Answered step by step

Verified Expert Solution

Question

1 Approved Answer

wh e. Completed a large delivery job, billed the custouner $25,000, and received a peomise to collect is f. Paid employee salary, S6s soo g.

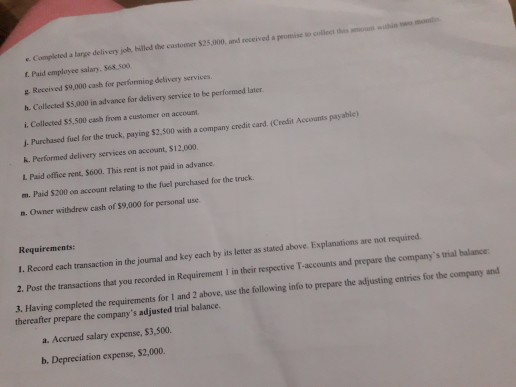

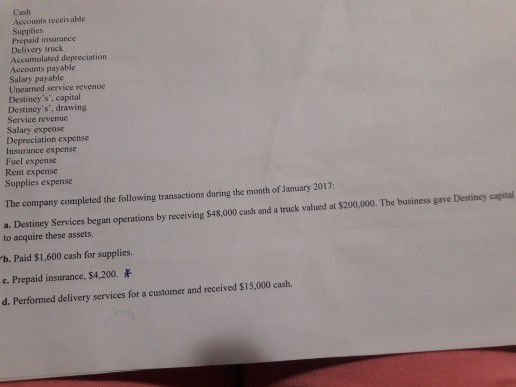

wh e. Completed a large delivery job, billed the custouner $25,000, and received a peomise to collect is f. Paid employee salary, S6s soo g. Received $9,000 cash for performing delivery services h. Collected $5,000 in advance for delivery service to be perfoemed later i. Collected $5,500 cash from a customer on account J Purchased fuel for the truck, paying $2,500 with a company credit card. (Credit Accounts payable) k. Performed delivery services on account, $12,000. L Paid office rent. S600This rent is not paid in advance. m. Paid $200 on account relating to the fuel purchased for the truck n. Owner withdrew cash of $9,000 for personal use Requirements: 1. Record each transaction in the journal and key each by its letter as stated above Explanations are not required 2. Post the transactions that you recorded in Requirement 1 in their respective T-accounts and prepare the company's trial balance 3. Having completed the requirements for I and 2 above, use the following info to prepare the adjusting entries for the company and thereafter prepare the company's adjusted trial balance. a. Accrued salary expense, $3,500. b. Depreciation expense, $2,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started