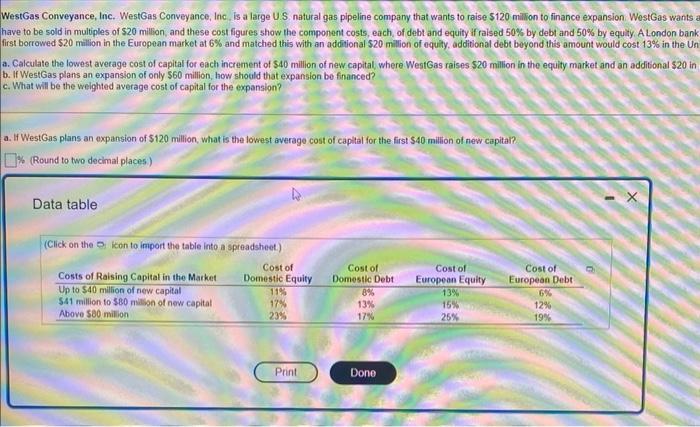

WestGas Conveyance, Inc. WestGas Conveyance, Inc. is a large U.S. natural gas pipeline company that wants to raise $120 million to finance expansion WostGas wants a have to be sold in multiples of $20 million, and these cost figures show the component costs, each, of debt and equity if raised 50% by debt and 50% by equity, A London bank first borrowed $20 million in the European market at 6% and matched this with an additional $20 million of equity, additional debt boyond this amount would cost 13% in the Un a. Calculate the lowest average cost of capital for each increment of $40 million of new capital, where WestGas raises $20 million in the equity market and an additional $20 in b. If WestGas plans an expansion of only $60 million, how should that expansion be financed? c. What will be the welghted average cost of capital for the expansion? a. If WestGas plans an expansion of $120 milion, what is the lowest average cost of capital for the first $40 million of new capital? (Round to two decimal places) Data table ias wants a capital structure that is 50% debt and 50% equaly fts corporate combined federal and state income tax rate is 38%. WestGas finds that it can finance in the domestic U S $. capita ndon bank advises WestGas that US. dollars could be raised in Europe at the folowing costs, also in mulliples of $20mali, while maintaining the 50/50 capital structure Each increment 5 in the United States and 12% in Europe. The same relationship holds for equity financing Snal $20 in the debt market at the same tirne WestGas Conveyance, Inc. WestGas Conveyance, Inc. is a large U.S. natural gas pipeline company that wants to raise $120 million to finance expansion WostGas wants a have to be sold in multiples of $20 million, and these cost figures show the component costs, each, of debt and equity if raised 50% by debt and 50% by equity, A London bank first borrowed $20 million in the European market at 6% and matched this with an additional $20 million of equity, additional debt boyond this amount would cost 13% in the Un a. Calculate the lowest average cost of capital for each increment of $40 million of new capital, where WestGas raises $20 million in the equity market and an additional $20 in b. If WestGas plans an expansion of only $60 million, how should that expansion be financed? c. What will be the welghted average cost of capital for the expansion? a. If WestGas plans an expansion of $120 milion, what is the lowest average cost of capital for the first $40 million of new capital? (Round to two decimal places) Data table ias wants a capital structure that is 50% debt and 50% equaly fts corporate combined federal and state income tax rate is 38%. WestGas finds that it can finance in the domestic U S $. capita ndon bank advises WestGas that US. dollars could be raised in Europe at the folowing costs, also in mulliples of $20mali, while maintaining the 50/50 capital structure Each increment 5 in the United States and 12% in Europe. The same relationship holds for equity financing Snal $20 in the debt market at the same tirne