Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Weygandt, Accounting Principles, 13e WilayPLUS: MWYPUS I Hele 1 Contact Us Los Rice Assignment Principles of Accounting 13e (ACC 171-185-272 Gradebook ORION Downloadable eTextbook ment

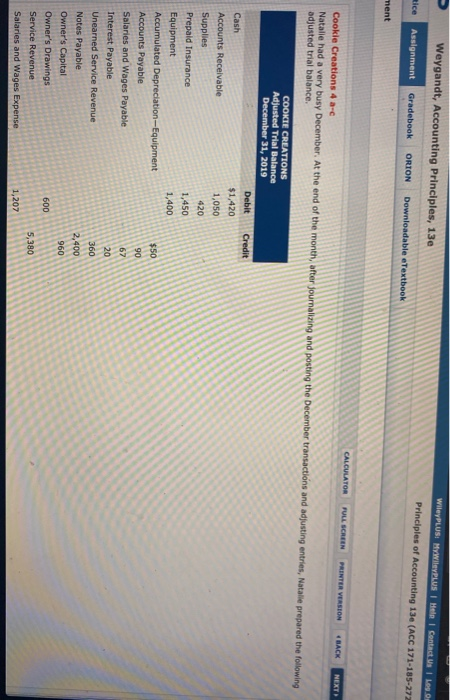

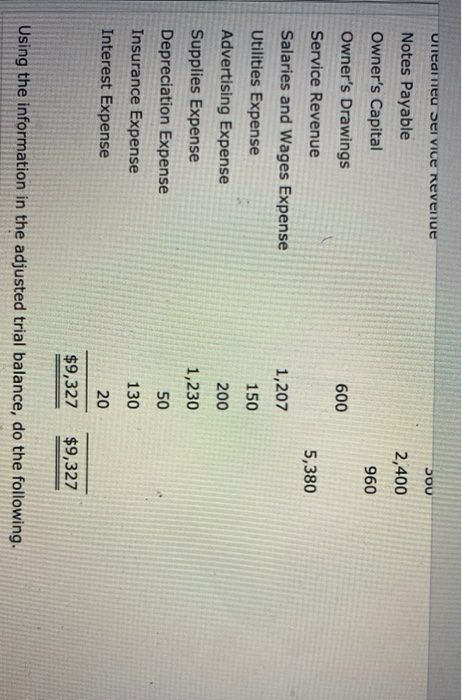

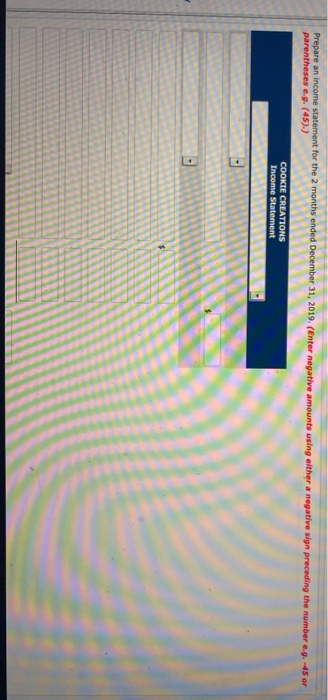

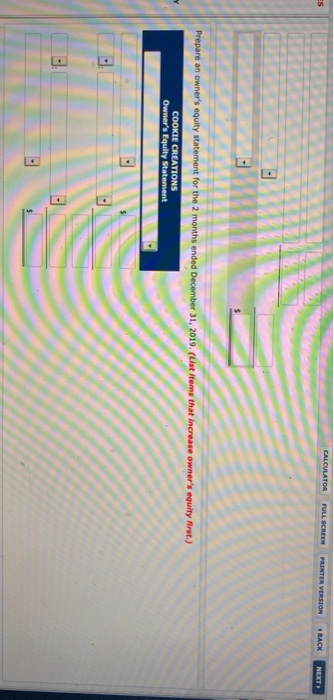

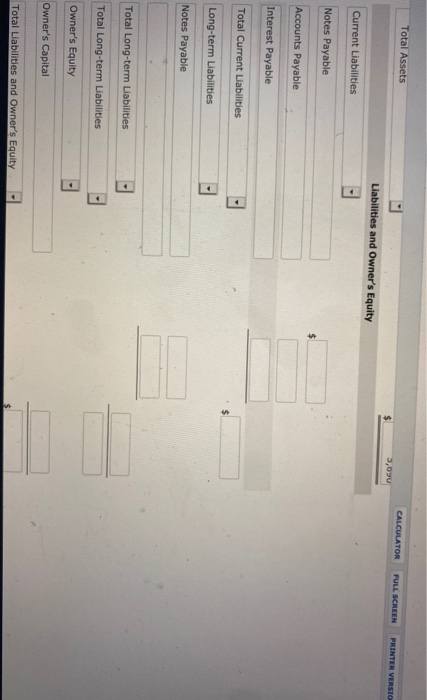

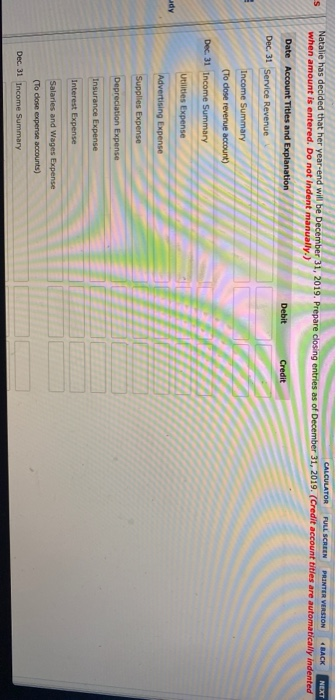

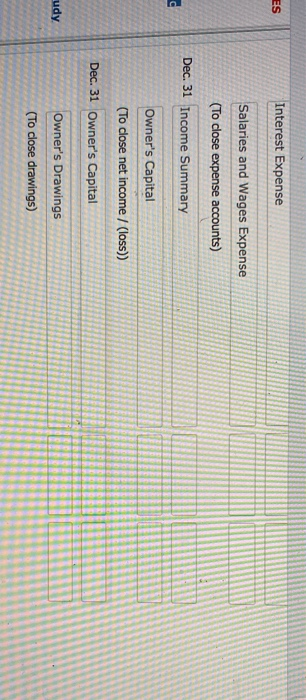

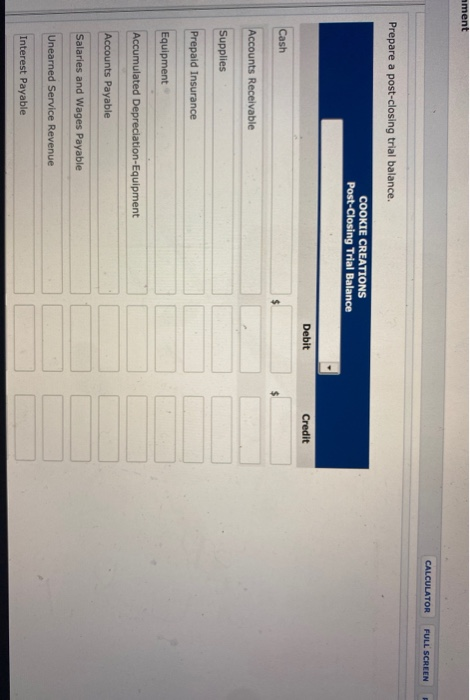

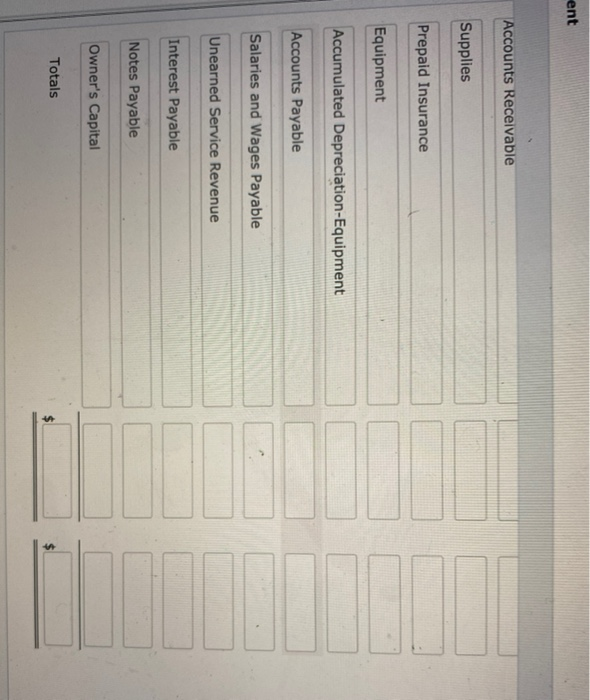

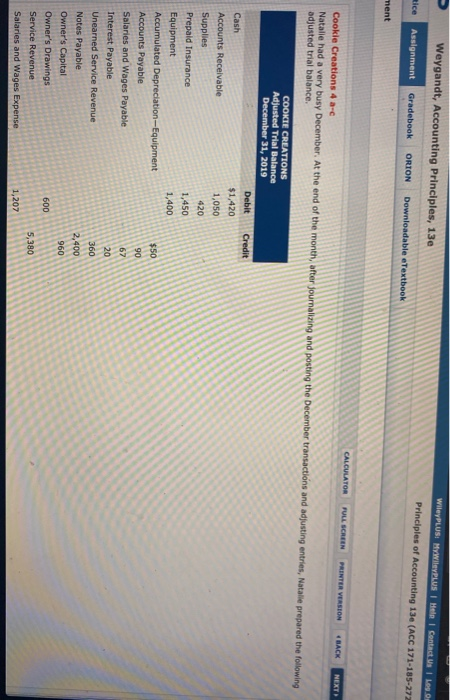

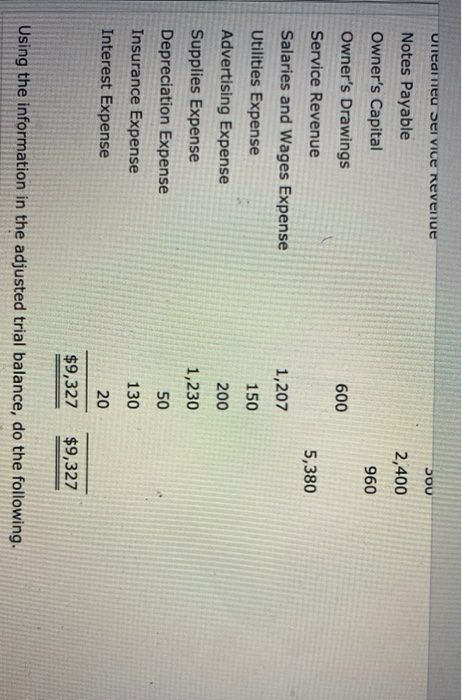

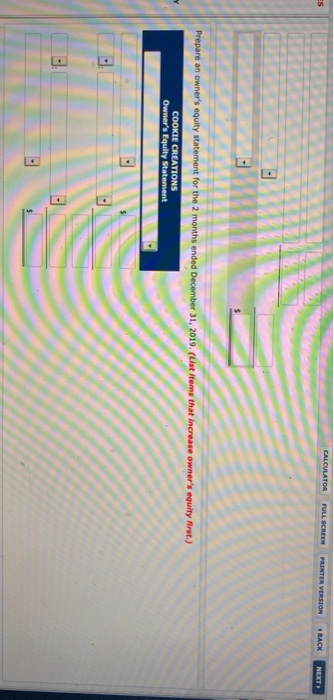

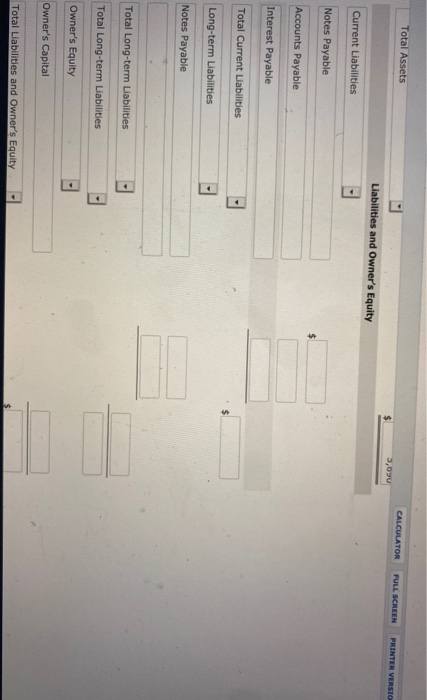

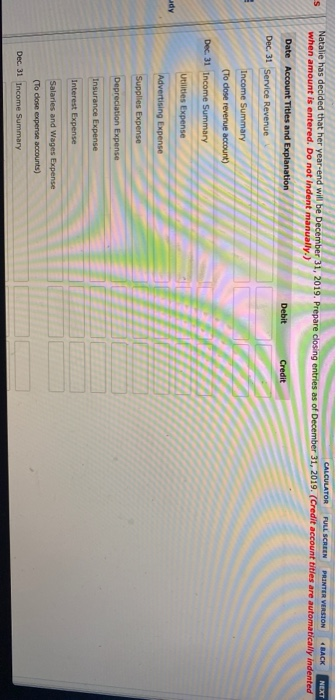

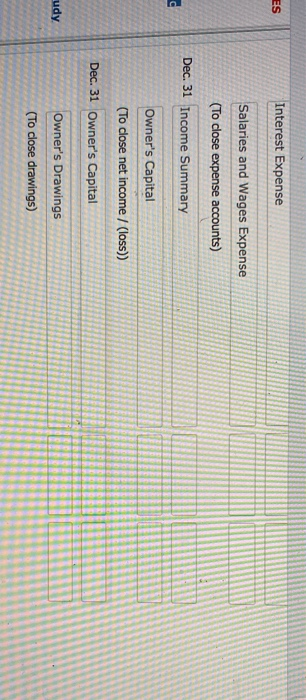

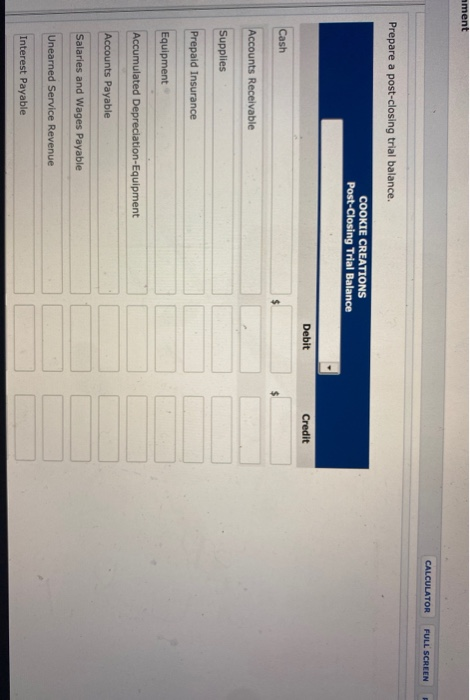

