Answered step by step

Verified Expert Solution

Question

1 Approved Answer

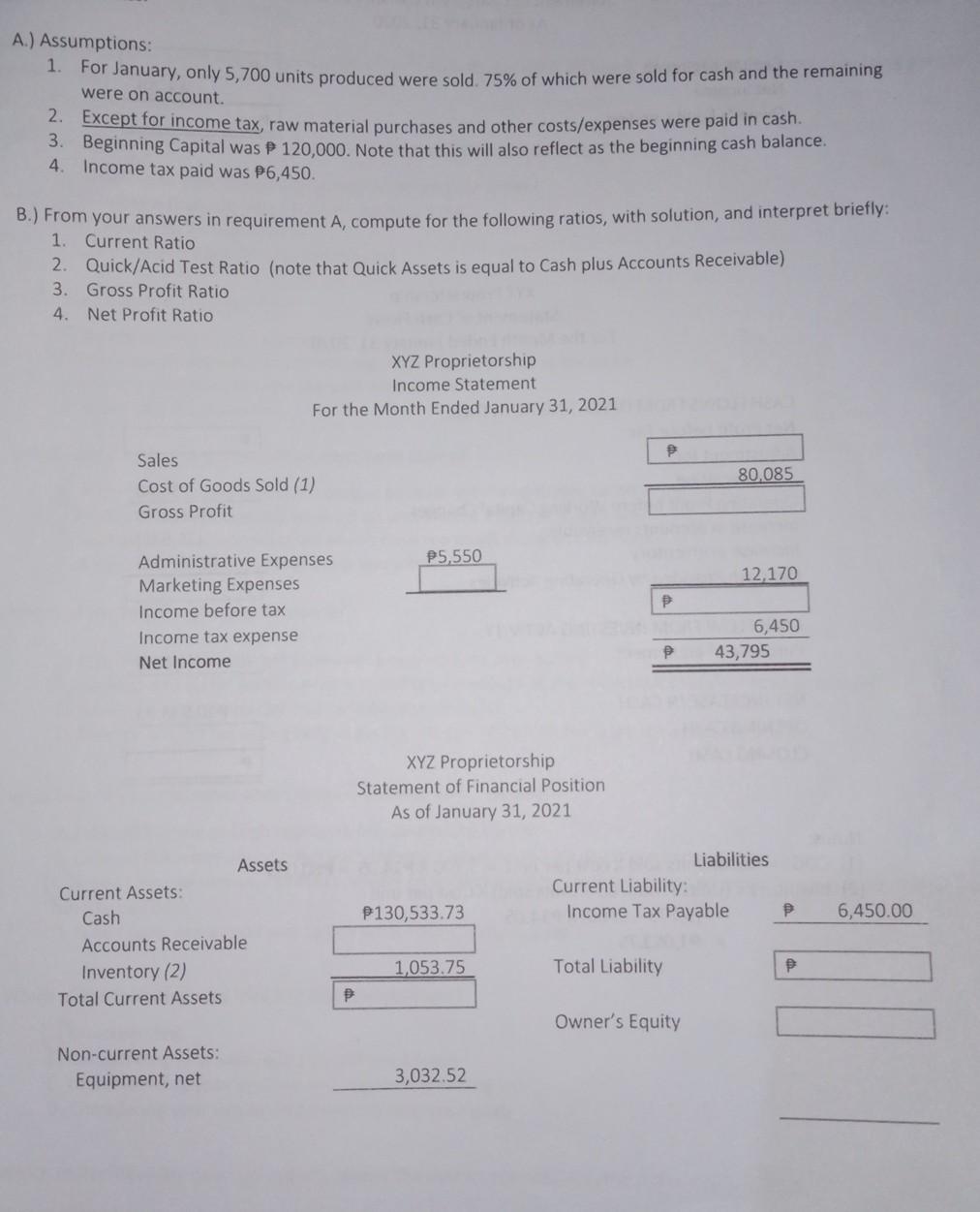

were on account. 4. A.) Assumptions: 1. For January, only 5,700 units produced were sold. 75% of which were sold for cash and the remaining

