $14,000 and her payments will be $390.00 per month. Wendy signs the contract and drives away in the car. Two months later, Wendy receives a letter from the finance office of Reliable Motors stating that when they calculated her costs, they made an error and the actual cost of the car is $15,100, and she would have to send them a certified check for $1,100 or they would take legal action against her.?

a. Describe the difference between a Unilateral Mistake and a Mutual Mistake.

b. What type of mistake happened on this contract?

c. If this case goes to trial, how do you think the court will rule? Fully explain your answer.?

? ?

? ?? ?? ?

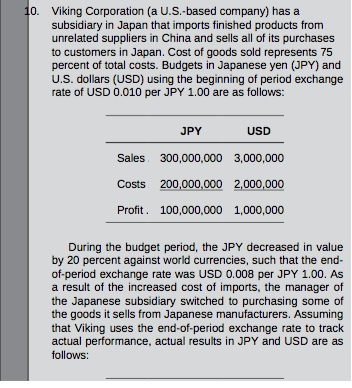

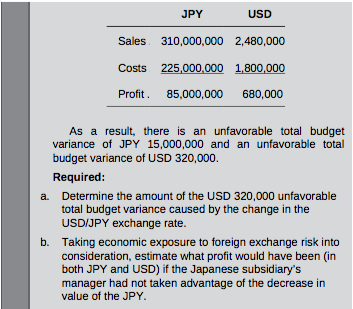

10. Viking Corporation (a U.S.-based company) has a subsidiary in Japan that imports finished products from unrelated suppliers in China and sells all of its purchases to customers in Japan. Cost of goods sold represents 75 percent of total costs. Budgets in Japanese yen (JPY) and U.S. dollars (USD) using the beginning of period exchange rate of USD 0.010 per JPY 1.00 are as follows: JPY Sales 300,000,000 3,000,000 Costs 200,000,000 2,000,000 Profit. 100,000,000 1,000,000 USD During the budget period, the JPY decreased in value by 20 percent against world currencies, such that the end- of-period exchange rate was USD 0.008 per JPY 1.00. As a result of the increased cost of imports, the manager of the Japanese subsidiary switched to purchasing some of the goods it sells from Japanese manufacturers. Assuming that Viking uses the end-of-period exchange rate to track actual performance, actual results in JPY and USD are as follows: JPY Sales 310,000,000 310,000,000 2,480,000 Costs 225,000,000 1,800,000 Profit. 85,000,000 680,000 USD As a result, there is an unfavorable total budget variance of JPY 15,000,000 and an unfavorable total budget variance of USD 320,000. Required: a. Determine the amount of the USD 320,000 unfavorable total budget variance caused by the change in the USD/JPY exchange rate. b. Taking economic exposure to foreign exchange risk into consideration, estimate what profit would have been (in both JPY and USD) if the Japanese subsidiary's manager had not taken advantage of the decrease in value of the JPY.

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Unilterl mistke This is defined s kind f mistke tht revils frm ne rty t the subjet mtter ntined in t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started