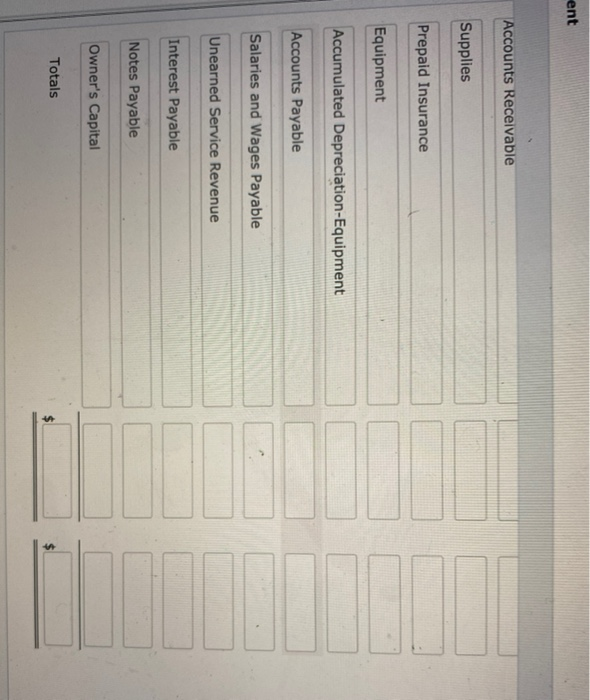

Weygandt, Accounting Principles, 13e WilayPLUS: MWYPUS I Hele 1 Contact Us Los Rice Assignment Principles of Accounting 13e (ACC 171-185-272 Gradebook ORION Downloadable eTextbook ment CALCULATOR FULL SCREEN PRINTER VERSION BACK NEXT Cookie Creations 4 a-c Natalie had a very busy December. At the end of the month, after journalizing and posting the December transactions and adjusting entries, Natalie prepared the following adjusted trial balance. COOKIE CREATIONS Adjusted Trial Balance December 31, 2019 Debit Credit $1,420 1,050 420 1,450 1,400 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Interest Payable Unearned Service Revenue Notes Payable Owner's Capital Owner's Drawings Service Revenue Salaries and Wages Expense $50 90 67 20 360 2,400 960 600 5,380 1,207 Unitameu Service Revenue 2,400 960 600 5,380 1,207 Notes