Question

Western Resort Company purchased a hot tub for 10,000 on January 1, 2021. Straight-line depreciation is used, based on a 6-year life and a

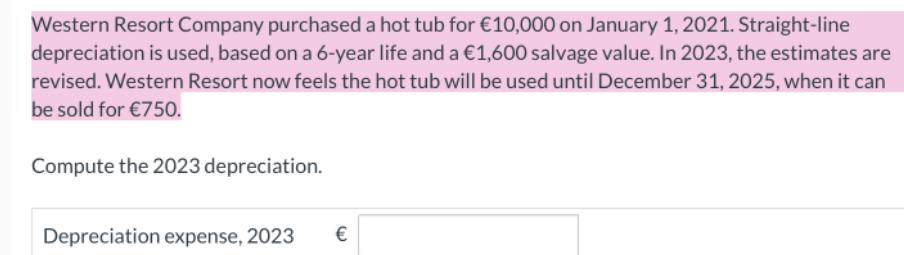

Western Resort Company purchased a hot tub for 10,000 on January 1, 2021. Straight-line depreciation is used, based on a 6-year life and a 1,600 salvage value. In 2023, the estimates are revised. Western Resort now feels the hot tub will be used until December 31, 2025, when it can be sold for 750. Compute the 2023 depreciation. Depreciation expense, 2023

Step by Step Solution

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Straight line depreciation Cost Salvage value Useful li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

4th Edition

1119607515, 978-1119607519

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App