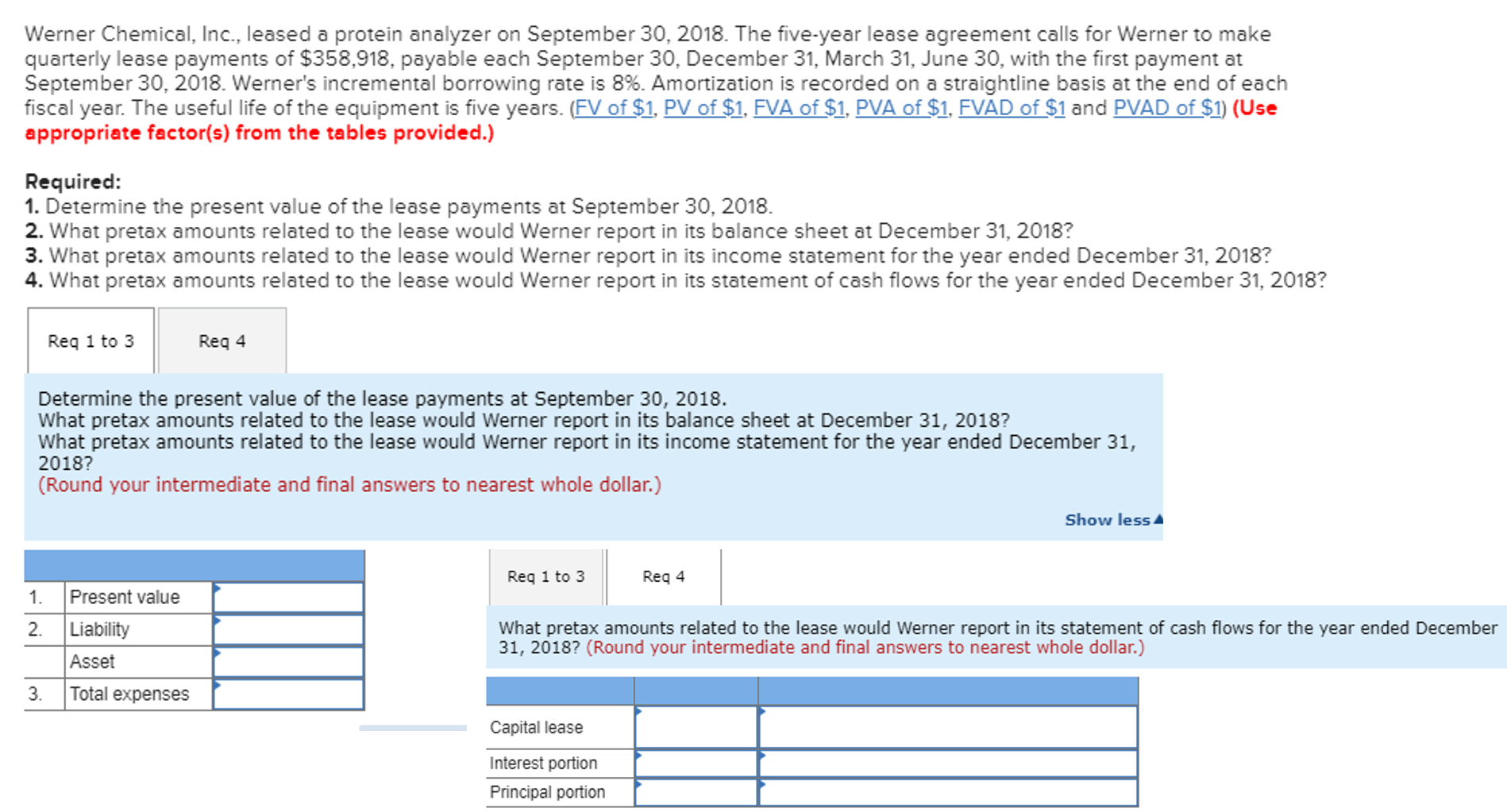

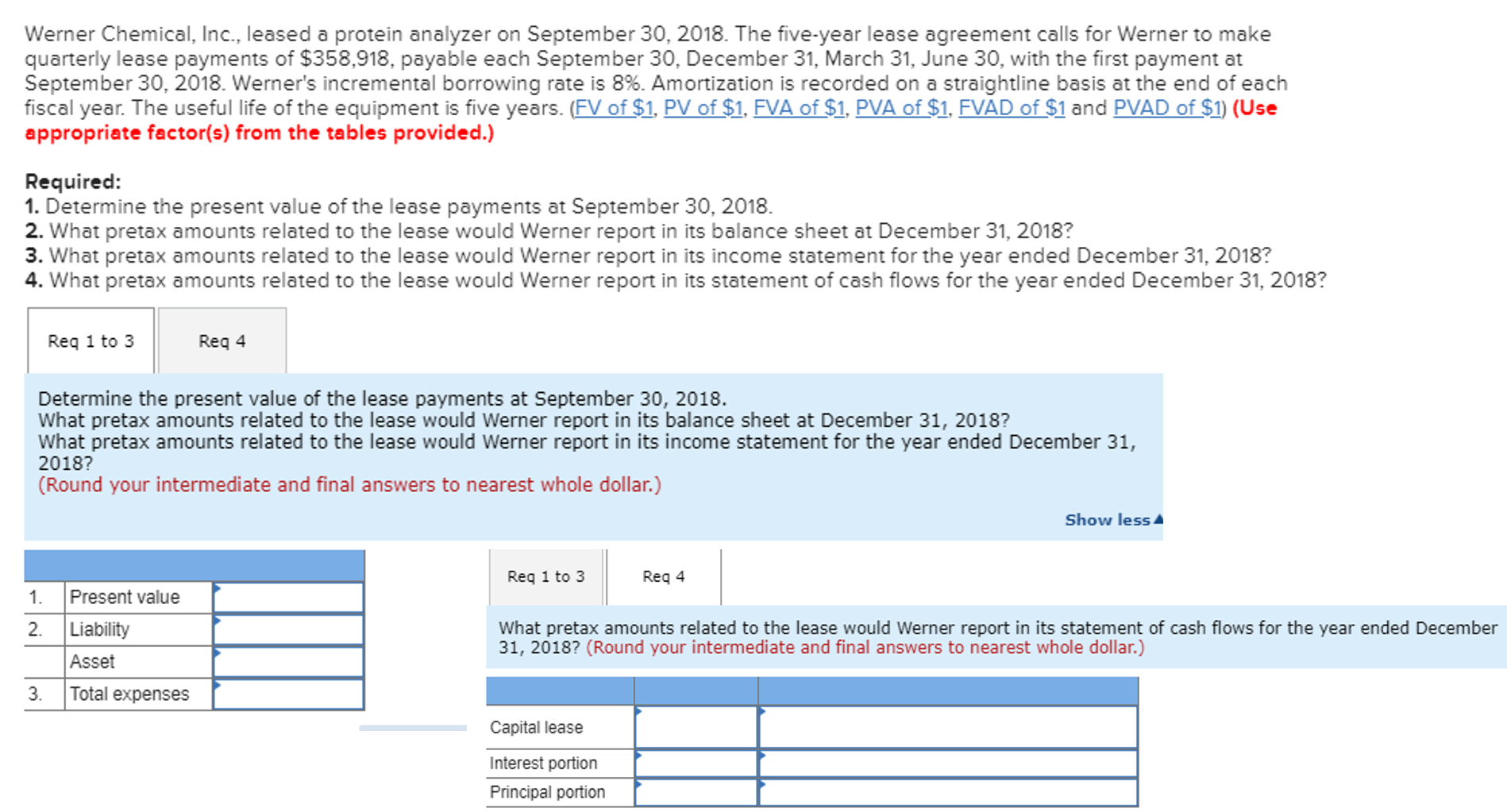

Werner Chemical, Inc., leased a protein analyzer on September 30, 2018. The five-year lease agreement calls for Werner to make quarterly lease payments of $358,918, payable each September 30, December 31, March 31, June 30, with the first payment at September 30, 2018. Werner's incremental borrowing rate is 8%. Amortization is recorded on a straightline basis at the end of each fiscal year. The useful life of the equipment is five years. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the present value of the lease payments at September 30, 2018. 2. What pretax amounts related to the lease would Werner report in its balance sheet at December 31, 2018? 3. What pretax amounts related to the lease would Werner report in its income statement for the year ended December 31, 2018? 4. What pretax amounts related to the lease would Werner report in its statement of cash flows for the year ended December 31, 2018? Reg 1 to 3 Reg 4 Determine the present value of the lease payments at September 30, 2018. What pretax amounts related to the lease would Werner report in its balance sheet at December 31, 2018? What pretax amounts related to the lease would Werner report in its income statement for the year ended December 31, 2018? (Round your intermediate and final answers to nearest whole dollar.) Show less Req 1 to 3 Reg 4 1 Present value Liability Asset What pretax amounts related to the lease would Werner report in its statement of cash flows for the year ended December 31, 2018? (Round your intermediate and final answers to nearest whole dollar.) 