Weve convinced ourselves that we dont know the expected return on a derivative even when we know the expected return on the underlying asset because the asset and the derivative represent different levels of risk. Example: Very out-of-the-money call. Theres a serious chance that it will expire worthless (and you will forfeit your entire premium).

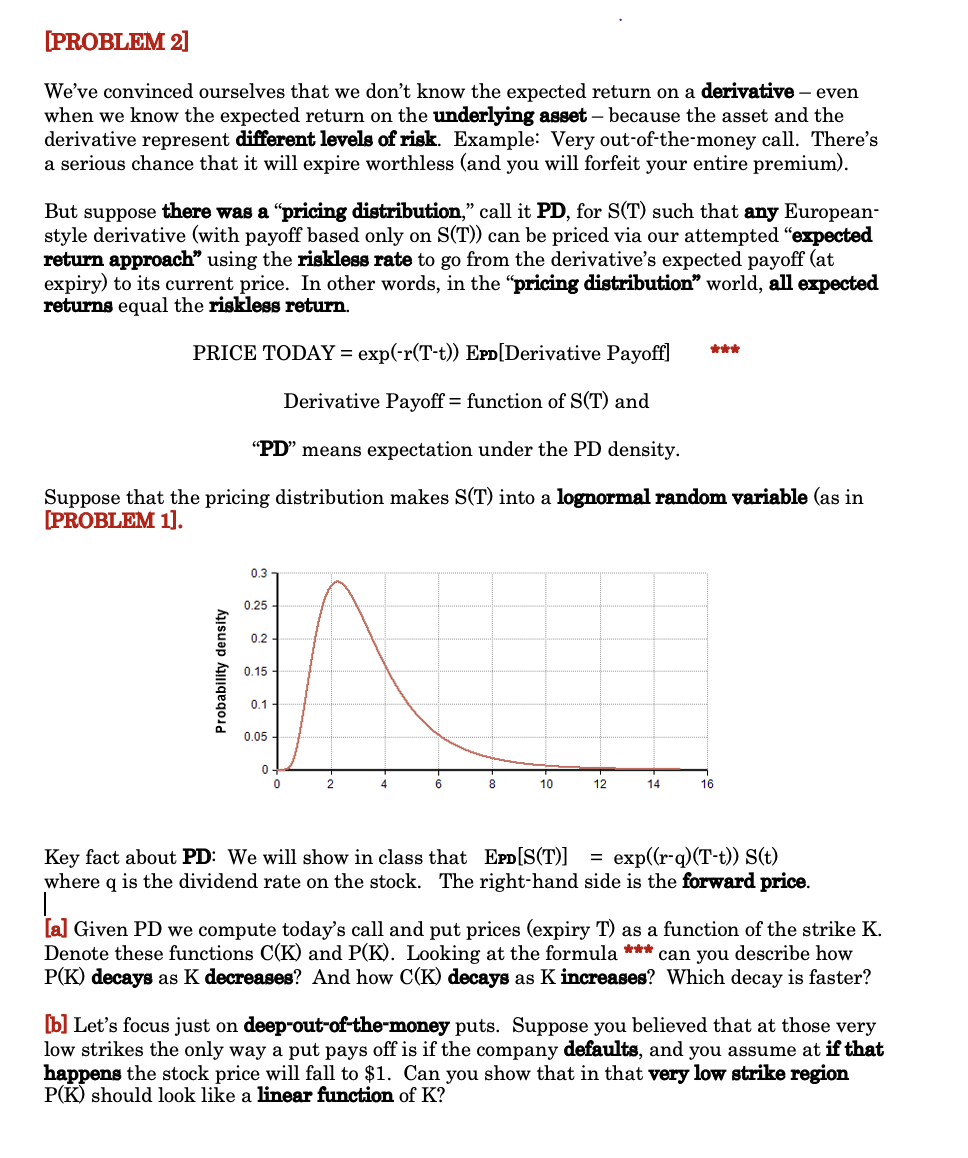

But suppose there was a pricing distribution, call it PD, for S(T) such that any European-style derivative (with payoff based only on S(T)) can be priced via our attempted expected return approach using the riskless rate to go from the derivatives expected payoff (at expiry) to its current price. In other words, in the pricing distribution world, all expected returns equal the riskless return.

]