Payable Owner's Capital Owner's Drawings Service Revenue Salaries and Wages Expense Utilities Expense Advertising Expense Supplies Expense Depreciation Expense Insurance Expense Interest Expense 150 200 1,230 50 130 20 $9,327 $9,327 Using the information in the adjusted trial balance, do the following. Prepare an income statement for the 2 months ended December 31, 2019. (Enter negative amounts using either a negative sign preceding the number .g. -45 or parentheses e.g. (45).) COOKIE CREATIONS Income Statement CALCULATOR Es FULL SCREEN PRINTER VERSION BACK NEXT . Prepare an owner's equity statement for the 2 months ended December 31, 2019. (List Items that increase owner's equity first.) COOKIE CREATIONS Owner's Equity Statement CALCULATOR FULL SCREEN PAINTER VERSION & LACK NEXT Prepare a classified balance sheet at December 31, 2019. The note payable has a stated interest rate of 6%, and the principal and interest are due on November 16, 2021. (List Current Assets in order of liquidity.) COOKIE CREATIONS Balance Sheet December 31, 2019 Assets Current Assets Cash 1420 Accounts Receivable 1050 Supplies 420 Prepaid Insurance 1450 Total Current Assets 4,340 Property, Plant and Equipment Equipment 1,400 Less 0 Accumulated Depreciation-Equipment 50 1,350 Total Assets 5,690 Total Assets CALCULATOR FULL SCREEN 3,090 PRINTER VERSIO Liabilities and Owner's Equity Current Liabilities Notes Payable Accounts Payable Interest Payable Total Current Liabilities Long-term Liabilities Notes Payable Total Long-term Liabilities Total Long-term Liabilities Owner's Equity Owner's Capital Total Liabilities and Owner's Equity CALCULATOR FULL SCREEN PRINTER VERSION 4 4 BACK NEXT Natalie has decided that her year-end will be December 31, 2019. Prepare closing entries as of December 31, 2019. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 Service Revenue Income Summary (To dose revenue account) Dec 31 Income Summary Utilities Expense udy Advertising Expense Supplies Expense Depreciation Expense Insurance Expense Interest Expense Salaries and Wages Expense (To close expense accounts) Dec. 31 Income Summary ES Interest Expense Salaries and Wages Expense (To close expense accounts) Dec. 31 Income Summary Owner's Capital (To close net income / (loss)) Dec. 31 Owner's Capital udy Owner's Drawings (To close drawings) ament CALCULATOR FULL SCREEN Prepare a post-closing trial balance. COOKIE CREATIONS Post-Closing Trial Balance Debit Credit Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Unearned Service Revenue Interest Payable ent Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Unearned Service Revenue Interest Payable Notes Payable Owner's Capital Totals

