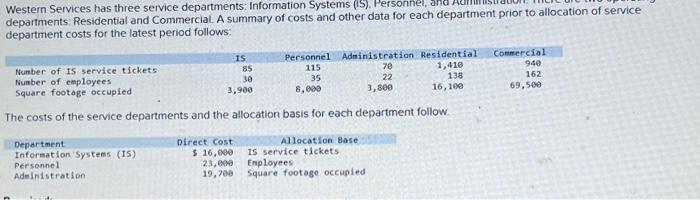

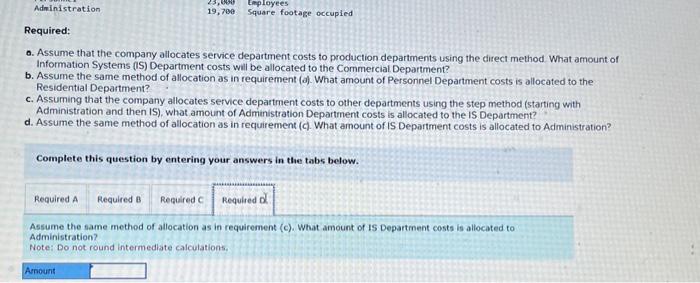

Western Services has three service departments: Information Systems (IS), Personnel, and departments: Residential and Commercial. A summary of costs and other data for each department prior to allocation of service department costs for the latest period follows: Number of IS service tickets Number of employees Square footage occupied IS Department Information Systems (IS) Personnel Administration 85 30 3,900 Personnel 115 35 8,000 Administration Residential 1,410 138 16,100 The costs of the service departments and the allocation basis for each department follow. Allocation Base 70 22 3,800 Direct Cost $ 16,000 IS service tickets 23,000 Employees 19,700 Square footage occupied Commercial 940 162 69,500

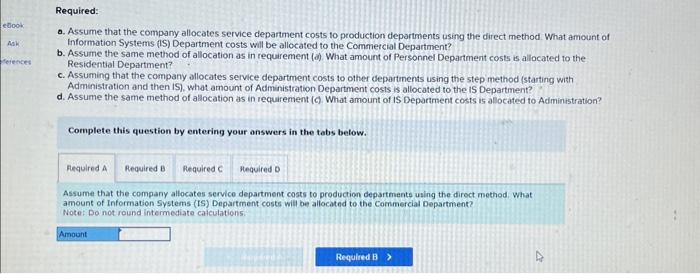

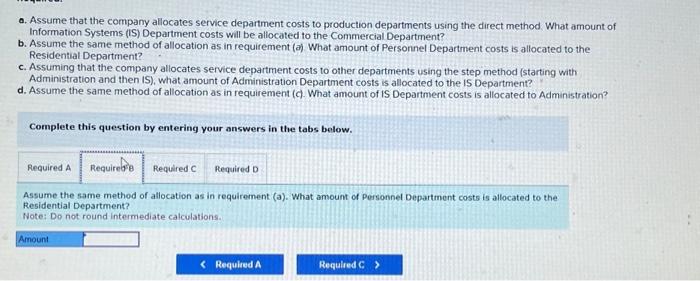

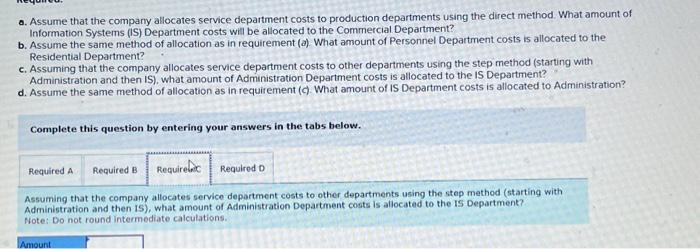

Western Services has three service departments: Information Systems (IS). Personnel, and Adarment prior to allocation of service departments: Residential and Commercial. A summary of costs and other data for each departme department costs for the latest period follows: The costs of the service departments and the allocation basis for each department follow. Required: 0. Assume that the company allocates service department costs to production departments using the direct method. What amount of Information Systems (IS) Department costs will be allocated to the Commercial Department? b. Assume the same method of allocation as in requirement (d). What amount of Personner Department costs is allocated to the Residential Department? c. Assuming that the company allocates service department costs to other departments using the step method (starting with Administration and then IS), what amount of Administration Department costs is allocated to the is Department? d. Assume the same method of allocation as in requirement (G) What amount of IS Deportment costs is allocated to Administration? Complete this question by entering your answers in the tabs below. Assume that the compary allocates service department costs to producion departments uaing the diroct method what amount of Information Systems (IS) Department costs will be allocated to the Commercial Department? Note: Do not round intermediate caiculations: a. Assume that the company allocates service department costs to production departments using the direct method. What amount of Information Systems (IS) Department costs will be aliocated to the Commercial Department? b. Assume the same method of allocation as in requirement (a) What amount of Personnel Department costs is allocated to the Residential Department? c. Assuming that the company allocates service department costs to other departments using the step method (starting with Administration and then IS), what amount of Administration Department costs is allocated to the IS Department? d. Assume the same method of allocation as in requirement (c). What amount of IS Department costs is allocated to Administration? Complete this question by entering your answers in the tabs below. Assume the same method of allocation as in requirement (a). What amount of Personnel Department costs is allocated to the Residential Department? Note: Do not round intermediate calculations. a. Assume that the company allocates service department costs to production departments using the direct method. What amount of Information Systems (IS) Department costs will be allocated to the Commercial Department? b. Assume the same method of allocation as in requirement (a). What amount of Personnel Department costs is allocated to the Residential Department? c. Assuming that the company allocates service department costs to other departments using the step method (starting with Administration and then IS), what amount of Administration Department costs is allocated to the IS Department? d. Assume the same method of allocation as in requirement (c). What amount of IS Department costs is allocated to Administration? Complete this question by entering your answers in the tabs below. Assuming that the company allocates service department costs to other departments using the step method (starting with Administration and then IS), what amount of Administration Department costs is allocated to the Is Department? Note: Do not round intermediate calculations. Required: 0. Assume that the company allocates service department costs to production departments using the direct method What amount of Information Systems (S) Department costs will be allocated to the Commercial Department? b. Assume the same method of allocation as in requirement (a). What amount of Personnel Department costs is allocated to the Residential Department? c. Assuming that the company allocates service department costs to other departments using the step method (starting with Administration and then IS), what amount of Administration Department costs is allocated to the IS Department? d. Assume the same method of allocation as in requirement (c). What amount of IS Department costs is allocated to Administration? Complete this question by entering your answers in the tabs below. Assume the same method of allocation as in requirement (c). What amount of 15 Department costs is allocated to Administration? Note: Do not round intermedlate calculations