Answered step by step

Verified Expert Solution

Question

1 Approved Answer

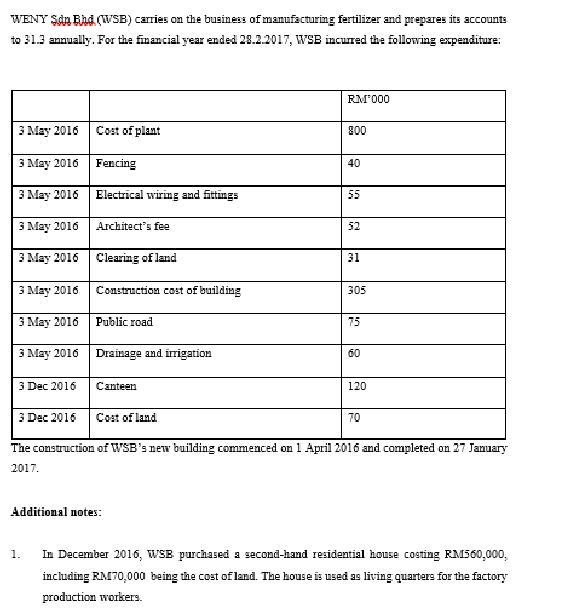

WENY Sdn Bhd (WSB) carries on the business of manufacturing fertilizer and prepares its accounts. to 31.3 annually. For the financial year ended 28.2.2017,

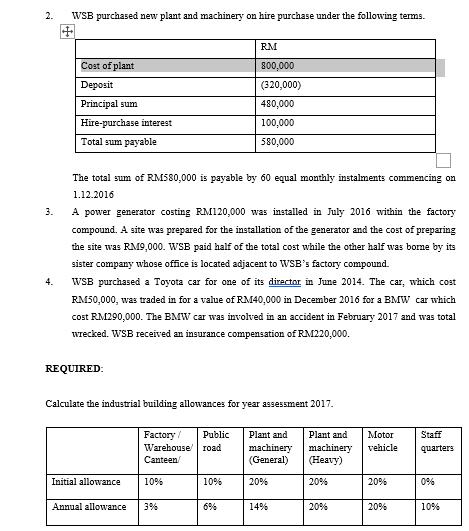

WENY Sdn Bhd (WSB) carries on the business of manufacturing fertilizer and prepares its accounts. to 31.3 annually. For the financial year ended 28.2.2017, WSB incurred the following expenditure: 3 May 2016 3 May 2016 3 May 2016 3 May 2016 3 May 2016 Clearing of land 3 May 2016 3 May 2016 3 May 2016 3 Dec 2016 3 Dec 2016 Cost of plant Fencing Electrical wiring and fittings 1. Architect's fee Construction cost of building Public road Drainage and irrigation Canteen Additional notes: RM'000 800 40 55 52 31 305 75 Cost of land The construction of WSB's new building commenced on 1 April 2016 and completed on 27 January 2017. 60 120 70 In December 2016, WSB purchased a second-hand residential house costing RM560,000, including RM70,000 being the cost of land. The house is used as living quarters for the factory production workers. 2. 3. 4. WSB purchased new plant and machinery on hire purchase under the following terms. Cost of plant Deposit Principal sum Hire-purchase interest Total sum payable REQUIRED: The total sum of RM580,000 is payable by 60 equal monthly instalments commencing on 1.12.2016 A power generator costing RM120,000 was installed in July 2016 within the factory compound. A site was prepared for the installation of the generator and the cost of preparing the site was RM9,000. WSB paid half of the total cost while the other half was borne by its sister company whose office is located adjacent to WSB's factory compound. WSB purchased a Toyota car for one of its director in June 2014. The car, which cost RM50,000, was traded in for a value of RM40,000 in December 2016 for a BMW car which cost RM290,000. The BMW car was involved in an accident in February 2017 and was total wrecked. WSB received an insurance compensation of RM220,000. Factory/ Public Warehouse/ road Canteen/ Calculate the industrial building allowances for year assessment 2017. Initial allowance 10% Annual allowance 3% RM 10% 800,000 (320,000) 480,000 100,000 580,000 6% Plant and machinery (General) 20% 14% Plant and Motor machinery vehicle (Heavy) 20% 20% 20% 20% Staff quarters 0% 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the industrial building allowances for the year assessment 2017 we need to determine th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started