Answered step by step

Verified Expert Solution

Question

1 Approved Answer

West Partners manufactures metal fixtures. Each fitting requires both steel and an alloy that can withstand extreme temperatures. The following data apply to the

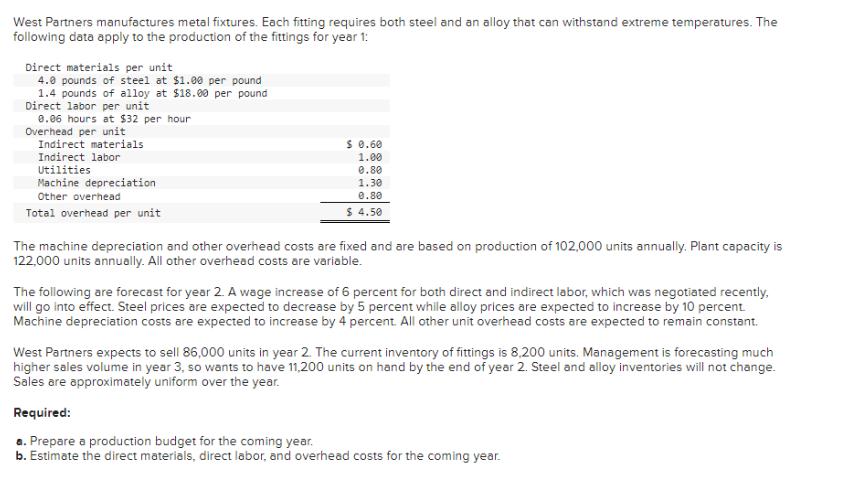

West Partners manufactures metal fixtures. Each fitting requires both steel and an alloy that can withstand extreme temperatures. The following data apply to the production of the fittings for year 1: Direct materials per unit 4.0 pounds of steel at $1.00 per pound 1.4 pounds of alloy at $18.00 per pound Direct labor per unit 0.06 hours at $32 per hour Overhead per unit Indirect materials Indirect labor Utilities Machine depreciation Other overhead Total overhead per unit $ 0.60 1.00 0.80 1.30 0.80 $ 4.50 The machine depreciation and other overhead costs are fixed and are based on production of 102,000 units annually. Plant capacity is 122,000 units annually. All other overhead costs are variable. The following are forecast for year 2. A wage increase of 6 percent for both direct and indirect labor, which was negotiated recently, will go into effect. Steel prices are expected to decrease by 5 percent while alloy prices are expected to increase by 10 percent. Machine depreciation costs are expected to increase by 4 percent. All other unit overhead costs are expected to remain constant. West Partners expects to sell 86,000 units in year 2. The current inventory of fittings is 8,200 units. Management is forecasting much higher sales volume in year 3, so wants to have 11,200 units on hand by the end of year 2. Steel and alloy inventories will not change. Sales are approximately uniform over the year. Required: a. Prepare a production budget for the coming year. b. Estimate the direct materials, direct labor, and overhead costs for the coming year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the information and calculate the production budget and estimated costs for the comi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e10fd5f98b_960373.pdf

180 KBs PDF File

663e10fd5f98b_960373.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started