Question

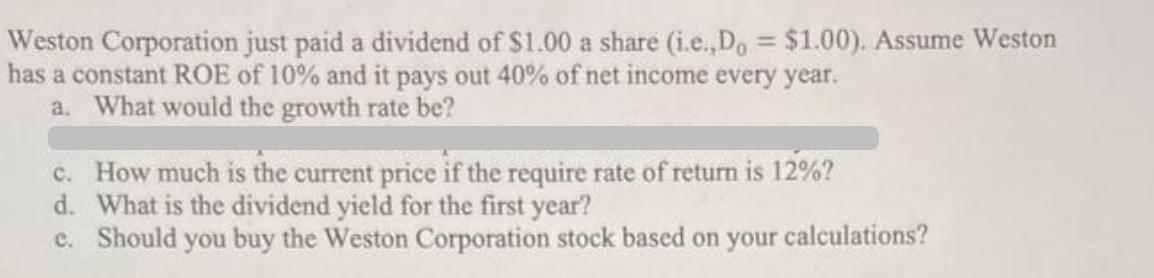

Weston Corporation just paid a dividend of $1.00 a share (i.e.,Do = $1.00). Assume Weston has a constant ROE of 10% and it pays

Weston Corporation just paid a dividend of $1.00 a share (i.e.,Do = $1.00). Assume Weston has a constant ROE of 10% and it pays out 40% of net income every year. a. What would the growth rate be? c. How much is the current price if the require rate of return is 12%? d. What is the dividend yield for the first year? e. Should you buy the Weston Corporation stock based on your calculations?

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To answer the questions we can use the Gordon Growth Model which relates the dividend growth rate an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Chemistry A Molecular Approach

Authors: Nivaldo Tro

5th Edition

0134874374, 978-0134874371

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App