Question

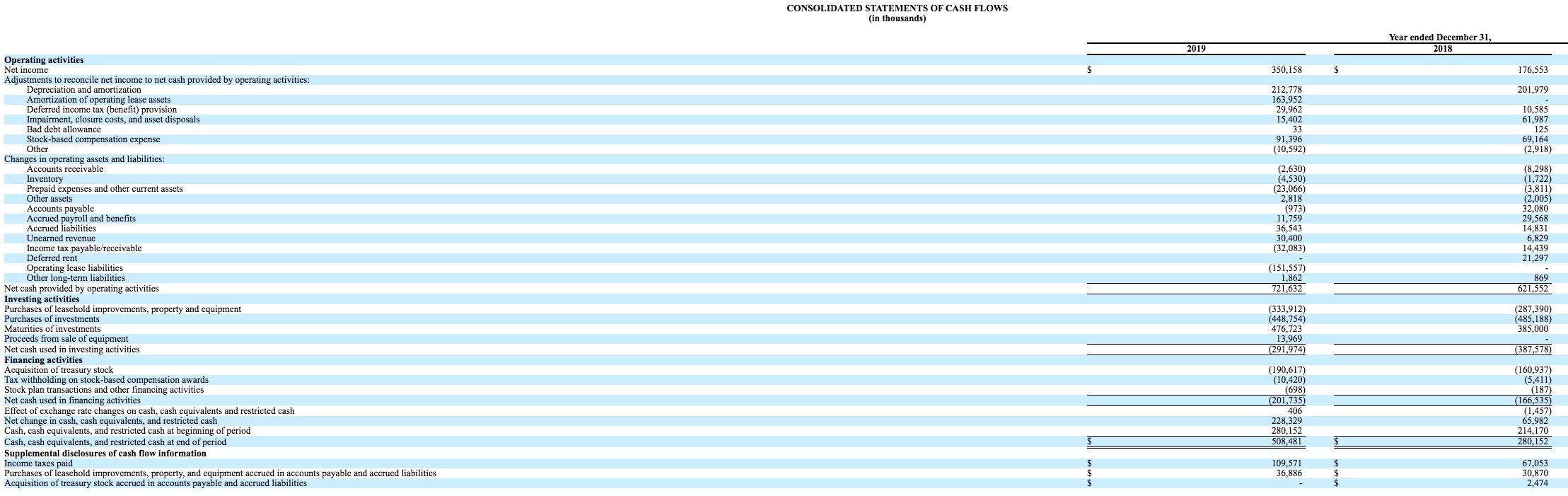

CASH FLOWS BALANCE SHEETS INCOME STATEMENTS SHAREHOLDERS EQUITY a. Were there any Non-Cash Investing/Financing Transactions? Describe the type and amount. b. What is the dollar