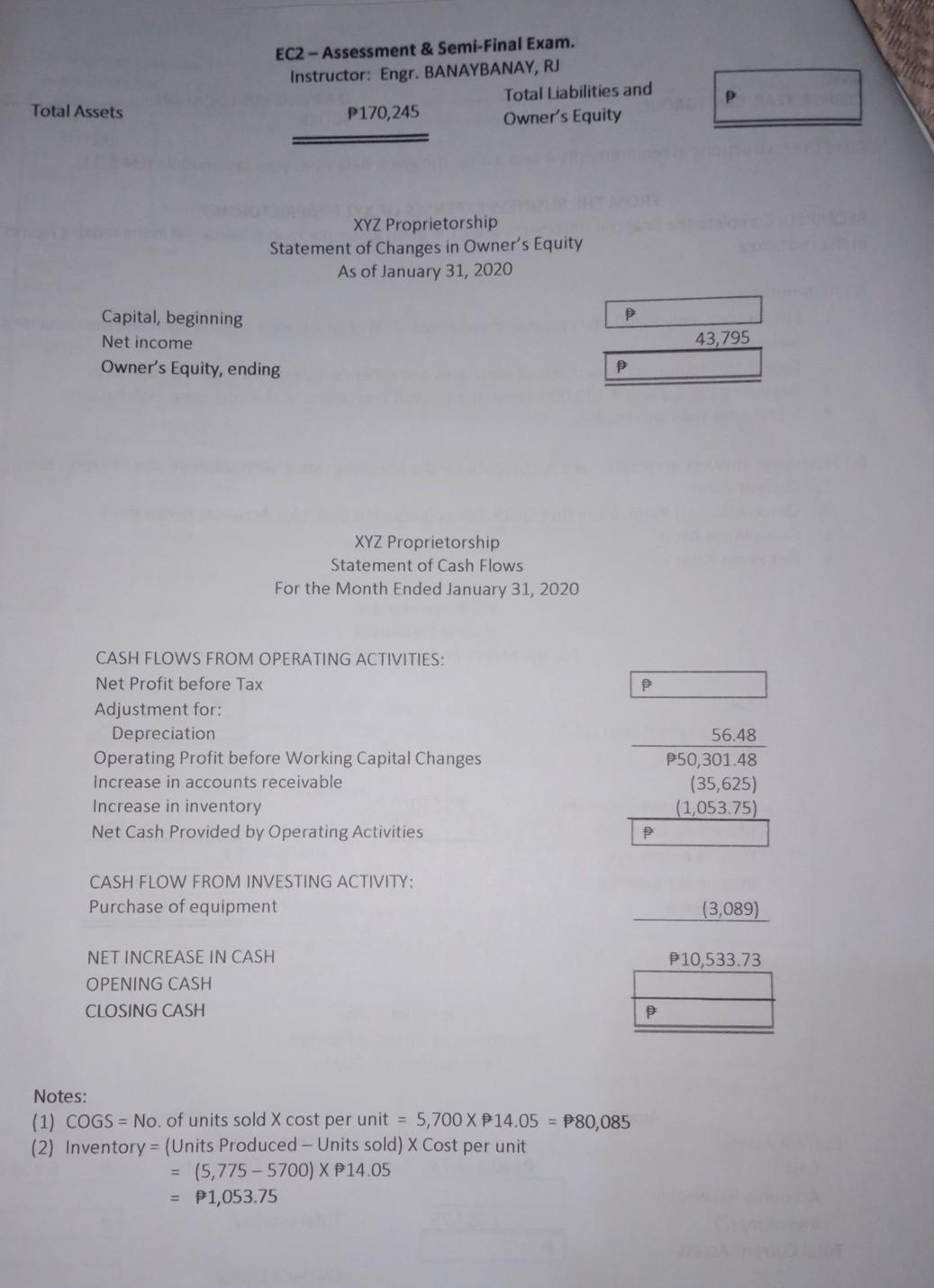

were on account. 4. A.) Assumptions: 1. For January, only 5,700 units produced were sold. 75% of which were sold for cash and the remaining 2. Except for income tax, raw material purchases and other costs/expenses were paid in cash. 3. Beginning Capital was P 120,000. Note that this will also reflect as the beginning cash balance. Income tax paid was P6,450. B.) From your answers in requirement A, compute for the following ratios, with solution, and interpret briefly: 1. Current Ratio 2. Quick/Acid Test Ratio (note that Quick Assets is equal to Cash plus Accounts Receivable) 3. Gross Profit Ratio 4. Net Profit Ratio XYZ Proprietorship Income Statement For the Month Ended January 31, 2021 80,085 Sales Cost of Goods Sold (1) Gross Profit P5,550 12,170 Administrative Expenses Marketing Expenses Income before tax Income tax expense Net Income 6,450 43,795 XYZ Proprietorship Statement of Financial Position As of January 31, 2021 Liabilities Current Liability: Income Tax Payable P130,533.73 6,450.00 Assets Current Assets: Cash Accounts Receivable Inventory (2) Total Current Assets 1,053.75 Total Liability Owner's Equity Non-current Assets: Equipment, net 3,032.52 EC2 - Assessment & Semi-Final Exam. Instructor: Engr. BANAYBANAY, RJ Total Liabilities and P170,245 Owner's Equity Total Assets XYZ Proprietorship Statement of Changes in Owner's Equity As of January 31, 2020 P Capital, beginning Net income Owner's Equity, ending 43,795 XYZ Proprietorship Statement of Cash Flows For the Month Ended January 31, 2020 P CASH FLOWS FROM OPERATING ACTIVITIES: Net Profit before Tax Adjustment for: Depreciation Operating Profit before Working Capital Changes Increase in accounts receivable Increase in inventory Net Cash Provided by Operating Activities 56.48 P50,301.48 (35,625) (1,053.75) CASH FLOW FROM INVESTING ACTIVITY: Purchase of equipment (3,089) P10,533.73 NET INCREASE IN CASH OPENING CASH CLOSING CASH Notes: (1) COGS = No. of units sold X cost per unit = 5,700 X P14.05 = P80,085 (2) Inventory = (Units Produced - Units sold) x Cost per unit (5,775 - 5700) X P14.05 = P1,053.75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started