Answered step by step

Verified Expert Solution

Question

1 Approved Answer

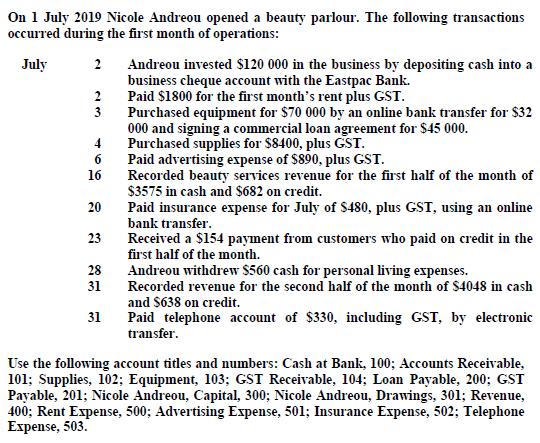

On 1 July 2019 Nicole Andreou opened a beauty parlour. The following transactions occurred during the first month of operations: July 2 2 3

On 1 July 2019 Nicole Andreou opened a beauty parlour. The following transactions occurred during the first month of operations: July 2 2 3 4 Purchased supplies for $8400, plus GST. Paid advertising expense of $890, plus GST. Recorded beauty services revenue for the first half of the month of $3575 in cash and $682 on credit. 6 16 20 23 Andreou invested $120 000 in the business by depositing cash into a business cheque account with the Eastpac Bank. Paid $1800 for the first month's rent plus GST. Purchased equipment for $70 000 by an online bank transfer for $32 000 and signing a commercial loan agreement for $45 000. 28 31 31 Paid insurance expense for July of $480, plus GST, using an online bank transfer. Received a $154 payment from customers who paid on credit in the first half of the month. Andreou withdrew $560 cash for personal living expenses. Recorded revenue for the second half of the month of $4048 in cash and $638 on credit. Paid telephone account of $330, including GST, by electronic transfer. Use the following account titles and numbers: Cash at Bank, 100; Accounts Receivable, 101; Supplies, 102; Equipment, 103; GST Receivable, 104; Loan Payable, 200; GST Payable, 201; Nicole Andreou, Capital, 300; Nicole Andreou, Drawings, 301; Revenue, 400; Rent Expense, 500; Advertising Expense, 501; Insurance Expense, 502; Telephone Expense, 503. (c) Prepare a Balance sheet as at 31 July 2019. (5 Marks) (d) Prepare an Income statement for year ending July 2019. (5 Marks)

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Balance Sheet Equity and Liability Amount Share Capital 120000 Retained Earnning 9957 Drawing 560 Non Current Liability Loan 45000 Current Liabilities ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started