3. Total expenses Capital lease Interest portion Principal portion Werner Chemical, Inc., leased a protein analyzer on September 30, 2018. The five-year lease agreement calls for Werner to make quarterly lease payments of $358,918, payable each September 30, December 31, March 31, June 30, with the first payment at September 30, 2018. Werner's incremental borrowing rate is 8%. Amortization is recorded on a straightline basis at the end of each fiscal year. The useful life of the equipment is five years. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the present value of the lease payments at September 30, 2018. 2. What pretax amounts related to the lease would Werner report in its balance sheet at December 31, 2018? 3. What pretax amounts related to the lease would Werner report in its income statement for the year ended December 31, 2018? 4. What pretax amounts related to the lease would Werner report in its statement of cash flows for the year ended December 31, 2018? Reg 1 to 3 Reg 4 Determine the present value of the lease payments at September 30, 2018. What pretax amounts related to the lease would Werner report in its balance sheet at December 31, 2018? What pretax amounts related to the lease would Werner report in its income statement for the year ended December 31, 2018? (Round your intermediate and final answers to nearest whole dollar.) Show less Req 1 to 3 Reg 4 1 Present value Liability Asset What pretax amounts related to the lease would Werner report in its statement of cash flows for the year ended December 31, 2018? (Round your intermediate and final answers to nearest whole dollar.) 3. Total expenses Capital lease Interest portion Principal portion