Weygandt, Accounting Principles, 13e WilayPLUS: MWYPUS I Hele 1 Contact Us Los Rice Assignment Principles of Accounting 13e (ACC 171-185-272 Gradebook ORION Downloadable eTextbook ment CALCULATOR FULL SCREEN PRINTER VERSION BACK NEXT Cookie Creations 4 a-c Natalie had a very busy December. At the end of the month, after journalizing and posting the December transactions and adjusting entries, Natalie prepared the following adjusted trial balance. COOKIE CREATIONS Adjusted Trial Balance December 31, 2019 Debit Credit $1,420 1,050 420 1,450 1,400 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Interest Payable Unearned Service Revenue Notes Payable Owner's Capital Owner's Drawings Service Revenue Salaries and Wages Expense $50 90 67 20 360 2,400 960 600 5,380 1,207 Unitameu Service Revenue 2,400 960 600 5,380 1,207 Notes Payable Owner's Capital Owner's Drawings Service Revenue Salaries and Wages Expense Utilities Expense Advertising Expense Supplies Expense Depreciation Expense Insurance Expense Interest Expense 150 200 1,230 50 130 20 $9,327 $9,327 Using the information in the adjusted trial balance, do the following. Prepare an income statement for the 2 months ended December 31, 2019. (Enter negative amounts using either a negative sign preceding the number .g. -45 or parentheses e.g. (45).) COOKIE CREATIONS Income Statement CALCULATOR Es FULL SCREEN PRINTER VERSION BACK NEXT . Prepare an owner's equity statement for the 2 months ended December 31, 2019. (List Items that increase owner's equity first.) COOKIE CREATIONS Owner's Equity Statement CALCULATOR FULL SCREEN PAINTER VERSION & LACK NEXT Prepare a classified balance sheet at December 31, 2019. The note payable has a stated interest rate of 6%, and the principal and interest are due on November 16, 2021. (List Current Assets in order of liquidity.) COOKIE CREATIONS Balance Sheet December 31, 2019 Assets Current Assets Cash 1420 Accounts Receivable 1050 Supplies 420 Prepaid Insurance 1450 Total Current Assets 4,340 Property, Plant and Equipment Equipment 1,400 Less 0 Accumulated Depreciation-Equipment 50 1,350 Total Assets 5,690 Total Assets CALCULATOR FULL SCREEN 3,090 PRINTER VERSIO Liabilities and Owner's Equity Current Liabilities Notes Payable Accounts Payable Interest Payable Total Current Liabilities Long-term Liabilities Notes Payable Total Long-term Liabilities Total Long-term Liabilities Owner's Equity Owner's Capital Total Liabilities and Owner's Equity CALCULATOR FULL SCREEN PRINTER VERSION 4 4 BACK NEXT Natalie has decided that her year-end will be December 31, 2019. Prepare closing entries as of December 31, 2019. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 Service Revenue Income Summary (To dose revenue account) Dec 31 Income Summary Utilities Expense udy Advertising Expense Supplies Expense Depreciation Expense Insurance Expense Interest Expense Salaries and Wages Expense (To close expense accounts) Dec. 31 Income Summary ES Interest Expense Salaries and Wages Expense (To close expense accounts) Dec. 31 Income Summary Owner's Capital (To close net income / (loss)) Dec. 31 Owner's Capital udy Owner's Drawings (To close drawings) ament CALCULATOR FULL SCREEN Prepare a post-closing trial balance. COOKIE CREATIONS Post-Closing Trial Balance Debit Credit Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Unearned Service Revenue Interest Payable ent Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Unearned Service Revenue Interest Payable Notes Payable Owner's Capital Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started