Question

Wendy have bought the share price of A company for $150 3 months ago, and it is currently trading at $190. Wendy has predicted that

Wendy have bought the share price of A company for $150 3 months ago, and it is currently trading at $190. Wendy has predicted that A company share price is expected to move up 1.5 times if A company can secure the project or may move down by 0.7 times if unsuccessful.

Vincent has observed the uptrend of A company shares price, he recommends Wendy to buy the call option on A company stocks to enjoy the financial leverage and ask Wendy to consider hedge her position if Wendy is afraid that the company might not secure the project.

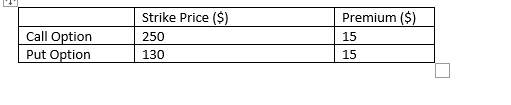

Explain how Wendy should design the hedging strategy in reference to what Vincent has suggested for me to do based on the following information obtained

\begin{tabular}{|l|l|l|} \hline & Strike Price ($) & Premium (\$) \\ \hline Call Option & 250 & 15 \\ \hline Put Option & 130 & 15 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & Strike Price ($) & Premium (\$) \\ \hline Call Option & 250 & 15 \\ \hline Put Option & 130 & 15 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started