Question

ABC common stock just paid a dividend of $9.75 per share. Dividends are paid annually. Two different analysts are valuing ABC's stock. The analyst

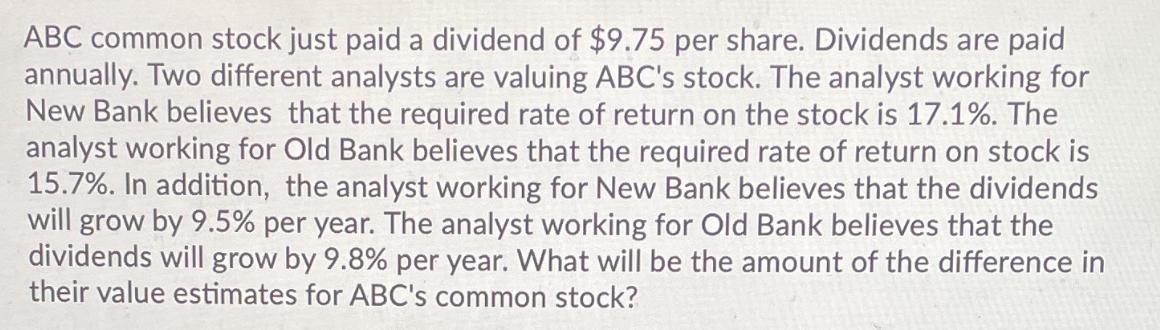

ABC common stock just paid a dividend of $9.75 per share. Dividends are paid annually. Two different analysts are valuing ABC's stock. The analyst working for New Bank believes that the required rate of return on the stock is 17.1%. The analyst working for Old Bank believes that the required rate of return on stock is 15.7%. In addition, the analyst working for New Bank believes that the dividends will grow by 9.5% per year. The analyst working for Old Bank believes that the dividends will grow by 9.8% per year. What will be the amount of the difference in their value estimates for ABC's common stock?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

We can use the Gordon Growth Model to calculate the value estimates for ABCs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

10th edition

978-0077511388, 78034779, 9780077511340, 77511387, 9780078034770, 77511344, 978-0077861759

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App