CASH FLOWS

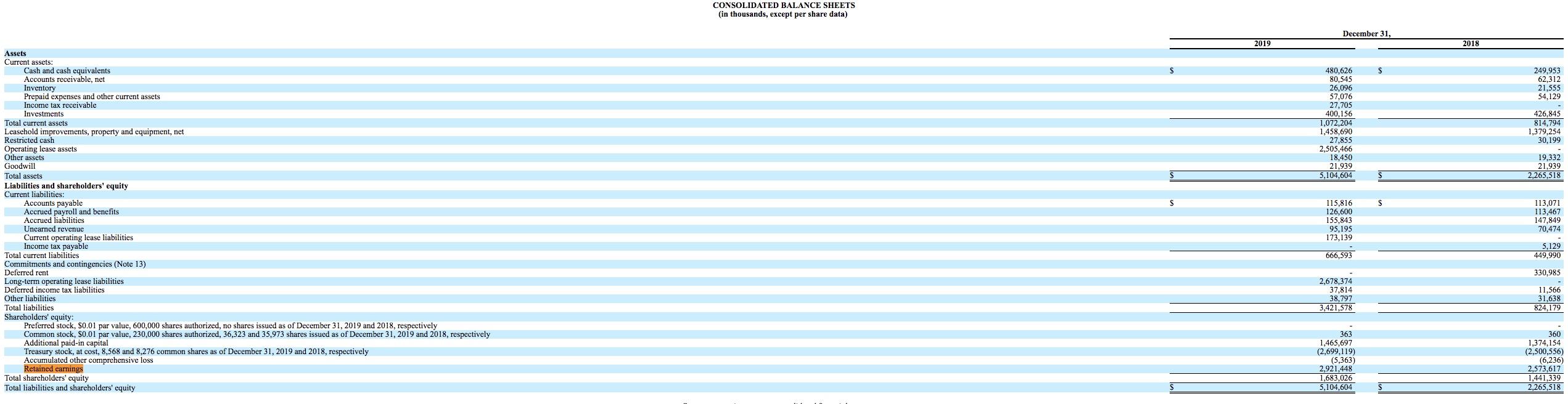

BALANCE SHEETS

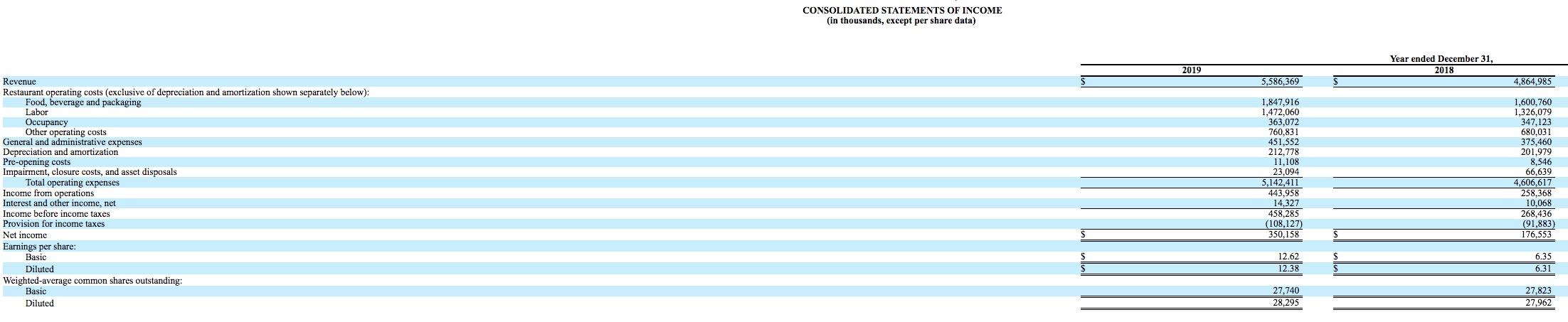

INCOME STATEMENTS

SHAREHOLDERS EQUITY

a. Were there any Non-Cash Investing/Financing Transactions? Describe the type and amount.

b. What is the dollar difference between accrual net income and Cash provided by Operations?

c. What investing activity provided the largest inflow of cash in the current year?

d. What investing activity used the largest amount of cash in the current year?

e. What financing activity provided the largest inflow of cash in the current year?

f. What financing activity used the largest amount of cash in the current year?

g. Does the company have sufficient cash inflows from the appropriate category? Describe any problems the company many experience with cash flow from your analysis of the cash flow statement.

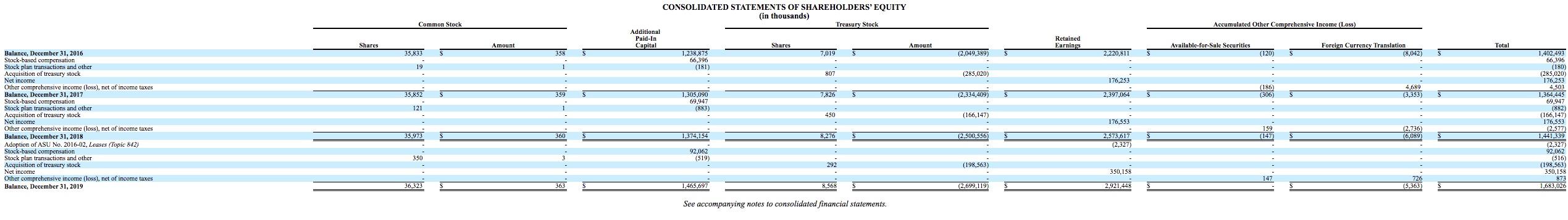

h. Show the change in Retained Earnings for the 2 most recent years. What was net income for each year? How much was paid out in dividends each year?

i. Were the dividends on common stock and/or preferred stock? What was the amount of each?

j. Did Retained Earnings change for any reasons other than net income or dividends? Explain.

k. What classes of stock does your company have?

l. How many shares of each class of stock are authorized, how many are issued, and how many are outstanding?

m. Does your company have any treasury stock? How many shares and what dollar amount?

n. What is the par or stated value of each of your company’s stocks?

Operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Amortization of operating lease assets Deferred income tax (benefit) provision Impairment, closure costs, and asset disposals Bad debt allowance Stock-based compensation expense Other Changes in operating assets and liabilities: Accounts receivable Inventory Prepaid expenses and other current assets Other assets Accounts payable Accrued payroll and benefits Accrued liabilities Unearned revenue Income tax payable/receivable Deferred rent Operating lease liabilities. Other long-term liabilities Net cash provided by operating activities Investing activities Purchases of leasehold improvements, property and equipment Purchases of investments Maturities of investments Proceeds from sale of equipment Net cash used in investing activities Financing activities Acquisition of treasury stock Tax withholding on stock-based compensation awards Stock plan transactions and other financing activities Net cash used in financing activities Effect of exchange rate changes on cash, cash equivalents and restricted cash Net change in cash, cash equivalents, and restricted cash Cash, cash equivalents, and restricted cash at beginning of period Cash, cash equivalents, and restricted cash at end of period Supplemental disclosures of cash flow information Income taxes paid Purchases of leasehold improvements, property, and equipment accrued in accounts payable and accrued liabilities Acquisition of treasury stock accrued in accounts payable and accrued liabilities CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) $ $ 2019 350,158 212.778 163,952 29,962 15,402 33 91,396 (10,592) (2,630) (4,530) (23,066) 2,818 (973) 11,759 36,543 30,400 (32,083) (151,557) 1,862 721,632 (333,912) (448,754) 476,723 13,969 (291,974) (190,617) (10,420) (698) (201,735) 406 228,329 280,152 508,481 109,571 36,886 $ $ $ Year ended December 31, 2018 176,553 201,979 10,585 61,987 125 69,164 (2,918) (8,298) (1,722) (3,811) _ (2,005) 32,080 29,568 14,831 6,829 14,439 21,297 869 621.552 (287,390) (485,188) 385,000 (387,578) (160,937) (5,411) (187) (166,535) (1,457) 65.982 214,170 280,152 67,053 30,870 2,474 Operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Amortization of operating lease assets Deferred income tax (benefit) provision Impairment, closure costs, and asset disposals Bad debt allowance Stock-based compensation expense Other Changes in operating assets and liabilities: Accounts receivable Inventory Prepaid expenses and other current assets Other assets Accounts payable Accrued payroll and benefits Accrued liabilities Unearned revenue Income tax payable/receivable Deferred rent Operating lease liabilities. Other long-term liabilities Net cash provided by operating activities Investing activities Purchases of leasehold improvements, property and equipment Purchases of investments Maturities of investments Proceeds from sale of equipment Net cash used in investing activities Financing activities Acquisition of treasury stock Tax withholding on stock-based compensation awards Stock plan transactions and other financing activities Net cash used in financing activities Effect of exchange rate changes on cash, cash equivalents and restricted cash Net change in cash, cash equivalents, and restricted cash Cash, cash equivalents, and restricted cash at beginning of period Cash, cash equivalents, and restricted cash at end of period Supplemental disclosures of cash flow information Income taxes paid Purchases of leasehold improvements, property, and equipment accrued in accounts payable and accrued liabilities Acquisition of treasury stock accrued in accounts payable and accrued liabilities CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) $ $ 2019 350,158 212.778 163,952 29,962 15,402 33 91,396 (10,592) (2,630) (4,530) (23,066) 2,818 (973) 11,759 36,543 30,400 (32,083) (151,557) 1,862 721,632 (333,912) (448,754) 476,723 13,969 (291,974) (190,617) (10,420) (698) (201,735) 406 228,329 280,152 508,481 109,571 36,886 $ $ $ Year ended December 31, 2018 176,553 201,979 10,585 61,987 125 69,164 (2,918) (8,298) (1,722) (3,811) _ (2,005) 32,080 29,568 14,831 6,829 14,439 21,297 869 621.552 (287,390) (485,188) 385,000 (387,578) (160,937) (5,411) (187) (166,535) (1,457) 65.982 214,170 280,152 67,053 30,870 2,474

Step by Step Solution

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Were there any NonCash InvestingFinancing Transactions Describe the type and amount NO b What is the dollar difference between accrual net income an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started