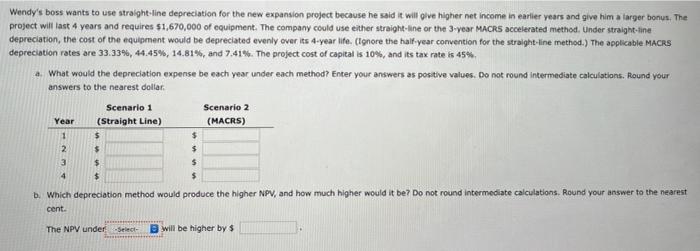

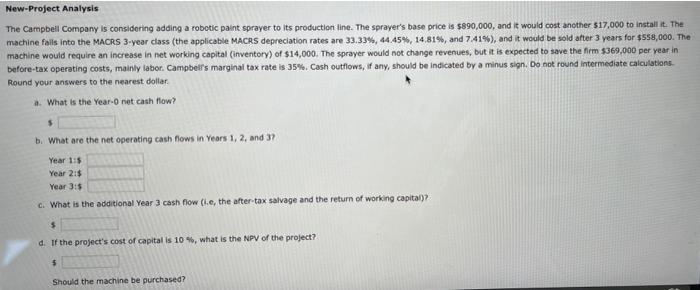

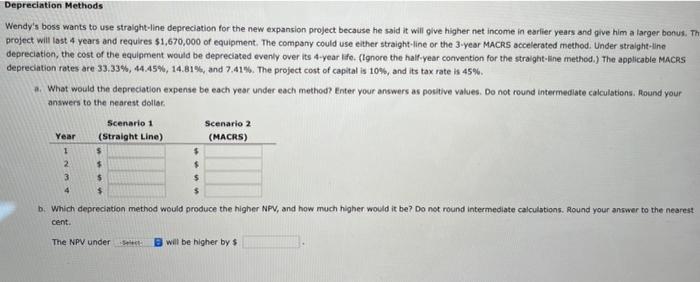

Wendy's boss wants to use straight line depreciation for the new expansion project because he said it will give higher net income in earlier years and give him a larger bonus. The project will last 4 years and requires $1,670,000 of equipment. The company could use either straight line or the 3-year MACRS accelerated method. Under straight-tine depreciation, the cost of the equipment would be depreciated evenly over its 4-year life. (ignore the half-year convention for the straight line method.) The applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%. The project cost of capital is 10%, and its tax rate is 45%. 4. What would the depreciation expense be each year under each method? Enter your answers as positive values. Do not round intermediate calculations. Round your answers to the nearest dollar Scenario 1 Scenario 2 Year (Straight Line) (MACRS) 1 $ 2 $ $ $ $ $ $ $ 3 4 b. Which depreciation method would produce the higher NPV, and how much higher would it be? Do not round Intermediate calculations. Round your answer to the nearest cent. The NPV under -Select- Dwill be higher by $ New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $890,000, and it would cost another 517,000 to install it. The machine falls into the MACRS 3-year class (the applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%), and it would be sold after 3 years for $558,000. The machine would require an increase in net working capital (inventory) of $14,000. The sprayer would not change revenues, but it is expected to save the firm $369,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 35%. Cash outflows, Wany, should be indicated by a minus sign. Do not found intermediate calculations Round your answers to the nearest dollar. a. What is the Year-O net cash flow? $ b. What are the net operating cash flows in Years 1, 2 and 3? Year 115 Year 2:$ Year 3: c. What is the additional Year 3 cash flow (ie, the after-tax salvage and the return of working capital)? $ d. If the project's cost of capital is 10%, what is the NPV of the project? $ Should the machine be purchased? Depreciation Methods Wendy's boss wants to use straight-line depreciation for the new expansion project because he said it will give higher net income in earlier years and give him a larger bonus. Th project will last 4 years and requires $1,670,000 of equipment. The company could use either straight line or the 3-year MACRS accelerated method. Under straight-line depreciation, the cost of the equipment would be depreciated evenly over its 4-year life. (Ignore the half year convention for the straight-line method.) The applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7,41%. The project cost of capital is 10% and its tax rate is 45%. What would the depreciation expense be each year under each method? Enter your answers as positive values. Do not round Intermediate calculations. Round your answers to the nearest dollar Scenario 1 Scenario 2 Year (Straight Line) (MACRS) 1 $ $ 2 $ 3 $ $ 4 $ $ b. Which depreciation method would produce the higher NPV, and how much higher would it be? Do not round Intermediate calculations. Round your answer to the nearest cent. The NPV under will be higher by $ Wendy's boss wants to use straight line depreciation for the new expansion project because he said it will give higher net income in earlier years and give him a larger bonus. The project will last 4 years and requires $1,670,000 of equipment. The company could use either straight line or the 3-year MACRS accelerated method. Under straight-tine depreciation, the cost of the equipment would be depreciated evenly over its 4-year life. (ignore the half-year convention for the straight line method.) The applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%. The project cost of capital is 10%, and its tax rate is 45%. 4. What would the depreciation expense be each year under each method? Enter your answers as positive values. Do not round intermediate calculations. Round your answers to the nearest dollar Scenario 1 Scenario 2 Year (Straight Line) (MACRS) 1 $ 2 $ $ $ $ $ $ $ 3 4 b. Which depreciation method would produce the higher NPV, and how much higher would it be? Do not round Intermediate calculations. Round your answer to the nearest cent. The NPV under -Select- Dwill be higher by $ New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $890,000, and it would cost another 517,000 to install it. The machine falls into the MACRS 3-year class (the applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%), and it would be sold after 3 years for $558,000. The machine would require an increase in net working capital (inventory) of $14,000. The sprayer would not change revenues, but it is expected to save the firm $369,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 35%. Cash outflows, Wany, should be indicated by a minus sign. Do not found intermediate calculations Round your answers to the nearest dollar. a. What is the Year-O net cash flow? $ b. What are the net operating cash flows in Years 1, 2 and 3? Year 115 Year 2:$ Year 3: c. What is the additional Year 3 cash flow (ie, the after-tax salvage and the return of working capital)? $ d. If the project's cost of capital is 10%, what is the NPV of the project? $ Should the machine be purchased? Depreciation Methods Wendy's boss wants to use straight-line depreciation for the new expansion project because he said it will give higher net income in earlier years and give him a larger bonus. Th project will last 4 years and requires $1,670,000 of equipment. The company could use either straight line or the 3-year MACRS accelerated method. Under straight-line depreciation, the cost of the equipment would be depreciated evenly over its 4-year life. (Ignore the half year convention for the straight-line method.) The applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7,41%. The project cost of capital is 10% and its tax rate is 45%. What would the depreciation expense be each year under each method? Enter your answers as positive values. Do not round Intermediate calculations. Round your answers to the nearest dollar Scenario 1 Scenario 2 Year (Straight Line) (MACRS) 1 $ $ 2 $ 3 $ $ 4 $ $ b. Which depreciation method would produce the higher NPV, and how much higher would it be? Do not round Intermediate calculations. Round your answer to the nearest cent. The NPV under will be higher by $