Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Western Engineering Co. leased a machine on January 1, 2003, under a contract calling for four annual payments of Sh15,000 on December 31 of

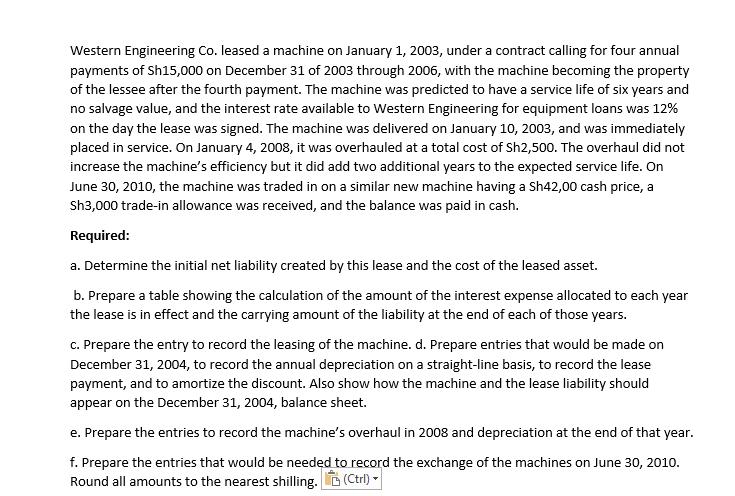

Western Engineering Co. leased a machine on January 1, 2003, under a contract calling for four annual payments of Sh15,000 on December 31 of 2003 through 2006, with the machine becoming the property of the lessee after the fourth payment. The machine was predicted to have a service life of six years and no salvage value, and the interest rate available to Western Engineering for equipment loans was 12% on the day the lease was signed. The machine was delivered on January 10, 2003, and was immediately placed in service. On January 4, 2008, it was overhauled at a total cost of Sh2,500. The overhaul did not increase the machine's efficiency but it did add two additional years to the expected service life. On June 30, 2010, the machine was traded in on a similar new machine having a Sh42,00 cash price, a Sh3,000 trade-in allowance was received, and the balance was paid in cash. Required: a. Determine the initial net liability created by this lease and the cost of the leased asset. b. Prepare a table showing the calculation of the amount of the interest expense allocated to each year the lease is in effect and the carrying amount of the liability at the end of each of those years. c. Prepare the entry to record the leasing of the machine. d. Prepare entries that would be made on December 31, 2004, to record the annual depreciation on a straight-line basis, to record the lease payment, and to amortize the discount. Also show how the machine and the lease liability should appear on the December 31, 2004, balance sheet. e. Prepare the entries to record the machine's overhaul in 2008 and depreciation at the end of that year. f. Prepare the entries that would be needed to record the exchange of the machines on June 30, 2010. Round all amounts to the nearest shilling. (Ctrl) -

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Initial Net liability created by this lease and cost of the leased asset Initial Net liabil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started