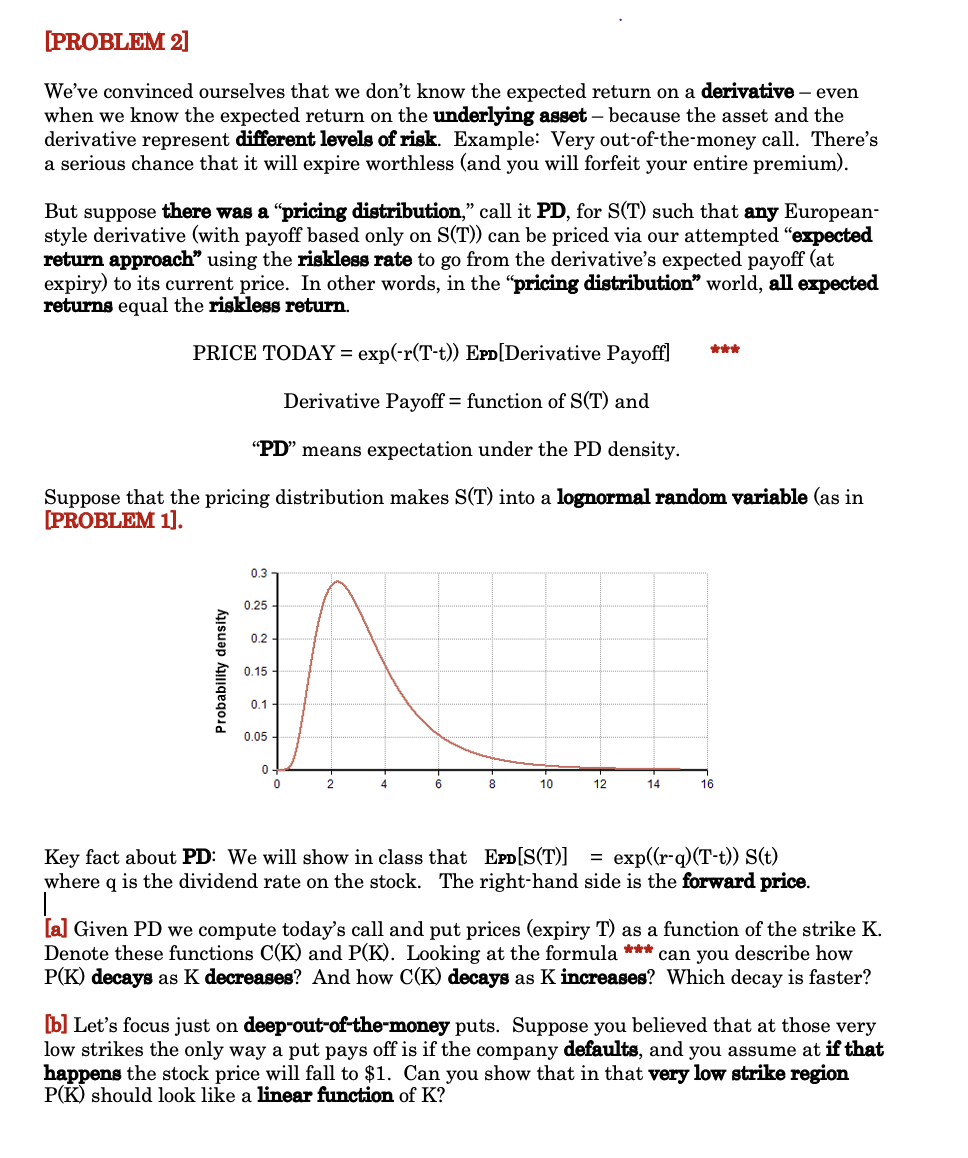

[PROBLEM 2] We've convinced ourselves that we don't know the expected return on a derivative - even when we know the expected return on the underlying asset because the asset and the derivative represent different levels of risk. Example: Very out-of-the-money call. There's a serious chance that it will expire worthless (and you will forfeit your entire premium). But suppose there was a "pricing distribution, call it PD, for S(T) such that any European- style derivative (with payoff based only on S(T)) can be priced via our attempted "expected return approach" using the riskless rate to go from the derivative's expected payoff (at expiry) to its current price. In other words, in the "pricing distribution" world, all expected returns equal the riskless return. PRICE TODAY = exp(-r(T-t) EPD[Derivative Payoff] Derivative Payoff = function of S(T) and "PD means expectation under the PD density. Suppose that the pricing distribution makes S(T) into a lognormal random variable (as in [PROBLEM 1]. 0.3 0.25 0.2 Probability density 0.15 0.1 0.05 0 0 10 12 14 16 Key fact about PD: We will show in class that EPD[S(T)] exp((r-q)(T-t)) S(t) where q is the dividend rate on the stock. The right-hand side is the forward price. [a] Given PD we compute today's call and put prices (expiry T) as a function of the strike K. Denote these functions C(K) and P(K). Looking at the formula *** can you describe how P(K) decays as K decreases? And how C(K) decays as K increases? Which decay is faster? [b] Let's focus just on deep-out-of-the-money puts. Suppose you believed that at those very low strikes the only way a put pays off is if the company defaults, and you assume at if that happens the stock price will fall to $1. Can you show that in that very low strike region P(K) should look like a linear function of K? [PROBLEM 2] We've convinced ourselves that we don't know the expected return on a derivative - even when we know the expected return on the underlying asset because the asset and the derivative represent different levels of risk. Example: Very out-of-the-money call. There's a serious chance that it will expire worthless (and you will forfeit your entire premium). But suppose there was a "pricing distribution, call it PD, for S(T) such that any European- style derivative (with payoff based only on S(T)) can be priced via our attempted "expected return approach" using the riskless rate to go from the derivative's expected payoff (at expiry) to its current price. In other words, in the "pricing distribution" world, all expected returns equal the riskless return. PRICE TODAY = exp(-r(T-t) EPD[Derivative Payoff] Derivative Payoff = function of S(T) and "PD means expectation under the PD density. Suppose that the pricing distribution makes S(T) into a lognormal random variable (as in [PROBLEM 1]. 0.3 0.25 0.2 Probability density 0.15 0.1 0.05 0 0 10 12 14 16 Key fact about PD: We will show in class that EPD[S(T)] exp((r-q)(T-t)) S(t) where q is the dividend rate on the stock. The right-hand side is the forward price. [a] Given PD we compute today's call and put prices (expiry T) as a function of the strike K. Denote these functions C(K) and P(K). Looking at the formula *** can you describe how P(K) decays as K decreases? And how C(K) decays as K increases? Which decay is faster? [b] Let's focus just on deep-out-of-the-money puts. Suppose you believed that at those very low strikes the only way a put pays off is if the company defaults, and you assume at if that happens the stock price will fall to $1. Can you show that in that very low strike region P(K) should look like a linear function of K