Answered step by step

Verified Expert Solution

Question

1 Approved Answer

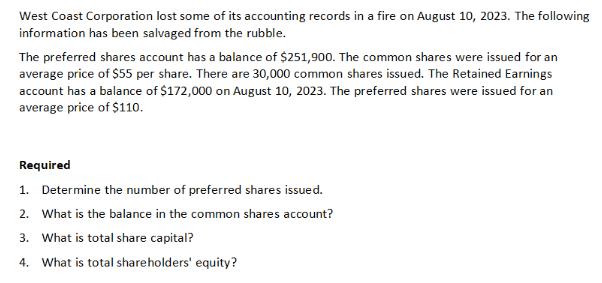

West Coast Corporation lost some of its accounting records in a fire on August 10, 2023. The following information has been salvaged from the

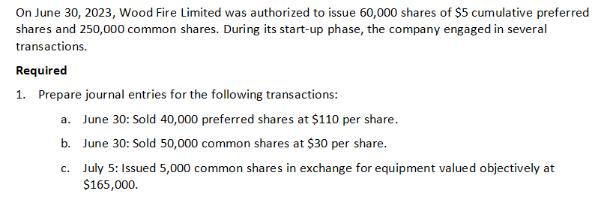

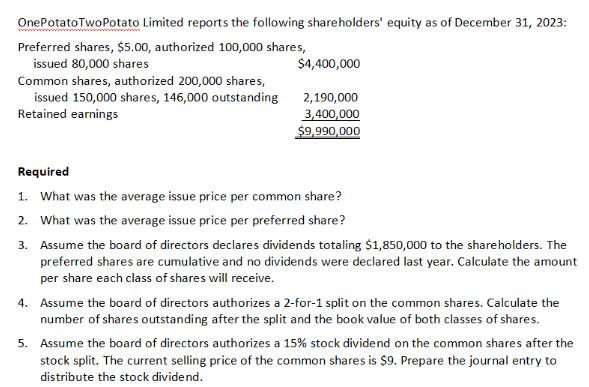

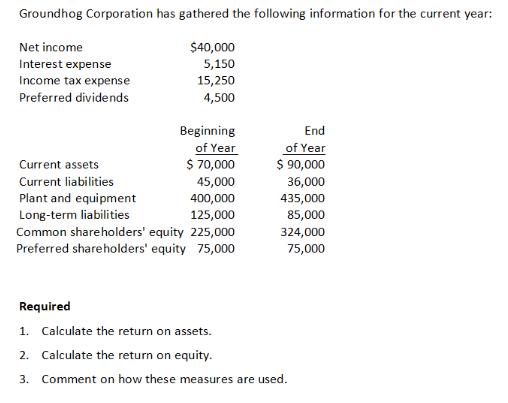

West Coast Corporation lost some of its accounting records in a fire on August 10, 2023. The following information has been salvaged from the rubble. The preferred shares account has a balance of $251,900. The common shares were issued for an average price of $55 per share. There are 30,000 common shares issued. The Retained Earnings account has a balance of $172,000 on August 10, 2023. The preferred shares were issued for an average price of $110. Required 1. Determine the number of preferred shares issued. 2. What is the balance in the common shares account? 3. What is total share capital? 4. What is total shareholders' equity? On June 30, 2023, Wood Fire Limited was authorized to issue 60,000 shares of $5 cumulative preferred shares and 250,000 common shares. During its start-up phase, the company engaged in several transactions. Required 1. Prepare journal entries for the following transactions: a. June 30: Sold 40,000 preferred shares at $110 per share. b. June 30: Sold 50,000 common shares at $30 per share. c. July 5: Issued 5,000 common shares in exchange for equipment valued objectively at $165,000. OnePotato TwoPotato Limited reports the following shareholders' equity as of December 31, 2023: Preferred shares, $5.00, authorized 100,000 shares, issued 80,000 shares Common shares, authorized 200,000 shares, issued 150,000 shares, 146,000 outstanding Retained earnings $4,400,000 2,190,000 3,400,000 $9,990,000 Required 1. What was the average issue price per common share? 2. What was the average issue price per preferred share? 3. Assume the board of directors declares dividends totaling $1,850,000 to the shareholders. The preferred shares are cumulative and no dividends were declared last year. Calculate the amount per share each class of shares will receive. 4. Assume the board of directors authorizes a 2-for-1 split on the common shares. Calculate the number of shares outstanding after the split and the book value of both classes of shares. 5. Assume the board of directors authorizes a 15% stock dividend on the common shares after the stock split. The current selling price of the common shares is $9. Prepare the journal entry to distribute the stock dividend. Groundhog Corporation has gathered the following information for the current year: $40,000 5,150 15,250 4,500 Net income Interest expense Income tax expense Preferred dividends Beginning of Year $ 70,000 Current assets Current liabilities 45,000 Plant and equipment 400,000 Long-term liabilities 125,000 Common shareholders' equity 225,000 Preferred shareholders' equity 75,000 End of Year $ 90,000 36,000 435,000 85,000 324,000 75,000 Required 1. Calculate the return on assets. 2. Calculate the return on equity. 3. Comment on how these measures are used.

Step by Step Solution

★★★★★

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To answer the questions lets use the information provided 1 Number of preferred shares issued Given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started